Fourth quarter (period July 1 – September 30, 2014).

• Launch of Google Search Appliance activity in the Netherlands

• Q4 total revenue increased by 70% to € 5.667k (Q4 2013: € 3.324k)

• Q4 SaaS and hosting revenues grew with 91% to € 2.346k (Q4 2013: € 1.230k)

• Q4 EBITDA amounts to € 459k (Q4 2013: € - 65k), including € 77k one-time expenses

• Q4 EBIT amounts to € 219k (Q4 2013: € - 890k), including € 77k one-time expenses

• Subsequent event: update on partial repayment of EU development grants. No provision for partial repayments in FY 2014.

TIE Kinetix (hereinafter “TIE”), the leading provider of cloud-managed Business Integration, E-Commerce, Demand Generation, and Business Analytics services today released the results for the fourth quarter and full fiscal year 2014 (Oct 1, 2013 – Sept 30, 2014) as follows:

Highlights Q4

(€ x 1,000) Q4 2014 Q4 2013

Business Integration 2.333 2.127

E-Commerce 1.277 567

Demand generation 1.287 272

Business Analytics 502 164

Revenues 5.399 3.130

EU Projects 273 233

Onetime income (5) (40)

Total Revenue 5.667 3.323

EBITDA 459 (65)

EBIT 219 (825)

Highlights full year 2014

(€ x 1,000) FY 2014 FY 2013

Business Integration 8.967 8.232

E-Commerce 3.445 2.200

Demand generation 4.584 1.388

Business Analytics 2.222 1.161

Revenues 19.218 12.981

EU Projects 1.114 958

Onetime income 142 354

Total Revenue 20.474 14.293

EBITDA 1.062 146

EBIT 243 (1.220)

Net income 445 (1.280)

Revenue

TIE closed a very strong fourth quarter, with revenue amounting to € 5.667k, and EBITDA of €459k (8.0%). Therewith, the performance in the fourth quarter is a prolongation of the continuously improving performance in fiscal year 2014. Particularly our Integration products and E-Commerce solutions reported strong performance in the fourth quarter, both in our Dutch markets as well as in the US market. The following highlights the developments in our four business lines this year:

· Integration: our solutions are well positioned in various vertical markets such as food retail, publishing, do-it-yourself, telecommunications and automotive industries. This year TIE has a.o. concluded contracts with customers Plus Retail, Bunzl, Revlon, Nutricia, Sodexo, V&D, Royal Canin and Bugaboo. The strength of our offering is reflected in a position in Gartner’s Magic Quadrant for Integration Brokerage. In fiscal year 2014, our Business Integration revenue grew with 9.3% from € 8.207k (2013) to € 8.967k (2014).

· E-Commerce: our E-Commerce proposition delivers webshop solutions with full back office integrations. Our customers are typically large scale telecommunications companies such as KPN and T-Mobile. In 2014, the contract with T-Mobile was renewed and provides for a multi-year partnership extending earlier service levels and covers even more T-Mobile products and services. In 2014, our E-Commerce revenue grew with 52% from € 2.271k (2013) to € 3.445k (2014).

· Demand Generation (before known as Content Syndication): TIE has repositioned our Demand Generation proposition into a modular solution, in an attempt to facilitate the market adoption. In 2014, TIE spent considerable efforts positioning its brand in the market but also recognized that this market is still very much in the development phase. TIE was able to conclude new business but not in the amounts that were initially foreseen. In 2014, our Demand Generation revenue increased with 262% from € 1.266k (2013) to € 4.584k (2014), fully as a result of the acquisition of the TFT activities.

· Analytics: with the acquisition of TFT, TIE Kinetix has become a dominant player in the German market for Analytics. TFT is a reseller of analytic tools (Google Search Appliance and Adobe) to the business community. As a full-service agency for web business performance and a pioneer in the field of user experience, Munich-based TFT provides e-commerce strategies, consulting services and managed-hosting solutions. It serves a number of high-profile customers such as blick.ch, Swisscom, wetter.com, FOCUS Online and HolidayCheck. TFT has been consolidated since its acquisition on December 2, 2013. In Q4, TIE acquired a foothold of Google Search Appliance customers in the Netherlands allowing it to further develop these activities in the Netherlands, using TFT expertise. In 2014 our Analytics revenue grew with 80% from € 1.237k (2013) to € 2.222k (2014).

