Key figures (in EUR x million)

2015 2014 Restated 2014 Published

Revenue 30.8 29.6 29.7

EBITDA 3.8 3.7 4.0

Operating Profit 3.0 2.7 3.0

Free cash flow

Profit after tax from continued operations 3.2 2.3 0.8 2.2 0.9 2.5

Profit per share (EUR) 1.24 1.15 1.31

Dividend (proposed 2015) 1.24 1.15 1.15

These figures are taken from the unaudited financial statements 2015. The audited financial statements will be published on the website www.brill.com on April 7th, 2016.

Highlights

• Organic revenue growth 2.4%, up from a 0.4% decline in 2014:

o Digital products up 6%

o Print books down 1.7%

o Recurring revenue up 11%

• EBITDA up 3.1%; EBITDA margin down to 12.3% from 12.4% due to underlying pressure on Cost of Goods Sold and effect of the stronger dollar on operating costs.

• Net Profit and EPS up 8.5% caused by higher EBITDA and lower depreciation expenses.

• Free cash flow up EUR 2.4 million; mainly driven by EUR 1 million change in working capital thanks to higher deferred income, and a smaller amount spent on investing activities (EUR 1.8 million).

• Proposed all cash dividend of EUR 1.24, up 9 cent or 8% from EUR 1.15 in 2014, for a payout of 100%.

• Restatement of 2014 results to reflect onerous lease contract of vacated Rodopi facility and corrected application of hedge accounting policy.

Development in 2015

2015 was an important year for Brill in terms of strategic progress. We saw good momentum in the product lines that we favor as the long term drivers of sustainable growth i.e. subscriptions and other sources of recurring revenue. Our geographical distribution of revenue develops as expected with Europe growing at 2%, the US at 5% and Rest of World at 7%. Book title output was meeting expectations and included major launches such as Brill’s Dictionary of Ancient Greek and The Student’s Dictionary of Classical and Medieval Chinese. Also the number of major reference works, sold as books as well as online databases, kept growing.

The number of journals grew as well and our catalog now lists 265 titles. Journal revenue was flat in 2015 but this is the result of one-off transactions and additional income in 2014. Underlying we saw journals revenue increase 5%.

In 2015 we established a representative office in Singapore to support sales promotion and title acquisition in the Asian region. In 2016 we will gradually expand the office to capitalize on the emerging market opportunity in the area. During 2015 we have stepped up our efforts to increase sales in China.

Measures and upside

Following a disappointing end of year 2014, 2015 was a turning point. Revenue development shows encouraging underlying dynamics but since 2015 still saw diminished profitability, the year was less than satisfactory from an overall perspective. During the year we implemented the following program to address the situation:

- Restructure and optimize outsourced fulfillment and distribution and create a United States onshore printing on demand capability as of January 1st, 2016;

- Prune and bundle publishing programs;

- Invest in enhanced content management capabilities to improve editorial efficiency and product development;

- Adjust pricing and transaction models to sustainably grow revenue and margin;

- Reduce other operational costs;

- Improve the sales per employee ratio.

The second half of 2015 already showed improved results and provided revenue levels hold up, we are confident that the above measures will contribute to further improvement of profitability.

Organization

Two new senior managers joined the company in August of last year; Olivier de Vlam was appointed EVP Finance & Operations and Peter Coebergh succeeded Stephen Dane as the EVP Sales & Marketing.

The Supervisory Board will reappoint Herman Pabbruwe as the managing director for a two year term until 2018.

After eight years André baron van Heemstra will step down as the chairman of the Supervisory Board in May. As his successor will be proposed to the AGM, Mr. Albert van der Touw (1955). Ab van der Touw has a broad senior management background at the publicly traded corporation Siemens, experience with the application of ICT, a strong network across academic and international organizations, and in depth knowledge of business in Germany.

Restatement of 2014 results

We identified two items in the annual accounts of 2014 that required restatement.

Rodopi lease contract – at the end of 2014, we vacated the Rodopi facilities in Amsterdam, where we had a fixed term lease until October 1st, 2017. Since the decision to vacate the premises was taken before year end 2014, we should have recognized a provision for the remaining duration of the contract in the 2014 accounts. Correcting the misstatement impacts 2014 results by EUR 195 thousand in profit before tax.

Hedge accounting – Brill applies hedge accounting to its forward currency agreements, hedging the incoming cash flows. Hedge accounting requires that the hedge effect is applied to revenue at the time BRILL • Plantijnstraat 2 • P.O. Box 9000 • 2300 PA Leiden • The Netherlands

T +31 (0)71-53 53 500 • F +31 (0)71-53 17 532 • Commercial Register Leiden 28000012

PRESS RELEASE

of recording the revenue and to currency revaluation effects until the time of cash settlement. Historically we followed a simplified approach. We applied the full hedge effect to revenue at the time of estimated cash settlement of the sale. After analysis we concluded that in an environment with high currency volatility this simplification would not result in a true and fair view of the 2014 and 2015 results. Therefore, starting 2014, we no longer apply the simplified approach. The impact on 2014 is EUR 147 thousand in revenue and EUR 200 thousand in profit before tax.

Outlook

Prospects for the 333 year old company are positive although -as usual- we refrain from giving specific guidance on expected performance. We continue to focus on growth through acquisitions, internal product development and through enhanced focus on marketing and sales. Also we focus on improving the margin.

In 2o16 we expect to further expand the product portfolio, especially in the number of journal titles and through additions to reference work product lines and book series. In addition it should be noted that the average hedged exchange rate against which the USD will be converted to EUR in 2016 will change from 1.33 to 1.15, having a favorable effect on margins.

We will invest in innovative, efficient and scalable business processes. Whereas our rate of capital investment abated somewhat in 2015 we expect to increase again in 2016 while managing an acceptable rate of asset turnover. Proven technology will remain a focus area of investment, with priority on those areas that directly support growth and profitability.

Our operating processes continue to rely heavily on outsourcing. We restructured our contracts for order processing, customer service and distribution and contracted with Turpin as our global partner on improved terms. Turpin is a global industry leader and serves many reputable publishers, both large and small. As part of this arrangement we have a new partnership with Bookmasters, Turpin’s logistical partner in the United States, to also act as our new Printing On Demand partner in the United States. As a result we expect better service and lower costs. Meanwhile we see physical stock declining as a result of our printing on demand policy, introducing more flexibility in our business model and reducing the risk of obsolete inventory.

Despite the decline in operating margin, Brill remains a financially healthy company, enabling us to keep investing in future growth. Our bolt-on acquisition policy shows continued opportunities for expansion. Should the opportunity for a strategic acquisition emerge, we have adequate financing resources available. In 2015 no attractive opportunity to acquire a larger strategically fitting business has occurred. However a number of smaller incremental title acquisitions have improved our program. Open Access activities currently play a minor role in Brill’s market but the company saw some growth in this new line of business and is ready to gear up as this publishing model gains traction.

Dividend

Based on the positive prospects for 2016 and the available cash resources we will propose an all-cash dividend of EUR 1.24, representing a payout of 100%. This proposal is in line with our policy of steady and if possible increasing dividends and marks the fifth consecutive year with a dividend increase.

Agenda 2016

As of April 7, the annual report will be posted on Brill’s website www.brill.com. Brill will release a trading update on the first quarter on April 14. A Press and Analyst meeting will be organized on April 28 in Leiden. On May 19, the Annual General Meeting will be held at the offices of the company in Leiden.

tijd 12.04

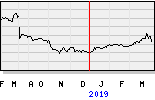

Brill EUR 24,005 +1,41 vol. 11.576