Royal Wessanen Q4 and full year 2013 results

Q4 2013 highlights

Revenue Branded up 3.5% to €101.9 million, autonomous revenue growth was 0.5%

Portfolio choices to improve profitability negatively impacting revenue

Strategic re-segmentation to more accurately reflect different business models and strategic focus

Distribution and IZICO classified as discontinued operations; divestment processes under way

Advanced discussions with Vroegop Ruhe & Co underway regarding the sale of Natudis

Christophe Barnouin appointed member of the Executive Board and new CEO

Full year highlights

Autonomous revenue growth of (3.3)%; at Branded autonomous growth of 2.1%

Operating result (EBITE) down to €13.3 million

EBITE at Branded up 47% to €24.3 million, even after higher marketing investments

Revenue and profit decline at ABC due to weakness at frozen pouches segment

Core brands, such as Bjorg, Bonneterre and Clipper, and core categories continue to grow

'Wessanen 2015' completed on plan, delivering expected cost savings

Dividend proposed of €0.05 (wholly in cash)

Consolidated key figures Q4 / FY 2013

in € million, unless stated otherwise Q4 2013 Q4 2012 ² FY 2013 FY 2012 ²

Revenue 114.3 115.4 508.5 520.1

Autonomous revenue development 1

(2.9)% (3.3)%

Normalised operating result (EBITE) (0.6) 0.5 13.3 17.5

Operating result (EBIT) (6.9) (46.8) 11.9 (30.8)

Net result, attributable to equity holders (7.7) (61.3) (0.1) (52.6)

Net debt 50.7 54.9

Earnings per share (in €) (0.10) (0.81) 0.00 (0.70)

Average nr. of outstanding shares (x 1,000) 75,736 75,665 75,723 75,688

¹ Including adjustments for currency effects and acquisitions/divestments;

2

Figures restated for effect of i) IAS19R and ii) Distribution and IZICO

qualified as discontinued operations as of 31 December 2013.

CEO statement

Christophe Barnouin (CEO) commented: "At Wessanen, we are jointly building with all the teams progressively a European champion in healthy and sustainable food. We are active in very attractive parts of the food market and our strategy is the right one to create long-term value.

Our core activity Branded reported a strong performance last year. We have grown our core brands and core categories and executed our restructuring ‘Wessanen 2015’ seamlessly. This has resulted in 47% growth of the Branded operating result (EBITE). ABC’s performance, in contrast, was very disappointing, due to a strong decline in its frozen pouches segment. Unfortunately, the improved results of the Branded business could not compensate for the decline at ABC. We therefore have to report a lower EBITE.

Distribution and IZICO, which we are reporting as discontinued operations, also showed a good performance, delivering their plans and showing an increased full year operating result.

To realise our ambitions in 2014 and beyond, our first priority is to execute the plans and actions in our Branded business well and at a higher pace. We also have commenced the divestment processes of IZICO and both Distribution businesses to accelerate this process of focus. The divestment of both Natudis and Bio-Distrifrais is in line with Wessanen’s strategy of focus on its own brands in the healthy and sustainable market. IZICO was already labelled as a non-core business.

After restoring profitability at ABC, a divestment is to follow as well.”

‘Wessanen 2015’ completed on plan We have completed the reorganisation ‘Wessanen 2015’ on plan. With respect to our continuing operations, the one-off costs were €(19.2) million, of which €(2.6) million has been expensed in 2013. The annual cost savings for total Wessanen amount to €15 million from 2014 onwards, of which half was realised in 2013.

New segmentation

To reflect more accurately the different business models we operate within Europe, the segment Branded has been created, replacing Grocery and HFS. Of the former HFS segment, the German and the French operations (except for Biodistrifrais) have become part of Branded as well as all operations previously reported as Grocery. Natudis and Biodistrifrais would have become part of a new segment, Distribution, to reflect their focus on wholesale. The segmentation of ABC and IZICO has not changed.

All corporate costs other than shareholder and stewardship costs are charged to the operating segments. This way of presentation better reflects that our corporate centre mainly performs functions on behalf of and for the benefit of these operating segments.

For reporting purposes, corporate expenses recharged to discontinued operations have been reallocated to continuing operations for both 2013 and 2012 as corporate expenses will not cease to be incurred upon divestments of either of these segments within Distribution.

Discontinued operations IZICO, Natudis and Bio-Distrifrais are classified as discontinued operations as of 31 December 2013.

The 2012 figures have been restated to reflect this change. For all three businesses, a divestment process has been commenced, all of which we expect to complete in the course of 2014.

The sales process of Natudis is progressing well. We are in advanced discussions with Vroegop Ruhe & Co regarding the sale of Natudis and its companies Kroon and Hagor. Vroegop is a leading Dutch wholesaler and importer of (organic) potatoes, vegetables, fruit and exotic produce as well as a logistics services provider of food products for food service and retail companies.

Two-tier Board structure to be maintained

After postponing the adoption of a one-tier board structure in January and in view of the accelerated disposal programme for IZICO and Distribution and the consequent further simplification of Wessanen’s business, Wessanen has decided not to change its governance model and to maintain its two-tier board structure.

Dividend 2013

Wessanen’s dividend policy is aimed at paying out a dividend of 35-45% of the consolidated net result excluding major non-recurring effects. It is therefore proposed to the Annual General Meeting of Shareholders to pay a dividend of €0.05 per share representing 41.5% of the consolidated net result, excluding major non-recurring effects. The dividend will be paid wholly in cash.

