Polylactic acid (PLA), which is made from agricultural sugars, is poised to become an important player in packaging and durables markets as sources of supply expand, properties improve, and the economics case becomes more interesting. “Biotech is changing the name of the game and this is no longer always a pound per pound, penny by penny comparison and decision-making process,” says Steve Davies, Director of Corporate Communication and Public Affairs at NatureWorks, which boosted production capacity of PLA at its Blair, Neb. plant to 150,000 metric tons per year in 2013. Adoption of bioplastics by American buyers has been slow because they often carry a price premium and possess different performance properties than the materials they are attempting to replace. Most large companies embrace sustainability policies that promote use of materials that reduce the carbon footprint of fossil fuel-based plastics, but only if the materials can compete on price and performance. The Danish company Lego provides an important example of why PLA figures to be an important player at companies with meaningful sustainability programs. Lego quietly began research three years ago into developing a bioplastic that could replace ABS in an effort to reduce the carbon footprint of its iconic toy bricks. PLA is durable and can be molded to tight tolerances, but lacks the creep resistance required by Lego. Tests showed that large, complex Lego models made from PLA would start to fall apart after a few weeks. In June, Lego announced that it will spend $146 million to launch its own research center to investigate a sustainable plastic. Polymerized lactic acid is still very much on the table. NatureWorks and Dutch company Corbion Purac both say that they have made important strides in improving the performance properties of PLA, often using process technology for lactide purification or polymerization developed by Sulzer that offers higher lactide and therefore higher PLA crystallinity. From a purchasing perspective, the case for PLA is complicated, but is improving. Initially, the focus at NatureWorks, which essentially created the PLA market when it launched Ingeo in 2003, was on biodegradable packaging applications. That’s still an important market, particularly in China, but less so in the United States where the prices of competing plastics such as polyethylene have dropped in price. The marketing focus has shifted more to styrenic materials, such as polystyrene and ABS, that do not benefit from shale gas economics. That creates opportunities in packaging and durable applications. Polyethylene terephthalate (PET) is also a target. Significant growth is also projected in 3D printing, where PLA and ABS compete.

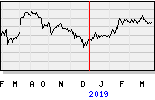

NatureWorks provided historical pricing data to My Purchasing Center (chart on left) showing that its global PLA prices are competitive head-to-head with polystyrene, and have experienced much less pricing volatility. PLA costs are tied to the cost of sugar, which has been more stable than oil pricing. It takes 1.25 pounds of sugar derived from corn to produce 1 pound of Ingeo PLA produced by Natureworks. The recent price (called net unit return) for Ingeo PLA is just above $1 per pound. My Purchasing Center projects that prices for newer, higher-performing grades start around $1.20 per pound.

But NatureWorks says the economics case for Ingeo isn’t just pound per pound, penny by penny. “Many manufacturers and brands are interested in using Ingeo because it offers better pricing stability and a hedge against oil-derived pricing volatility,” says Davies. The economics for PLA will have to be tested on a case-by-case basis.

Supply chain is also an issue.

Some buyers at Fortune 1000 manufacturers have shunned the use of PLA because NatureWorks has been the only industrial-scale producer. Several compounders offer PLA, but they receive polymer from NatureWorks or very small-scale producers.

Corbion Purac operates a sugar-to-lactic acid to lactide plant in Thailand and uses toll converters to polymerize lactide into PLA neat resin. The Dutch company, which specializes in premium grades, now says it will build a 75,000 metric tons per year plant in Asia. Corbion announced in May that it has signed letters of intent for one-third of the volume of the proposed plant.

It’s not clear when the plant will be built, and it should be noted that there have been many delays in announced PLA production projects due to a much slower rate of adoption than had been forecast by producers and research groups going back several years. There are projects in the pipeline that would create 600,000 metric tons of global PLA capacity by 2025, but history shows that projects tend to get pushed back due to a variety of factors. Current production capacity is about 190,000 metric tons per year.

NatureWorks has announced plans to build a major new PLA plant in Thailand, the home of PTT Chemicals, which bought a $150 million stake in the PLA producer from Cargill in 2011. At that time, it was announced that the new PLA plant in Thailand was expected to come online in 2015. But that won’t happen.

