Sustained focus on cost and cash

Cautiously optimistic for second half of 2010

• Volume decline of 0.8% in first four months of 2010; stabilised relative to H2 2009. Lower volume mainly due to reduced construction volumes in Europe, drop in demand for elevator cable and copper telecommunication cable. Recovery in demand for automotive cable, first seen in H2 2009, sustained and optical fiber business continues to be buoyant.

• EBITDA2 expected to be € 61–66 million in H1 2010 (€ 71.8 million in H1 2009).

• Operating result2 of € 31–36 million expected in H1 2010, compared with € 41.0 million in H1 2009.

• Result for the period2 expected to be around € 17–22 million, compared with € 19.4 million in H1 2009.

• Market conditions stabilised compared with H2 2009. Tentative signs of underlying recovery with respect to industrial related cable activities, construction related cable activities in Asia and communication cable activities. Provided international confidence continues to recover, the positive impact this will have should be reflected in Draka's results from the second half of 2010 onwards.

• Cost-saving programmes on track. Annual savings estimated at € 30 million in 2010, with savings of approximately € 15 million to be achieved in H1 2010.

• Operating working capital as a percentage of revenue expected to be 15–17%, in line with the first half of 2009 (H1 2009 15.8%).

• Net debt expected to be € 50–60 million higher than at year-end 2009 (€ 295 million), mainly owing to the increase in working capital due to a significant rise in the price of copper.

Amsterdam, 18 May 2010 – This trading update for H1 2010 is issued by Draka Holding N.V., one of the world's leading producers of low-voltage cable, cable for OEMs and communication cable, ahead of the publication of the half-year figures on Thursday, 19 August 2010 (before start of trading).

Commenting on the expected results in the first half of 2010, CEO Frank Dorjee said, ‘The general stabilisation of demand on the world cable market seen in the second half of 2009 has continued in the first months of 2010. The additional cost savings, being realized by Draka, are expected to absorb the effects of the highly competitive market environment. On balance, we expect Draka to achieve a satisfactory operating result over the first six months of 2010 -- before non-recurring items -- comparable with those achieved in the second half of 2009.

Although still fragile, we note that the recovery of the global economy is becoming broader based. Developments in Draka’s industrial and communication cable activities and in the construction-related cable business in Asia, in particular, feed our cautious optimism for the second half of the year, provided the restoration of international confidence is maintained. With its streamlined organisation and reduced cost base, Draka should be capable of profiting to the full from the eventual recovery of our end-markets.’

1 All figures are unaudited.

2 Excluding non-recurring items. Gross non-recurring items in H1 2010 are expected to be around € 18 million negative (H1 2009: € 17.9 million negative).

Draka Group

Developments in H1 2010

The stabilisation of the market which began in the second half of 2009 continued in the first few months of 2010. However, this is the overall picture; the recovery of the various end-markets is still fragile and the market developments are more mixed.

As far as the construction-related business is concerned, the European market has more or less stabilised, with the exception of the Benelux countries, where volume is still falling. The harsh winter in Europe hit demand in the first few months of 2010. In the Asia-Pacific region, however, after an initial decline, the level of construction activities has bounced back since March, driven by the economic recovery.

The automotive cable segment shows a recovery compared with the first half of 2009 and is developing in line with the second half of last year. The cable activities related to renewables remain weak but the order intake is improving and this is expected to be reflected in the results from the second half of 2010 onwards. The oil & gas market and the various niche segments in the United States develop along similar lines to those in the first half of 2009. Demand for elevator cables has stabilised relative to the second six months last year but is still well down on the first half of 2009.

As regards communication cable, demand for optical fiber remains at the high level of the second half of 2009. The order intake for the optical fiber cable activities in Europe and the United States is improving and there is some recovery in the data communication business after the sharp downturn in 2009.

Forecast result for H1 2010

Draka expects to report a marginal decline in volume during the first half of 2010 compared with the first six months of 2009. This marginal volume decline will result in somewhat lower capacity utilisation in Draka's production facilities, which will impair profitability. The unmitigated competition in the market will also adversely affect results. Partial compensation for these downside effects will be provided by a slight improvement in the product mix and the impact of the various programmes to control costs. The cost savings are expected to total around € 15 million in the first half of 2010.

Draka is forecasting an operating result, excluding non-recurring items, in the range € 31–36 million in the first half of 2010, compared with € 41.0 million for the corresponding period in 2009 (H2 2009: € 34.3 million). The net result excluding non-recurring items is expected to come in at € 17–22 million, compared with € 19.4 million for the first six months of 2009 (H2 2009: € 28.9 million). Including non-recurring items, the operating result is expected to be € 13–18 million (H1 2009: € 23.1 million), with a net result of between € 1 million loss and € 4 million profit (H1 2009: € 6.0 million profit).

