Revenue trend gradually turning; increased gross margin pressure largely offset by continued strong cost management

Key points third quarter 2009

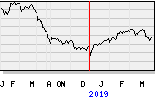

Revenue of € 3,178 million; organic growth1 per working day -28% (from -30% in July to -26% in September)

Gross profit reached € 596 million (-35%) with the gross margin coming down from 20.6% to 18.8%

Operating expenses reduced by 25% to € 503 million, backed by natural attrition, synergies and restructuring

EBITA2 amounted to € 93 million (-61%), with the underlying EBITA margin reaching 2.9% (vs. 5.5% in Q3 2008)

Net debt reduced by € 355 million to € 1.167 million; leverage ratio stable at 2.4

Adjusted net income3 attributable to holders of ordinary shares € 72.5 million; diluted EPS4 € 0.42 (-54%)

"It is encouraging", says Ben Noteboom, CEO of Randstad, "that the revenue trend has become a little better through the quarter on average, a trend which has continued in October. The pattern is classic, with professionals businesses stabilizing, while staffing and inhouse services are gradually picking up in several geographies. Stringent cost control has paid off. We will certainly need to keep a close eye on costs the coming quarters, especially in view of increased pressure on gross margin. However, as our renewed marketing campaigns show, for instance in France, we are also carefully rebalancing our investments. We have welcomed many new clients this quarter. I want to give a special thanks to our people for their dedication and perseverance. We look forward to keep improving our business wherever we can."

Revenue

In Q3 2009, organic revenue per working day decreased by 28%. During the quarter the trend gradually improved, with the rate of decline moving from -30% in July to -26% in September. The comparison base is getting somewhat easier as Q3 2008 was the quarter when revenue turned negative. Like in Q2 2009, our combined US staffing and inhouse businesses, as well as our Spanish operations, continued to improve during the quarter. Germany now also showed a clear improvement throughout the whole quarter. In main markets such as the Netherlands, France, and Belgium the year-on-year revenue decline softened somewhat compared to the previous quarter but progression is less pronounced and a bit more volatile. The Indian, Australian and Latin American businesses, which trended down in Q2 2009, started to trend up again during the quarter. The professionals businesses show signs of stabilization.

Permanent placement fees declined by 55% organically, similar to the rate of decline in the previous quarter. Perm fees made up 1.4% of revenue and 7.3% of gross profit (11.2% in Q3 2008).

Gross profit

In Q3 2009, gross profit amounted to € 603.4 million, or € 596.3 million when corrected for some wage cost related one-offs. The underlying gross margin amounted to 18.8% compared to 20.6% in Q3 2008. The underlying temp margin declined by 1.1%, caused by increased commercial pressure across many geographical areas. This effect was only partly offset by positive temp mix effects (0.1%) based on changes in the segmental and geographical mix. The reduction in perm fees had a negative effect of about 0.9% on the total gross margin. Currency and other mix effects (relatively stable HR Solutions fees) together had a positive impact of 0.1%. In recent months many client contracts have been renewed in regular or early tender processes. Whilst we believe that in several larger countries a large part of the contract renewals is now behind us, the full effect of recent renewals and potential mix shifts will become visible the coming quarters.

Operating expenses

As the pace and consistency of recovery are hard to predict, we maintained our strong focus on cost containment. With pressure on gross margins increasing, we executed some cost reductions faster than initially planned. As a result, underlying operating expenses amounted to € 502.9 million compared to guidance of around € 520 million. The underlying operating expenses were 25% lower than in Q3 2008 and 5% below the level of the previous quarter. Total operating expenses amounted to € 495.7 million. The reported operating expenses have been adjusted for a total of € 7.2 million. On the one hand we corrected for restructuring charges of € 3.2 million, primarily related to the professionals segment, and the final integration costs of € 2.7 million. On the other hand we corrected for an amount of € 13.1 million, related to book profits on the sale of subsidiaries (see paragraph M&A).

At the end of the quarter we operated a network of 4,181 outlets, 151 less (-3%) than in the previous quarter, and 24% less (organic) than at the end of Q3 2008. The reduction in Q3 2009 included a reclassification of 80 branches in Australia, which used to be registered as separate entities, with different brands, at the same address. After the rebranding operation earlier this year these branches are now combined. Average headcount (measured by FTE) amounted to 26,470. This was 25% lower organically than in Q3 2008 and 5% below the level of the previous quarter. The commercial strength and future growth potential remain in place. Natural attrition remains one of the drivers of the headcount reductions.

EBITA

Underlying pro forma combined EBITA decreased by 61% to € 93.4 million, with the EBITA margin reaching 2.9% compared to 5.5% pro forma in Q3 2008. EBITA after one-offs amounted to € 107.7 million.

Net finance costs

In Q3 2009, net finance costs amounted to € 7.2 million, compared to € 33.6 million in Q3 2008. This improvement is largely based on the significant net debt reduction over the past few quarters and a sharp reduction in short-term interest rates, as our debt is financed using floating interest rates.

Tax

The effective tax rate amounted to roughly nil. The underlying rates of the various components have not materially changed. For the full year the tax rate on amortization, which shows as a benefit on the tax line, is expected to be constant at 31.4%. The tax rate on the underlying profit before tax (before amortization) is expected to be around 20-22% for the full year. The expected full year rate after one-offs has come down to 13-15% instead of 15-17% due to this quarter's book profit on divestments.

Net income & EPS

In Q3 2009, adjusted net income attributable to holders of ordinary shares amounted to € 72.5 million (-53%). Diluted EPS decreased by 54% to € 0.42 (Q3 2008 € 0.91). The net result including integration costs and one-offs amounted to € 60.9 million.

Cash flow

In Q3 2009, the free cash flow amounted to € 359.0 million, compared to 303.9 million in Q3 2008. Operating cash flow was supported by a 2-day DSO improvement to 57 days. Our clients' increasing pursuit to hold on to their cash is mitigated by additional focus on the internal processes and a positive effect from regulation changes in France. Therefore, the net investment in receivables was limited, despite the sequential rise in revenue.

The Dutch fiscal stimulus measure, allowing VAT payments on a quarterly rather than a monthly basis, contributed around € 80 million to cash flow, which is visible in the cash flow statement on the payables line. Furthermore, we had a tax refund of € 152 million, as announced with the Q2 2009 results.

Balance sheet

At the end of Q3 2009 net debt amounted to € 1,166.8 million compared to € 1,889.0 million at the end of Q3 2008. The net debt position was some € 355 million lower than at the end of the previous quarter. The leverage ratio (net debt end of period divided by the EBITDA of the past 12 months) remained stable at 2.4. The covenants of the syndicated facility allow a leverage ratio of up to 3.5.

Following the sharp net debt reduction we have reduced the term facility by an additional amount of € 270 million. The mandatory repayments of May and November 2010 of € 135 million each have been brought forward. After the early repayment of € 135 million in June, the term facility now amounts to € 675 million, while the revolving part still amounts to € 1,620 million, with the whole facility now totaling € 2,295 million. With no mandatory repayment until May 2011, and the revolving facility available until May 2013, financial flexibility is high.

meer info op www.randstad.com

de cijfers waren niet juist weer te geven door het systeem.