Highlights 2019

• Stable revenue of €191.5 million in 2019, with increasing added value

• Recurring revenue rose 20% and is now at 23% of the total revenue

• The Healthcare business unit continued its robust growth trend. Identification Systems, Light Controls and Security

Management also performed well, while Livestock Management and Retail posted lower revenue. Revenue at

Staffing Solutions remained more or less stable

• Continued investments in the organisation, especially in the recruitment of new employees, brought the operating

profit down to €17.5 million (€19.4 million in 2018)

• The operating margin (EBIT) came in at 9.1%, compared to 10.2% in the same period of 2018

• The increase in the number of FTE resulted in an added value per FTE of €173,000 in 2019 (€179,000 in 2018)

• Net profit, including the book profit generated in the third quarter of 2019 upon completion of the sale of Nedap

France S.A.S., amounted to €24.1 million (€17.1 million in 2018), i.e. earnings per share of €3.74 (€2.66 in 2018).

Net profit excluding the book profit came in at €14.2 million

• Dividends for the 2019 financial year have been set at €4.50 (€2.50 in 2018)

• Nedap is expecting 2020 revenue to be up on 2019

Ruben Wegman, CEO of Nedap: “2019 was a tough year for Nedap. Several markets that we operate in experienced considerable volatility throughout the year, but our policy of developing activities in numerous markets enables us to compensate for considerable drops in revenue. We were able to maintain our strategic course, even in these dynamic and challenging market conditions. Given the promising perspectives for long-term growth at all business units, we continued to invest in the recruitment and development of talented people in 2019. These continuous investments in product innovation and commercial clout have further reinforced our competitive position, we are therefore confident about the future.”

Key figures

in millions of euros or expressed as a percentage 2019 2018 Growth

Revenue 191.5 191.4 -

Recurring revenue 44.6 37.2 20%

Added value as % of revenue 63% 62%

Operating profit 17.5 19.4 -10%

Operating margin1 9.1% 10.2%

Profit for the financial year2 24.1 17.1 41%

Earnings per share (x €1) 3.74 2.66 41%

Dividend per share (x €1) 4.50 2.50

31/12/2019 31/12/2018

Net debt/EBITDA - 0.2 0.6

Solvency 61% 56%

ROIC3 25% 25%

1 Defined as operating profit excluding one-off items expressed as % of revenue

2 Profit for the 2019 financial year includes book profit of €9.9 million achieved on the sale of Nedap France

3 ROIC is operating profit/loss excluding one-off items divided by the invested capital (fixed assets + net working capital - (associate & nonconsolidated

company))

Progress on the strategy

The past year saw sound progress with Changing Gears, the strategic multi-year plan aimed at stepping up commercial activities, improving mutual collaboration and creating new opportunities for growth.

The newly appointed Management Board fits this plan. Consisting of the CEO, CFO and three business unit managers, it boosts effectiveness in the implementation of various elements of Changing Gears and also gets business unit managers more closely involved with Nedap-wide themes.

We said farewell to our CFO Eric Urff in late 2019, after a tenure on the Nedap Board of Directors of more than five years. He will be succeeded by Daniëlle van der Sluijs on 1 March 2020.

During the financial year, a lot of attention was paid to bundling the commercial expertise and experience already present within the entire Nedap organisation and gearing its use towards improving the marketing efforts of the

individual business units. Further work was also put into striking a new balance in the organisation. We want to retain the business units’ market focus and entrepreneurship, but at the same time we see sound opportunities for

bundling similar processes such as accounting, order processing and IT. Good progress was made in this area in 2019 and the first processes and subprocesses have been simplified and standardised across the business units,

which is a key prerequisite for further automation. The aim is to release valuable capacity to further improve our services to our customers .

In July 2019 Nedap and the other Nedap France S.A.S. (Nedap France) shareholders reached agreement on the sale of all Nedap France shares to B&Capital, a French investment fund. Net proceeds for Nedap amounted to

€14.5 million. This step is in keeping with Nedap’s strategy of focusing on the development and sale of proprietary products and solutions. Nedap France will remain a key business partner for Nedap’s Retail and Security

Management business units, thus guaranteeing the continuity of Nedap’s operations on the French market.

Financial affairs

Revenue

Revenue over 2019 as a whole amounted to €191.5 million, at the same level as in 2018 (€191.4 million).

Recurring revenue continued its growth trend, rising by 20% again to €44.6 million (€37.2 million in 2018). The Healthcare, Identification Systems, Light Controls and Security Management business units achieved healthy

revenue growth. Revenue posted by the Staffing Solutions business unit remained more or less stable, while the swine fever epidemic caused a drop in 2019 revenue for the Livestock Management business unit compared to

2018. The Retail business unit’s revenue was negatively impacted by challenging circumstances on the Retail market.

Added value was up from €118.9 million in 2018 to €121.1 million in 2019. As a percentage of the revenue, added value increased slightly to 63%, thanks to the growing share of recurring revenue in the overall revenue. Added

value per FTE dropped from €179,000 in 2018 to €173,000 in 2019, mainly due to the hiring of new employees during the year.

