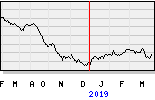

“Strong cash flow and earnings despite the worst stainless market

environment since inception of Aperam”

Luxembourg, February 5, 2020 (07:00 CET) - Aperam (referred to as “Aperam” or the “Company”) (Amsterdam, Luxembourg,

Paris, Brussels: APAM, NYRS: APEMY), announced today results for the three months and full year ending December 31, 2019.

Highlights

. Health and Safety: LTI frequency rate of 1.7x in 2019 compared to 1.4x in 2018

. Steel shipments of 1,786 thousand tonnes in 2019, 9.4% decrease compared to steel shipments of 1,972 thousand

tonnes in 2018

. EBITDA of EUR 357 million in 2019, including an exceptional gain2

of EUR 17 million, compared to EUR 504 million in

2018

. EBITDA of EUR 102 million in Q4 2019, including an exceptional gain2

of EUR 17 million, compared to EUR 79 million

in Q3 2019

. Net income of EUR 148 million in 2019, compared to EUR 286 million in 2018

. Basic earnings per share of EUR 1.82 in 2019, compared to EUR 3.39 in 2018

. Cash flow from operations amounted to EUR 400 million in 2019, compared to EUR 295 million in 2018

. Free cash flow before dividend and share buy-back of EUR 281 million in 2019, including EUR 30 million from the

divestment of the entire Gerdau stake, compared to EUR 108 million in 2018

. Net financial debt of EUR 75 million as of December 31, 2019, compared to EUR 48 million as of December 31, 2018

Strategic initiatives

. Leadership Journey®3

Phase 3: The realized annualized gains reached EUR 18 million in Q4 2019. Aperam realized

cumulative annualized gains of EUR 123 million till year end 2019

Prospects

? Adj EBITDA in Q1 2020 is expected at a comparable level to Q4 2019 adj EBITDA

? Net financial debt is expected to increase due to seasonal effects in Q1 2020, however, will continue to remain at low

levels

Cash Deployment

In coherence to its Financial Policy, Aperam is announcing:

? To maintain its base dividend at EUR 1.75 per share (subject to AGM approval)

? A share buyback program of up to EUR 100 million

Timoteo Di Maulo, CEO of Aperam, commented:

“In Q4 2019 Aperam has faced the most difficult market conditions since its inception. This was due to unprecedented pricing

pressure combined with a strong volume contraction from trade war induced extremely high import volumes. This was amplified

by weak economic conditions in both Europe and Brazil. In this context Aperam has achieved solid cash flow and earnings

which demonstrates the value of the Leadership Journey® and proves how this program has transformed Aperam over the past

years. Going forward we expect the economic environment to remain challenging and high competitive pressure to persist in

2020. We are therefore intensifying our efforts to increase efficiency and competitiveness. We will also continue in our efforts to

the European Commission to promptly set a level playing field.”

see & read more on

https://www.aperam.com/sites/default/files/documents/Q4_2019_ER_Press%20Release_EN_0.pdf

Aperam announces dividend payment schedule for 2020

Luxembourg, 5 February 2020 (07:00 CET) - Aperam announces its detailed dividend payment schedule for 2020.

The Company proposes to maintain its base dividend at EUR 1.75/share, subject to shareholders approval at the next Annual General Meeting to be held on 5 May 2020.

The dividend payments would occur in four equal quarterly installments of EUR 0.4375 (gross) per share in 2020 as described below in the detailed dividend schedule.

Dividends are announced in Euros. Dividends are paid in Euros for shares listed on the European Stock Exchanges (Amsterdam, Brussels, Paris, Luxembourg). Dividends are paid in US dollars for shares traded in the United States on the over-the-counter market in the form of New York registry shares and converted from Euros to US dollars based on the European Central Bank exchange rate at the date mentioned in the table below. A Luxembourg withholding tax of 15% is applied on the gross dividend amounts.

Table: Detailed dividend schedule 2020

1st Quarterly Payment (interim)

2 nd Quarterly Payment 3 rd Quarterly Payment 4 th Quarterly Payment

Announcement date 26 February 2020 12 May 2020 11 August 2020 9 November 2020

Ex-Dividend 02 March 2020 15 May 2020 14 August 2020 12 November 2020

Record Date 03 March 2020 18 May 2020 17 August 2020 13 November 2020

Payment Date 26 March 2020 12 June 2020 11 September 2020 9 December 2020

FX Exchange rate 27 February 2020 13 May 2020 12 August 2020 10 November 2020

In order to benefit from exemption of Luxembourg dividend withholding tax at source, an “Informative

Memorandum” describing the procedure to obtain an exemption at source of the Luxembourg dividend

withholding tax is available at the following:Link

go to

https://www.aperam.com/sites/default/files/documents/2018-08/INFORMATIVE%20MEMORANDUM%20APERAM%20-%20Dividend%20distribution.pdf

tijd 09.21

Aperam EUR 28.86 +1.86 vol. 128.000