LogicaCMG has issued the following trading update for the twelve months ended 31 December 2006. All references are to provisional unaudited results as reported under International Financial Reporting Standards (IFRS). LogicaCMG will announce its preliminary results on 28 February.

Overview

Overall, the market remained positive with increasing volumes and a generally improving pricing environment.

Our margin increased in 2006 and we continued to deliver improved profitability on a like for like basis, in line with market expectations.

Second half operating cash flow was strong, with full year cash conversion in line with our expectations.

A number of significant contract wins contributed to a book to bill for the year of 1.11:1. Orders booked in the second half include £164 million under our 7-year applications outsourcing contract with the UK Department of Constitutional Affairs and €86 million from the previously-announced ING order. We also extended our outsourcing contracts with InBev and Welsh Water in the second half.

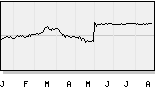

Full year revenue growth (before the consolidation of WM-data) was driven by improvements in Financial Services and Industry, Distribution and Transport. Weakness in the Euro and dollar exchange rates, which accelerated through the second half, had an adverse impact of approximately 1% on reported revenue. In the third quarter, capacity constraints had a dampening effect on revenue growth in a number of our key territories. Headcount improved steadily through the fourth quarter and we are better-positioned for improved growth as we enter 2007. On a constant currency basis, pro forma organic revenue growth in IT services was just under 5% in 2006, with telecom products revenue broadly stable on last year. The adverse currency movements are expected to have a minimal effect on operating profit. Their effect on adjusted EPS is expected to be offset by a more favourable tax rate.

As highlighted in previous announcements, the results of the WM-data business acquired in 2006 were consolidated from mid-October. Full year results for WM-data were in line with market expectations. Organic revenue growth on a local currency basis was approximately 4%.

Progress on integration

We achieved the anticipated Unilog cost savings in 2006 and continued to make good progress with cross-selling. Two major customers in France have awarded us applications management contracts which will be partly delivered out of our delivery centres in India and Morocco.

Following the acquisition of WM-data, we are seeing good early momentum in cross-selling solutions to Nordic customers, which we expect to convert to orders in 2007. In addition, WM-data has recently renewed its outsourcing contract with Volvo, one of its largest customers.

Our expectations for cost savings in 2007 remain unchanged. We expect to achieve approximately £7.5m of cost savings resulting from the WM-data acquisition and a full year of the anticipated Unilog cost savings.

IT services

Operating margin in the UK for the year remained strong, as we continued to extend the use of our global service delivery capability and to reduce the use of subcontractors in the second half. Underlying revenue growth for 2006 (excluding the impact of £20 million of passthrough materials revenue in Energy and Utilities in 2005) was 2%. Financial Services and Industry, Distribution and Transport (IDT) continued to drive revenue and order growth in the second half. This offset slower Public Sector revenue growth as a major contract awarded in the second half transitioned more slowly than initially expected. Joe Hemming, the former head of our UK Space and Defence business, was appointed as our new UK chief executive in early January 2007.

Full year revenue in the Netherlands grew by 10% on a constant currency basis. A strong market, improved utilisation and increased use of offshore resources all contributed to a substantial improvement in operational performance in 2006. We continue to recruit in the Netherlands to meet strong market demand.

In France, the implementation of restructuring actions in the first half and improved utilisation led to a significant improvement in full year operating margin. Revenue growth for the year was in line with the group performance. Capacity constraints and a lower level of passthrough revenue than last year in the former LogicaCMG business limited revenue growth during the second half. The peak recruiting season in the fourth quarter allowed us to significantly increase capacity, with the net addition of over 300 employees. This positions us well to increase revenue growth in 2007, benefiting from continuing good demand in the French market.

Germany returned to profitability in the second half, in line with our guidance, as the restructuring programme benefits came through. In addition, we achieved modest revenue growth. With the restructuring complete and a stronger organisation in place, we have now appointed the former head of the Avinci business, Torsten Strass, as German country manager. His focus will be on increasing recruitment to drive revenue growth in 2007. We are well-placed to benefit from an improving market in Germany.

Telecoms products

Telecom products revenue was broadly stable on last year on a constant currency basis. Operating profit improved marginally due to continued cost management and a favourable revenue mix with a higher proportion of licence revenue.

Commenting on the full year trading update, Dr Martin Read, LogicaCMG’s Chief Executive, said: “We are pleased to have delivered another year of significantly increased operating profit and good operating cashflow. Particular highlights were the return to profitability in Germany and continued strength in the Netherlands. We had good order intake in the second half and have seen early cross-selling momentum in the Nordics. For 2007, our focus is on the integration of WM-data and on delivering benefits to our customers and shareholders from our strengthened European footprint.”

Note: All references to revenue growth are on a constant currency and proforma/like for like basis (including Unilog and Edinfor as if consolidated from 1 January 2005) unless otherwise stated. Proforma numbers were included in our 2006 interim results presentation.

2005 and 2006 exchange rates were as follows:

FY 2005 H1 2006 H2 2006 FY 2006 €/£

Average 1.46 1.46 1.48 1.47

End of 1.46 1.45 1.48 1.48 $/£

Average 1.82 1.79 1.90 1.84

End of 1.72 1.85 1.96 1.96 SEK/£

Average 13.59 13.56 13.57 13.57

End of 13.66 13.32 13.39 13.39