Jan Sundelin (CEO) said:

“Our Q4 performance confirms that TIE has been able to successfully turn the corner and that TIE’s operations are able to consistently generate positive cash flow. In 2014 our SaaS revenue grew to almost € 8 million bringing our recurring revenue level close to 60% and our three year contract value to € 34 million. This brings stability in our business and provides a solid basis for investment in marketing, sales and product development. Our Integration business continues to do well and we intend to actively exploit market opportunities in this business line. In 2014, our E-Commerce business expanded its relationship with T-Mobile in the Netherlands covering more T-Mobile products and services and includes active involvement in the successful launch of various new features. Our Demand Generation business did not bring the results that we planned for. The reason for this primarily lies in the immature market for this product and customer prudence to invest in our channel marketing automation tools. Given the sizeable customer investments in direct marketing automation tools, we expect that customer investments in channel marketing could be imminent. We therefore remain convinced about the market prospects for our product, but will reduce earlier planned investments. In 2014, we also expanded our Analytics business to the Netherlands with the acquisition of a small Google Search Appliance customer base. We are positive about our market opportunity in the Netherlands. Late October, we received a letter from the European Commission on possible repayments that TIE has to make. We are still studying the letter with our advisors, and whilst we recognize that certain formal procedures have not been met, we seriously question whether a full repayment of this is in the interest of all parties involved. On November 14th, we signed an agreement with a guarantor for the maximum possible damages, ensuring our customers that they may count on our ability to deliver quality products and services, now and in the future.”

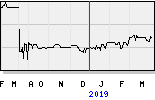

tijd 09.00

Tie EUR 7,30 +90ct vol. 1.309

Gewijzigde versie

TIE KINETIX Announces Strong Q4 Performance And Profitable Full Year 2014

Fourth quarter (period July 1 – September 30, 2014).

Launch of Google Search Appliance activity in the Netherlands

Q4 total revenue increased by 70% to € 5.667k (Q4 2013: € 3.324k)

Q4 SaaS and hosting revenues grew with 91% to € 2.346k (Q4 2013: € 1.230k)

Q4 EBITDA amounts to € 459k (Q4 2013: € - 65k), including € 77k one-time expenses

Q4 EBIT amounts to € 219k (Q4 2013: € - 890k), including € 77k one-time expenses

Subsequent event: update on partial repayment of EU development grants. No provision

for partial repayments in FY 2014.

TIE Kinetix (hereinafter “TIE”), the leading provider of cloud-managed Integration, E-Commerce,

Demand Generation, and Business Analytics services today released the results for the fourth quarter

and full fiscal year 2014 (Oct 1, 2013 – Sept 30, 2014) as follows:

Highlights Q4 2014 Q4 2013

(€ x 1,000)

Business Integration 2.333 2.127

E-Commerce 1.277 567

Demand generation 1.287 272

Business Analytics 502 164

Revenues 5.399 3.130

EU Projects 273 233

Onetime income (5) (40)

Total Revenue 5.667 3.323

EBITDA 459 (65)

EBIT 219 (825)

Highlights full year 2014

(€ x 1,000) Q4 2014 Q4 2013

Business Integration 8.967 8.232

E-Commerce 3.445 2.200

Demand generation 4.584 1.388

Business Analytics 2.222 1.161

Revenues 19.218 12.981

EU Projects 1.114 958

Onetime income 142 354

Total Revenue 20.474 14.293

EBITDA 1.062 146

EBIT 243 (1.220)

Net income 445 (1.280)

Revenue

TIE closed a very strong fourth quarter, with revenue amounting to € 5.667k, and EBITDA of €459k

(8.0%). Therewith, the performance in the fourth quarter is a prolongation of the continuously

improving performance in fiscal year 2014. Particularly our Integration products and E-Commerce

solutions reported strong performance in the fourth quarter, both in our Dutch markets as well as in

the US market. The following highlights the developments in our four business lines this year:

Integration: our solutions are well positioned in various vertical markets such as food retail,

publishing, do-it-yourself, telecommunications and automotive industries. This year TIE has

a.o. concluded contracts with customers Plus Retail, Bunzl, Revlon, Nutricia, Sodexo, V&D,

Royal Canin and Bugaboo. The strength of our offering is reflected in a position in Gartner’s

Magic Quadrant for Integration Brokerage. In fiscal year 2014, our Business Integration

revenue grew with 9.3% from € 8.207k (2013) to € 8.967k (2014).