Davies tells My Purchasing Center: “NatureWorks is wrapping up the front-end engineering design work for the Thai facility with Jacobs Engineering, and our focus now shifts to finalizing negotiations with Thailand’s Finance Ministry on incentive structures for the significant investment required in a second production facility.”

Two other production investments have been completed, both in China, where growth has been spurred by a provincial decision to mandate biodegradable shopping bags.

Hisun Biomaterials Co. this year expanded its PLA production capacity in Taizhou, a port city in southeastern China to 15,000 metric tons per year. The company was formed in 2004 by Zhejiang Hisun Group Co., the Changchun Institute of Applied Chemistry (CIAC), and Taizhou Jiaojiang State-owned Assets Management Co. The plant makes injection molding and extrusion grades of Revode PLA, but the focus is on biodegradable packaging and foodservice grades.

The Supla (Su Qian) New Material Co. is bringing on line a 10,000 metric tons per year PLA plant in China. The company was created in 2012 by an investment group consisting of Taiwan Supla Material Technology Co., Kuender MEMS, Grand Dynasty Industrial , Yuan Yang Electron & Insulation (SU ZHOU), and Chih Ro Enterprise. At a German plastics show held in 2013, Corbion Purac displayed the world’s first touch-screen computer with a housing made from Supla PLA. The screen was developed by Kuender, which uses proprietary injection molding processes for the screen.

One of the drivers of global PLA growth is Swiss equipment producer Sulzer, which designs and manufactures equipment for lactide purification and PLA production and has supplied equipment to most of the relevant producers, including NatureWorks.

“Sulzer operates a 1,000 metric ton per year PLA plant in Switzerland for companies to use for testing or scaling up” said Sulzer’s Emmanuel Rapendy, Head of Sales for Polymer Technology, in an interview with My Purchasing Center. Sulzer also supplied the complete equipment for a 5000 metric tons per year PLA plan operated by Synbra, a Dutch processor that specializes in making foamed products.

Sulzer is confident that there will be a strong growth in PLA, adoption, as soon as the market offers multiple large scale sources.

The chart, provided by NatureWorks, shows how PLA prices compare to general-purpose polystyrene (GPPS) in North America, Asia and Europe. Please click on chart to enlarge for better viewing.

What Is Sustainability?

Sustainability can, and is, defined in many different ways.

In early years, the focus was often on biodegradability. That faded somewhat as it became clear to many consumers that there are very few commercial composting facilities in the United States. The focus has shifted to carbon footprint, based on research that harvesting and processing agricultural materials into plastics creates a smaller carbon footprint than plastics made from oil and gas.

But there are caveats. The current feeling is that the agricultural material should not be a human food source. So focus is shifting to use of waste agricultural products or switchgrass or even pure methane gas. In Europe, there is significant pressure not to use feedstocks made from genetically modified organisms (GM0). Is the material grown and harvested in a way that is environmentally responsible? Is slave labor used? Those last two issues are more significant as PLA production shifts to Asia.

Also, is the material recyclable?

Some corporate programs, such as Lexmark, focus exclusively on a closed-loop process in which materials produced are later captured and re-used.

PLA is technically recyclable, but in reality, extremely little is actually recycled. Commercial residential recycling systems focus on bottle-grade PET and high-density polyethylene.

Here’s a quick (starter) sustainability check list:

What is the carbon footprint of the material?

Is it made from a material that could potentially be used as a foodstuff by someone in the world?

What is the percentage of renewable content in the compound, that is the percentage actually made from renewable resources such as sugar beets?

Does the compound contain any hazardous materials?

Have all of the contents of the material been tested for human safety?

Was the compound made from any GMO material? (An issue in Europe)

Is the material recyclable?

Is the material actually part of any commercial recycling streams?

What is the recycled content of the material?

Are the materials used in the compound produced in a way consistent with United Nations protocols on the environment and human rights?

Is degradability important? Is there a realistic expectation that material will actually be composted in a responsible way after its use?

Are you pursuing these goals because you actually care about the environment or because you think it’s important for marketing purposes?

Also see these articles at My Purchasing Center:

Sourcing, Engineering Collaborate to Meet Sustainability Goals at Lexmark

2015 Sustainable Procurement Report

- See more at: http://www.mypurchasingcenter.com/commodities/commodities-articles/bioplastics-important-player-sustainable-procurement/#sthash.5VgpJeak.dpuf