in thousands of euros 2020 2019 Change

Revenue 37,859 37,128 2.0%

EBITDA 6,600 5,183 27.3%

Operating profit 4,502 3,291 36.8%

Free cashflow 4,515 2,164 108.6%

Profit, attributable to shareholders of Koninklijke Brill NV 2,896 2,162 34.0%

Profit per share in EUR 1.54 1.15 34.0%

Dividend (proposed 2020) in EUR 1.25 —

Key Financial Performance Indicators

Organic growth 2.2% 2.5%

ROIC 13.8% 10.1%

EBITDA margin 17.4% 14.0%

These figures are unaudited. The audited financial statements will be published on our website brill.com on April 7th, 2021

Summary

• Revenue increased by 2%, EBITDA by 27%, and net profit by 35%, with strong revenue development in Q4

• Underlying net profit, excluding restructuring and acquisition costs and one-off tax impact, up by 39%

• Strong growth in eProduct sales and Open Access revenue

• 57% of revenue comes from digital publications, eBook sales grew by 9.5%

• The 2018-2020 profit improvement plan finalized in line with expectations

• Profit increased partly by one-off savings due to COVID-19 and other events – see financial development

• Integration of Vandenhoeck & Ruprecht acquisition started according to plan

Peter Coebergh, CEO commented

The year 2020 was unprecedented in Brill's 338-year history. Following a positive first quarter, the COVID-19 pandemic led to lockdowns and closed universities around the world and a sharp decline in our print book sales in

the period March-June. However, taking rapid action in March, Brill management launched a cost-saving program and we transitioned to working from home, maintaining contact with our authors, customers and vendors in online

environments. Over the summer the academic publishing market again demonstrated resilience in economic crises. Together with a significant growth of our e-business, an exceptionally good financial outcome resulted.

In this extraordinary year, more than ever, our employees had the greatest impact on the health of our business and for this we owe a debt of gratitude.

Developments in 2020

Strategic progress

In the course of 2020, we continued to make progress towards achieving our strategic objectives as laid out in our mission statement and corporate strategy.

At the end of 2019, we launched the Digital Health Check to review our digital infrastructure with the strategic objective to become a truly digitally driven publishing house. A number of projects to improve our digital capabilities and skills will be realized during the next few years.

Strategic progress is reflected in the further increase of our digital revenue, which was accelerated by the pandemic.

Also, our Open Access publishing program continued to grow rapidly, crossing the EUR 1 million revenue mark in 2020. Brill expanded its portfolio by acquiring several journals from competitors and by launching a variety of new

reference works and primary sources. Last but not least, we made serious progress in achieving our strategic

objective to increase our scale and to create a second-home market in Germany, the most important global humanities market. The reputable publishers Vandenhoeck & Ruprecht and Böhlau were acquired on March 1, 2021

and they will be combined with our imprints Ferdinand Schöningh, Wilhelm Fink and mentis in our German subsidiary Brill GmbH.

Operational progress

We continued to invest in our online platforms. The user experience of our web shop on brill.com was improved,

which led to a doubling of revenue vs. 2019. We also developed our special text editions platform, which was launched in 2019, and migrated the first products from their previous platforms. Our financial processes were

further improved in 2020. However, continuous IT problems with our UK-based global distributor led to significant extra costs and delays in enhancing our management information. Compensation was agreed at the end of 2020.

The profit improvement plan, launched in 2018, delivered savings as anticipated, especially by the reduction of typesetters and further optimizing our print on demand operations. The program was concluded at the end of 2020.

Financial development (all numbers in euro)

Revenue

In 2020, Brill’s organic revenue increased by 2.2%, which was much better than our expectations in Q2 and Q3 of

2020, a year that was heavily impacted by the COVID-19 pandemic. Total organic book revenues increased by 2.4%, with a 9.2% growth in eBooks offsetting the -3.0% organic decline in print book sales that is mainly due to the COVID-19 situation. Total organic journal sales increased by 3.4% due to continued growth in subscription value

and improved renewal management.

in thousands of euros 2020 2019 Organic growth Growth

Print books 13,511 14,145 -3.0% -4.5%

eBooks 12,196 11,139 9.2% 9.5%

Journals 11,075 10,611 3.4% 4.4%

Primary sources 1,078 1,234 -11.9% -12.7%

Total 37,859 37,128 2.2% 2.0%

in thousands of euros % of total

growth

Year on year

growth

Revenue 2019 37,128 100.0 %

Print books (424) (1.1)% -3.0%

eBooks 1,033 2.8 % 9.2%

Journals 369 1.0 % 3.4%

Primary sources (148) (0.4) -11.9%

Organic revenue 2020 37,958 102.2 % 2.2%

Currency (99) (0.3)%

Total revenue 2020 37,859 102.0 % 2.0%

Revenue generated through digital products was EUR 21.4 million or 57% of total (2019 EUR 21 million or 56% of total). Subscription revenue as a percentage of total revenue improved from 38% to 42%, mainly due to the decline

in print books which are non-subscription products.

We increased the number of major sales deals (i.e. over EUR 100 thousand per order) versus last year. In 2020, we successfully closed large deals with new and existing clients in the US, China, Australia, Germany, the Netherlands

and the UK. These deals included renewals from deals closed with these customers in previous years as well as new business.

Cost of Goods Sold and Operating Expenses, EBITDA

The cost of goods sold increased by EUR 0.3 million or 2.5% and the gross margin slightly decreased to 69.7% versus

69.8% in 2019. The cost of goods sold include a COVID-19 - induced write-off of the MONK project (EUR 0.2 million),

without this one-off item gross margin would have been 70.2%, showing the continuing improvement in our gross

margin as a result of, amongst others, the shift from print to electronic products.