Costs

Personnel costs rose more than 8% from €67.1 million to €72.7 million in 2019. This is partly due to the increase in the number of FTEs, in line with our strategy of investing in the recruitment and development of talented people.

The number of FTEs went up from 681 at year-end 2018 to 724 at the end of 2019.

Other operating costs went down from €25.3 million in 2018 to €22.4 million in 2019, mainly as a result of the application of IFRS 16 leases and the capitalisation of tangible fixed assets (mostly new measuring and testing equipment manufactured by Nedap) and intangible fixed assets.

Research and development costs of €30.0 million (including €1.3 million in capitalised development costs) amounted to 16% of revenue (€25.9 million or 14% of revenue in 2018, including €0.7 million in capitalised

development costs), which reflects the emphasis on innovation and our focus on software service development within our strategy. Research and development costs mostly relate to maintaining current products and services

and keeping them up to date. The remaining costs are for research and development in relation to new products or services. Such development costs are only capitalised if the applicable IAS 38 criteria are met.

Amortisation and depreciation

Depreciation increased from €6.5 million in 2018 to €7.6 million in 2019, primarily due to the application of IFRS 16 Leases. Depreciation remained relatively low due to the limited investments in tangible fixed assets in recent

years. At €0.9 million, amortisation was up on 2018 (€0.6 million). This increase is related to the capitalised development costs.

Operating profit

2019 saw the operating profit (EBIT) drop to €17.5 million from the €19.4 million in 2018. This decrease is the result of continuing investments in the organisation, aimed at recruiting and further developing employees. The

operating margin, i.e. the operating profit as a percentage of revenue, amounted to 9.1% in 2019 (10.2% in 2018).

Financing costs

Net financing costs in 2019 were at more or less the same level as in 2018 (€0.2 million).

Share in profit of associate (after income tax) Share in profit of associate concerns the share in Nedap France’s result. The sale of the 49.8% participation in Nedap France, which was announced in July and completed in the third quarter of 2019, generated a book profit of €9.9 million. Together with the share in the result up to the sale (€0.3 million), the share in profit of associate for 2019 amounted to a rounded off figure of €10.3 million (€1.1 million in 2018).

Taxation

Taxes paid over 2019 totalled €3.4 million (€3.2 million in 2018), while the net tax rate came in at 19.7% for 2019

(16.6% for 2018). The share in profit of associate is exempt from taxation due to the application of the participation exemption.

Profit for the financial year

Nedap posted €24.1 million in profit for the 2019 financial year, an increase compared to the €17.1 million posted in 2018. The 2019 profit includes the book profit on the sale of the participation in Nedap France as described

above.

Earnings per share and dividend

Earnings per share rose from €2.66 in 2018 to €3.74 in the 2019 financial year. The average number of outstanding shares was 6,444,622 at 31 December 2019 (6,407,929 at 31 December 2018). This increase results

from the sale of shares held by the company itself to cover employee participation plans. As stated previously, the net proceeds generated by the sale of Nedap France will primarily be used for a one-off increase of the dividend for 2019. Dividend per share for the 2019 financial year amounts to €4.50 (€2.50 in 2018).

Financial position

The balance sheet total grew from €115.4 million as at 31 December 2018 to €120.5 million as at 31 December 2019, mainly due to an increase in cash and cash equivalents. Inventories decreased by almost a quarter. Fewer

buffer inventories are needed now that the reorganised supply chain is performing better and better, and collaboration with supply chain partners is going well. The global shortages in electronics components also decreased.

During the first six months of 2019, Nedap entered into a new 7-year credit agreement. The term of the credit facility has been extended to April 2026 and improved rates have been agreed. The committed credit facilities

amount to €44 million in total.

Following the reduction of inventories and the sale of Nedap France, the net debt position is temporarily a surplus, levelling out once dividend has been paid out, ending up in line with the financial parameters determined by Nedap

in its strategic framework. The net debt position amounted to a surplus of €4.5 million at year-end 2019, compared with the net debt position of €16.6 million at year-end 2018. The net debt/EBITDA stood at -0.2 on 31 December

2019 (0.6 at year-end 2018). Solvency stood at 61% on 31 December 2019 (56% on 31 December 2018).

Cash flow

2019 saw the net working capital decrease to €26.9 million (€38.5 million in 2018). This decrease is primarily the result of lower (buffer)inventory levels. The operational cash flow was €29.5 million in 2019, up on 2018 (€18.2

million), mainly due to decreasing inventories.

Return on invested capital

The return on invested capital (ROIC) remained at 25%, the same level as in 2018.

Business unit developments

Healthcare

The Healthcare business unit (automation of administrative tasks for healthcare professionals) again posted a

robust increase in revenue in 2019, increasing its market share in all the healthcare markets it operates in (elderly, disabled and mental healthcare). Over 250,000 healthcare professionals are using Healthcare’s user-friendly Ons®

software platform. The business unit welcomed the first major mental healthcare facility as a customer in 2019 and various other major mental healthcare facilities have expressed their interest in Nedap and are expected to switch

to Nedap in the next few years.