E-Commerce: our E-Commerce proposition delivers webshop solutions with full back office

integrations. Our customers are typically large scale telecommunications companies such as

KPN and T-Mobile. In 2014, the contract with T-Mobile was renewed and provides for a

multi-year partnership extending earlier service levels and covers even more T-Mobile

products and services. In 2014, our E-Commerce revenue grew with 52% from € 2.271k

(2013) to € 3.445k (2014).

Demand Generation (before known as Content Syndication): TIE has repositioned our

Demand Generation proposition into a modular solution, in an attempt to facilitate the

market adoption. In 2014, TIE spent considerable efforts positioning its brand in the market

but also recognized that this market is still very much in the development phase. TIE was

able to conclude new business but not in the amounts that were initially foreseen. In 2014,

our Demand Generation revenue increased with 262% from € 1.266k (2013) to € 4.584k

(2014), fully as a result of the acquisition of the TFT activities.

Analytics: with the acquisition of TFT, TIE Kinetix has become a dominant player in the

German market for Analytics. TFT is a reseller of analytic tools (Google Search Appliance and

Adobe) to the business community. As a full-service agency for web business performance

and a pioneer in the field of user experience, Munich-based TFT provides e-commerce

strategies, consulting services and managed-hosting solutions. It serves a number of highprofile

customers such as blick.ch, Swisscom, wetter.com, FOCUS Online and HolidayCheck.

TFT has been consolidated since its acquisition on December 2, 2013. In Q4, TIE acquired a

foothold of Google Search Appliance customers in the Netherlands allowing it to further

develop these activities in the Netherlands, using TFT expertise. In 2014 our Analytics

revenue grew with 80% from € 1.237k (2013) to € 2.222k (2014).

Jan Sundelin (CEO) said:

“Our Q4 performance confirms that TIE has been able to successfully turn the corner and that TIE’s operations are able to consistently generate positive cash flow. In 2014 our SaaS revenue grew to almost € 8 million bringing our recurring revenue level close to 60% and our three year contract value to € 34 million. This brings stability in our business and provides a solid basis for investment in marketing, sales and product development. Our Integration business continues to do well and we intend to actively exploit market opportunities in this business line. In 2014, our E-Commerce business expanded its relationship with T-Mobile in the Netherlands covering more T-Mobile products and services and includes active involvement in the successful launch of various new features. Our Demand Generation business did not bring the results that we planned for. The reason for this primarily lies in the immature market for this product and customer prudence to invest in our channel marketing automation tools. Given the sizeable customer investments in direct marketing automation tools, we expect that customer investments in channel marketing could be imminent. We therefore remain convinced about the market prospects for our product, but will reduce earlier planned investments. In 2014, we also expanded our Analytics business to the Netherlands with the acquisition of a small Google Search Appliance customer base. We are positive about our market opportunity in the Netherlands. Late October, we received a letter from the European Commission on possible repayments that TIE has to make. We are still studying the letter with our advisors, and whilst we recognize that certain formal procedures have not been met, we seriously question whether a full repayment of this is in the interest of all parties involved. On November 14th, we signed an agreement with a guarantor for the maximum possible damages, ensuring our customers that they may count on our ability to deliver quality products and services, now and in the future.”

In the first quarter the acquisition and integration of the German company Tomorrow Focus Technologies GmbH, was completed on December 2nd, 2013. In this report the results of TFT have been included as from that date. Acquisition costs amounted to € 348k and have been reported under Professional Services in the Profit & Loss statement.

tijd 16.52

TIE EUR 5,521 -88ct vol. 19.211