Operating expenses were significantly lower compared to 2019, due to COVID-19 related measures and restrictions

(total positive effect of around EUR 1.7 million) and otheritems (total a net negative effect of around EUR 0.2 million).

To make 2020 EBITDA comparable to 2019, the following items should be taken into consideration:

• Cost for travel and conferences declined EUR 1.1 million versus 2019 due to the COVID-19 restrictions;

• In Q2 we implemented a hiring freeze that resulted in EUR 0.3 million lower personnel costs, despite salary

increases from the collective labor agreement;

• We received a subsidy of EUR 0.3 million in the USA as part of PPP, a COVID-19 relief program;

• We came to an agreement with our distribution partner about damages Brill incurred over 2019 and 2020, related to the quality of the provided services. At the end of 2020 Brill agreed with the distributor that the damages incurred by Brill will be compensated for an amount of EUR 0.5 million;

• Our finance and operations costs increased by EUR 0.4 million, due to consultancy costs for the Digital Health

Check and further improvement of our finance function;

• We incurred EUR 0.3 million costs for advice, due diligence and legal fees related to the 2021 acquisition of Vandenhoeck & Ruprecht.

Reported actuals including the above resulted in an EBITDA of EUR 6.6 million in 2020 (2019: EUR 5.2 million). The EBITDA margin came in at 17.4%. Taking into account the items above, our EBITDA would have been around EUR 5.3 million, and the EBITDA margin would be around 14%.

In 2020, we recorded EUR 0.3 million in costs related to our profit improvement plan, that started in 2018 and was

finalized in December 2020. These exceptional costs are reported outside our EBITDA.

Depreciation and Amortization, and Financing Income and Costs

Depreciation and amortization, other than recognized in cost of goods sold, were in line with 2019.

Profit and Profit per Share

In summary, operating profit and profit before tax increased significantly due to the operating expense items discussed above.

As in 2018 and 2019, net profit was impacted by corporate income tax rate movements. We again incurred a partial

reversal of the 2018 tax benefit. In 2019, the Dutch government decided to partly reverse the decrease of future

corporate income tax rates, and as a result, the deferred tax liability increased by EUR 0.2 million. In December 2020,

the Dutch government decided to reverse the decrease completely and keep the corporate income tax rate at 25%.

Consequently, in our statement of financial position, our deferred tax liability increased by EUR 0.5 million and the

same amount was added to the tax charge in our statement of profit or loss.

Underlying net profit, which is net profit excluding one-off expenses related to the profit improvement plan, acquisition costs, the one-off benefit of the PPP subsidy in the US and the one-off tax impact, amounted to EUR 3.5

million in 2020, an increase of 56.5% compared to 2019 (EUR 2.4 million). This translates into an underlying earnings per share of EUR 1.25 for 2020, which forms the basis for the dividend proposal. Reported net profit for 2020 came

in at EUR 2.9 million (2019: EUR 2.2 million).

in thousands of euros 2020 2019 Growth

Profit before tax 4,427 3,107 42.5%

Cost of the 2018-2020 profit improvement plan 308 85

Costs for the acquisition of V&R 262

PPP Subsidy US (COVID-related) -296

Underlying profit before tax 4,701 3,192 47.3%

Tax, at the statutory rate -1,175 -798

Underlying net profit 3,525 2,394 47.3%

Non-benchmark items, after tax -206 -64

Change in deferred tax liability and other -424 -169

Profit attributable to shareholders of Koninklijke Brill NV 2,896 2,162 34.0%

Underlying earnings per share 1.88 1.28

Earnings per share 1.54 1.15

Operating Working Capital and Cash Flow

Deferred income increased significantly because we sent out our renewal invoices earlier and total subscriptions

increased. Together with higher EBITDA and COVID-19 related measures (not paying dividend over 2019 and postponing 3 quarters of repayments of our long-term loan) this resulted in a cash flow improvement of EUR 4.1 million versus 2019.

Return on Invested Capital

Return on Invested Capital (ROIC) improved to 13.8% versus 10.1% in 2019, driven by an improvement in operating

margin and a stable asset turnover.

Solvency and Liquidity

Total assets (EUR 53.6 million) increased versus 2019 (EUR 51.8 million). Solvency (Shareholders’ equity divided by

total assets) improved to 44.6% in 2020 (2019: 40.9%; target range of 40–60%).

Dividend

We wish to adhere to our corporate solvency policy of 40–60% and to the covenants agreed upon with our main bank. Also, we will continue to pursue our capital management policy where strategic investments and add-on

acquisitions must be funded within free cash flow. Given that in 2020 we did not pay out dividend over 2019 and our 2020 financial results, we will propose at the Annual General Meeting of Shareholders on 19 May 2021 an allcash ordinary dividend of EUR 1.25 per (certificate of) ordinary share. This is 81% of 2020 Earnings Per Share of

EUR 1.54.

Long-term Outlook

Given the current uncertainties, we do not provide an outlook for 2021. Despite the COVID-19 situation, we continue

to focus on the execution of our long-term strategy. A significant step in that strategy was taken by the acquisition

of Vandenhoeck & Ruprecht Verlage on 1 March 2021. We remain committed to our long-term objective of an average organic revenue growth of around 2% and an EBITDA margin of more than 17%, with a return on invested

capital showing material headroom to our weighted average cost of capital.

Leiden, March 25, 2021

Peter Coebergh, Chief Executive Officer

Lokaal tijd 09.56

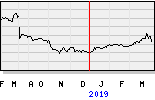

Brill EUR 26,40 +1,20 vol. 2.808