Demand for innovative solutions and deployment of modern technology to support healthcare processes will continue to grow in the various healthcare markets over the coming years. In anticipation of this, the business unit

is continuing to invest in the recruitment of software developers above all, so as to reinforce its leading role in the healthcare sector.

The business unit expects to continue its revenue growth over the coming year.

Identification Systems

Revenue posted by the Identification Systems business unit (vehicle and driver identification products and wireless parking systems) increased in 2019, partly due to the large number of SENSIT projects (parking space management proposition) fulfilled in 2019 and a generally positive underlying trend.

Work was also put into making three core propositions - vehicle detection, vehicle identification and vehicle access control - fit in better with market needs in 2019.

Further growth is expected over the coming year.

Light Controls

The Light Controls business unit (power electronics and control systems for the lighting industry) posted a healthy growth in revenue, especially during the last six months of 2019. The ballast water purification driver technology

developed by the business unit contributed significantly to this growth. The focus of the Luxon proposition shifted from hardware to software services and the number of light points managed using Luxon doubled during the year.

However, since hardware revenue dropped, the overall revenue generated by the Luxon proposition remained more or less the same in 2019.

The business unit expects growth in both UV solutions and the Luxon proposition in 2020.

Livestock Management

Revenue posted in 2019 by the Livestock Management business unit (automation of livestock management processes based on identification of individual animals) was lower than in the strong year 2018. The global African swine fever epidemic has caused investments in this sector to drop significantly, thereby reducing the business unit’s revenue in the pig farming industry. In the long term, however, the outlook on this market remains positive, and the outbreak will pave the way for accelerated professionalisation of the pig farming sector, which Nedap will be able to benefit from.

The business unit only noted a small decrease in revenue in the dairy farming industry, following a peak in 2018.

Although developments are currently difficult to predict, especially in the pig farming industry, the business unit expects higher revenue in 2020.

Retail

Market conditions for the Retail business unit (security, management and information systems for the retail sector) remain challenging and volatile. Demand for conventional anti-shoplifting systems is continuing to drop as expected, but cannot as yet be compensated fully by growth in RFID-based solutions. Thanks to targeted marketing campaigns and the release of new functionalities on the !D Cloud platform, the number of retailers choosing Nedap’s stock management solution grew rapidly. This makes !D Cloud the platform with the most connected stores worldwide. Following Europe, the number of retailers selecting !D Cloud and Nedap in North America is also starting to increase.

The business unit expects to post increased revenue this year.

Security Management

Revenue posted by the Security Management business unit (systems for access control and security) over the year showed a healthy upward trend. Following solid growth in the first six months of 2019, the revenue growth levelled off in the last six months of 2019, compared with the previous financial year. This is down to the fulfilment of several major projects at the end of 2018. Major investments were made in both product innovation and targeted commercial campaigns, such as social media campaigns and expert contributions to conferences and webinars.

This helped Nedap reinforce its leading position in the market for major and complex security issues.

The business unit continues to note increasing interest in its capacities to implement large-scale access control projects all over the world, and therefore expects revenue to keep growing over the coming year.

Staffing Solutions

The Staffing Solutions business unit (digitised timesheet processing, planning and employee scheduling) has managed to achieve a growth in the number of temporary employment organisations and companies that use its

software services, therefore fully compensating for the reduction in the number of hours processed by two major temporary employment organisations. Staffing Solutions’ revenue remained more or less unchanged across the board. The business unit has developed a new proposition for temporary employment organisations called Source, which will be brought to the market in the second half of 2020.

Growth in the number of hours worked and therefore also of revenue is expected in 2020.

Outlook

Nedap focuses on the development and supply of Technology for Life: technological products that enable people to work more meaningful and successful in their professional lives. By continuously making investments in proposition development and commercial strength, we are better able to set ourselves apart from our competitors and improve our market positions. The solid balance sheet and availability of long-term financing give us a firm financial foundation. We are confident about the future and expect healthy long-term growth. On this basis, we expect an increase in revenue in 2020, exceptional circumstances notwithstanding.

Annual report publication and general meeting of shareholders

The 2019 annual report will be published on the company website on 25 February (after the close of trading). The annual general meeting of shareholders will take place at 11:00 am on Thursday 9 April at the Amsterdam RAI

nhow hotel in Amsterdam.

About Nedap N.V.

High-tech company Nedap N.V. creates high-quality,

innovative hardware and software products that enable

people to work more meaningful and successful in their

professional lives. Nedap N.V. has a workforce of around

750 employees and operates on a global scale. The

company was founded in 1929 and has been listed on

Euronext Amsterdam since 1947. Its headquarters is

located in Groenlo, the Netherlands.

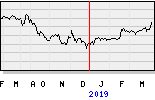

tijd 16.23

Nedap EUR 51,00 +1,40 vol. 24.833