Non-recurring items

The non-recurring items in the first half of 2010 are expected to total around € 18 million negative, and relate to the costs of closing two factories, Triple S projects and other cost-saving measures. This concerns projects which were started in 2009 and further expanded at the beginning of 2010. The total of non-recurring charges in 2010 is expected to be around € 25 million.

Cost-saving measures

The previously announced plans to close the factories in Ystad (Sweden) and Årnes (Norway) are being implemented and are expected to be completed in the second half of the year. Other actions, including the further downsizing of the automotive cable production activities in various countries (Automotive & Aviation) and the implementation of various efficiency measures in the Communications Group, are proceeding according to plan. As a result of these projects, the workforce will be reduced by an additional 300 in 2010, representing a reduction of 3% relative to year-end 2009. The cost savings for 2010 are estimated at approximately € 30 million, of which around € 15 million will be achieved in the first half of the year.

Working capital and cash flow

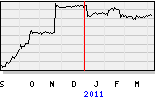

Draka’s operating working capital is expected to increase strongly in the first six months of 2010 compared with year-end 2009 (€ 281 million). The expected increase is being driven by the significant rise in the price of copper on top of the normal seasonal pattern whereby the absolute amount of working capital increases in the first half of the year.

The operating working capital as a percentage of revenue is expected to be 15-17%, similar to the figure in the first half of 2009 (15.8%) and slightly above the target range of 14-16% for year-end 2010.

Owing to the anticipated increase in the operating working capital, the cash flow from operating activities in the first half of 2010 is expected to be negative (H1 2009: € 74.7 million positive). Apart from the working capital effect itself, the utilisation of provisions will have a negative impact on the cash flow.

The net debt will increase by about € 50–60 million in the first half of 2010 compared with € 295 million at year-end 2009 driven mainly by the expected increase in working capital.

Energy & Infrastructure

The European construction market generally stabilised at the relatively low level reached in the second half of 2009. The main exception to this was the Benelux region, where demand has continued to fall after a small drop in 2009. Coupled with that, the relatively harsh winter in Europe adversely affected demand in the first few months of 2010.

In Asia, after a sharp downturn in the second half of 2009 and the first few months of 2010, business is picking up on the back of the sharply improved economic climate and the expansion of Draka's position in the region, thanks in part to the opening of a second plant in Malaysia. This favourable trend is expected to continue.

Draka continues to respond to the altered market conditions. Adjustments are constantly being made to production capacity in line with changes in the market, including the closure of the plant in Ystad (Sweden), which will be completed in the course of 2010. The sales organisation is increasingly focussing on securing cable orders for major industrial projects in Europe.

Industry & Specialty

Within the Automotive & Aviation division, the upturn in demand for cars, seen in the second half of 2009, continued in the first few months of 2010. Although several government incentives to trade-in older cars for new ones (scrappage schemes) have come to an end, demand is still being driven especially by the more upmarket end of the car industry, a segment in which Draka occupies a stronger position. As regards the aviation activities (cables for Airbus), business is steady at 2009 levels.

Elevator Products is a relatively late-cycle activity, which was faced with a strong volume downturn in the second half of 2009. The market has since stabilised but that nevertheless implies a strongly reduced volume relative to the first half of 2009.

The divisions Cableteq USA, Offshore and Industrial are industry-related businesses in which the level of activity is relatively stable. In recent months, Draka has noticed a tentative recovery in the order intake. This is expected to be reflected in the results in the second half of 2010 in particular. Cableteq USA will also be able to profit in the second half of the year from the recent acquisition of Pressure Tube Manufacturing, a producer of high-quality, corrosion-resistant tubing for the oil & gas industry in America. In the Offshore division, the start-up phase of the new plant for subsea cable in Norway will be concluded.

Communications

Within the telecommunications cable market, the optical fiber segment continues to develop positively, mainly driven by the steady demand from Asia, which is on a par with the high level of the second half of 2009. China in particular continues to invest heavily in networks. The European and North American markets are stable, with a slight improvement in order intake.

Draka is benefiting optimally from the healthy trends in the Chinese market, thanks to the strong positions occupied by the Group's joint ventures in this market.

As regards the cable activities in Europe and North America, the market continues to be difficult, with intense competition and pressure on selling prices. In response to this, Draka is lowering its cost base still further.

Demand for data communication cable is exhibiting a small recovery after the strong downturn in 2009. Demand is picking up in the high-end applications market, such as for 10GB networks in data centres.

The various cost-saving measures which were implemented at an accelerated pace in 2009 are on track. They are mainly aimed at cutting overheads and direct costs across the board.