Time table: Annual Report, AGM and dividend 2013

28 February Publication Annual Report 2013 and Agenda AGM (online)

19 March Record date

16 April Annual General Meeting of Shareholders (Marriott Stadhouderskade Amsterdam) (14h00)

22 April Ex-dividend date

24 April Dividend record date

30 April Payment date dividend

(Financial) guidance FY 2014 (continuing operations only)

EBIT(E)

Wessanen is expected to report a higher EBITE in 2014.

o In Q1 we expect a lower EBITE, due to phasing of advertising spending.

ABC is expected to be profitable again in 2014.

Non-allocated expenses (including corporate expenses) are expected to be €(2-3) million.

Financial items

Net financing costs expected to be €(2) million.

Effective tax rate expected to be around 25-30%.

Capital expenditures expected to be €(4) million.

Depreciation and amortisation expected to be €(11) million.

Branded - operational review

At Wessanen, we focus on healthier food, healthier people and a healthier planet. During 2013, our

strategy has further evolved from ‘purely’ organic to healthier and sustainable food. Although organic food is and will remain very important to Wessanen, we feel that healthier, sustainable food better describes what we stand for, since fair trade, free-from and vegetarian options are included as well.

The healthy and sustainable markets we operate in represent a structural growth opportunity. These markets seemed almost immune to weak macro-economic conditions in Europe throughout the year.

The organic market, for example, continues to trend positively, growing 5-6% in 2013.

Revenue at Branded grew 3.5% to €101.9 million. Autonomous growth was 0.5% with volume up 0.6% and a price/mix effect of (0.1)%. The acquisition of Alter Eco added 4.3%, lower intercompany sales had an impact of (0.6)% and negative currency exchange effects impacted growth by (0.7)%.

Strategic actions such as exiting the German and Italian grocery business and a UK private label contract, stopping most of the fruits and vegetables business at Bonneterre and delisting Biorganic had a €3.3 million negative impact (or (3.8)%). Underlying autonomous growth was therefore 4.3%

The quality of our revenue growth continued to improve with our core brands and core categories continuing to grow, whereas private label and other sales (deliberately) declined. Most of our core brands have been growing, including Bjorg, Bonneterre, Clipper and Zonnatura. Also seven out of eight core categories are up in revenue.

In France, Bjorg continued to perform well on the back of various promotional actions. Areas of growth include sweets in between and dairy alternatives. Other brands such as Tanoshi and Dr Schär also performed well. Gayelord Hauser had a difficult quarter in a modestly declining dietetic market.

The integration of Alter Eco is progressing well. During the quarter, the sales teams have been merged, while good progress was made with next steps such as the ICT integration. The Bonneterre and Evernat brand were both up, driven by increased distribution at HFS chains and promotional

support.

The UK performed well with about stable revenue. The impact of exiting a private label contract, with volumes skewed to the fourth quarter, was fully mitigated by strong performances of dairy alternatives and Whole Earth spreads. Clipper was up in revenue and market share with especially every day teas and infusions doing well. Kallø showed good growth with amongst others its bread replacers, while the further roll out of the packaging redesign is progressing well.

zie meer op

www.wessanen.com

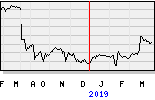

tijd 09.22

De Smallcap 552,93 +4,94 +0,90% Wessanen EUR 3,46 +12ct vol. 176.000

De neiuwe man is goed bezig, geen producten in je assortiment die weinig omzet fvergaren, eruit dat en winstgevende meer aandacht! Terecht, ga zo door, je maakte bij ons in de BAVA een goede indruk.

Uit ons verslag van 25 jan. j.l. de BAVA van Wessanen.

Onze indruk over de Heer C. Barnouin.

Zijn lichaamstaal vertelde ons: aan zijn manier van lopen en zijn vlotheid van spreken (was Engels) maar niet het echte Franse Engels, maar toch redelijk verstaanbaar. Een aanwezige vroeg of hij Nederlands wilde leren, dat beloofde hij. Maar onze vertegenwoordiger zei tegen Barnouin, dat hoeft U van ons niet, maar doe waar U goed in bent. Dat is belangrijker voor Wessanen.

Barnouin maakte een doortastende indruk op ons en wist dat ook duidelijk en overtuigend te brengen. Dat gaf ons vertrouwen en dan komt de rest later wel.

Hij vertelde zich volledig te willen focussen op 'n versnelling van groei in gezonde en duurzame voeding en waardecreatie voor Wessanen en aandeelhouders.

Met zijn 45 jaar en vader van 4 kinderen, die net als vader dagelijks gezonde voeding op tafel krijgen zei hij, daarmee wil hij de basis leggen voor iedere consument. Meer naar betaalbare gezonde voeding op basis van duurzaamheid. De organic voeding proefden wij in de ondertoon, is te duur en dan is voor Wessanen de omzet groei moeilijker te realiseren. Terechte opmerking.

Wat zei Barnouin, we willen naar duurzaamheid en gezonde voeding en niet zelf eigenlijk de winkel runnen, laat andere dat maar doen. Koffrie had al gezegd dat dat niet bij de kern van Wessanen paste, dat runnen van winkels. Ook dit onderschreef Barnouin.