Key Highlights:

Health and safety performance: Protecting the health and well-being of employees remains the Company’s overarching priority; LTIF rate3 of 0.54x in 3Q 2022 as compared to 0.67x in 2Q 2022

Steel spread compression and seasonally lower shipments: 3Q 2022 was impacted by a negative price-cost effect, energy costs headwinds and a 5.6% sequential decrease in steel shipments to 13.6Mt (-7.1% lower vs. 3Q 2021). Steel shipments remain broadly stable YoY excluding ArcelorMittal Kryvyi Rih which is impacted by the ongoing war in Ukraine

Operating income: $1.7bn in 3Q 2022 (vs. $4.5bn in 2Q 2022); 9M 2022 operating income of $10.6bn (vs. $12.4bn in 9M 2021)

EBITDA: $2.7bn in 3Q 2022 vs. $5.2bn in 2Q 2022; 9M 2022 EBITDA of $12.9bn (vs. $14.4bn in 9M 2021)

Net income: $1.0bn in 3Q 2022 (vs. $3.9bn in 2Q 2022); 9M 2022 net income of $9.0bn (vs. $10.9bn net income in 9M 2021)

Share repurchases driving enhanced value: Company repurchased a further 31m shares during the quarter (96.2m in 9M 2022); diluted share count now 873m (vs. 1,224m at end of September 30, 202020); 3Q 2022 basic EPS of $1.11/sh; 9M 2022 basis EPS of $9.76/sh vs $9.52/sh for 9M 2021 benefiting from lower share count; last 12 months ROE15 of 26%; book value per share12 of $59/sh

Further FCF generation: Free cash flow (FCF) of $1.1bn in 3Q 2022 ($2.0bn net cash provided by operating activities less capex of $0.8bn less minority dividends $0.1bn) despite $0.6bn investment in working capital; FCF to be supported by a working capital release in 4Q 2022

Financial strength: Net debt of $3.9bn at the end of September 2022 as compared to $4.2bn at the end of June 2022 and $4.0bn at the end of December 2021; Gross debt of 9.0bn as at end of September 2022

Strategic update:

Decarbonization leadership: ArcelorMittal breaks ground on first transformational low-carbon emissions steelmaking project in Dofasco (Canada)19

Strategic growth: AMNS India announced its strategy to capture growth, expand its market share and play a leading role in the development of the Indian steel industry. Expansion of the Hazira plant to a ~15Mt capacity by early 2026 is underway including automotive downstream and enhancements to iron ore operations, with capex of ~$7.4bn and targeting to increase the EBITDA capacity by 2.5x4

Consistently returning capital: As at September 30, 2022, the Company had completed approximately 50% (i.e. ~31 million shares or ~$0.7bn) of the previously announced share buy-back program which totaled 60 million shares, with the balance to be completed by the end of May 2023

Financial highlights (on the basis of IFRS1,2):

(USDm) unless otherwise shown

see & read more on

https://corporate.arcelormittal.com/media/press-releases/arcelormittal-reports-third-quarter-2022-results

tijd 14.57

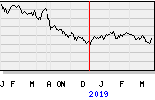

Arcelor EUR 24.075 +3 ct vol. 2,2 miljoen.