Capital position remains strong; lower operating result

· Operating result ongoing business of EUR 321 million versus EUR 488 million in 2Q15; the current quarter was impacted by higher claims at Netherlands Non-life due to severe storms, while the second quarter of last year was supported by a private equity dividend and a significantly higher technical margin in Netherlands Life

· Net result of EUR 335 million versus EUR 392 million in 2Q15 reflecting a lower operating result and negative hedge results in Japan Closed Block VA due to market volatility, partly offset by higher non-operating items

· Progress on cost savings in the Netherlands, bringing the annual expense base down to EUR 786 million

· Solvency II ratio increased to 252% from 241% at 1Q16 as positive market impacts were only partly offset by deductions for the EUR 500 million share buyback programme and the 2016 interim dividend

· Holding company cash capital increased to EUR 2.3 billion driven by dividends from almost all segments

· Interim dividend 2016 of EUR 0.60 per ordinary share or approximately EUR 195 million

Statement of Lard Friese, CEO

'With a Solvency II ratio of 252% and a cash capital position of EUR 2.3 billion, NN Group's capital position remained strong and resilient during the second quarter of 2016, allowing us to weather severe market volatility and pay an interim dividend in line with our dividend policy.

Our businesses were however impacted by market conditions and low interest rates, reducing the investment income of our insurance businesses. Extraordinary developments in recent months, including the result of the 'Brexit' referendum, impacted global financial markets. The asset management environment remains difficult due to ongoing market turmoil, resulting in continued de-risking by clients and pressure on fees.

Our Non-life combined ratio was impacted by severe storms in the Netherlands in the Property and Casualty business, which was only partly compensated by a favourable claims development in the Disability & Accident portfolio. Regulatory changes, such as the tax on assets in Poland introduced in February 2016, impacted the operating result of Insurance Europe. We are closely following the Polish government's plans to further reform the pension system.

Amidst these challenging conditions, new sales of life insurance products held up well compared with the same quarter last year. The execution of our cost saving plans is well underway, and NN Bank is showing robust growth in mortgages and savings, reporting a solid net inflow of retail saving deposits in the first six months of this year.

Going forward, we will continue to focus on the execution of our strategy, delivering excellent service to our customers making our operations more efficient and effective, and pursuing growth in selected European markets and Japan.'

NN Group key figures

In EUR million

2Q16 2Q15 Change 6M16 6M15 Change

Operating result ongoing business 321 488 -34.1% 626 792 -21.0%

Net result 335 392 -14.6% 605 877 -31.0%

Net operating ROE 8.6% 14.9% 8.6% 11.8%

Solvency II ratio1) 252% 252%

Note: All footnotes are included on page 27

Quarterly Business Update

NN Group's strong financial position in the first half of 2016 reflects the resilience of its businesses in an environment which continues to be characterised by low interest rates and market volatility. This provides a solid foundation for executing the strategy, which is to deliver an excellent customer experience based on transparent products and services and long-term relationships. NN Group aims to help people secure their financial futures, and is committed to delivering products and services that are easy to understand and meet customers' lifetime needs.

Transparent products and services

NN Hungary successfully launched a new accident insurance product which has been well received by both customers and tied agents. The product offers financial support and unique medical and assistance services that are crucial for faster recovery after an accident.

Our Czech business unit launched NN Život, an insurance product covering a wide range of risks including death, illnesses, long-term disability and hospitalisation. Japan Life launched a new COLI critical illness product to help ensure business continuity when SME owners fall ill.

In the Netherlands, Nationale-Nederlanden helps SME companies to understand the implications of a new 'Return to Work' regulation for partially disabled employees (WGA Flex), also offering them solutions. Non-life's continued focus on customer centricity and transparent customer communication resulted in higher customer loyalty as measured by its increasing Net Promotor Scores. Furthermore, Netherlands Life is strengthening its commercial position by developing new features for group pension schemes, allowing participants to invest additional contributions during their working life ('Bijsparen'), or to keep investing after their retirement ('Doorbeleggen').

Capturing growth

The fundamental need of people to protect themselves against uncertainties will continue to drive growth in the insurance industry over the long term. For example, NN Life in Romania launched an innovative private health insurance solution in their market, insuring the financial future of a customer's family should unexpected medical situations arise.

In Spain, Nationale-Nederlanden recently launched a suite of Growing Guarantee savings products, which are less capital intensive, while guaranteeing our customers their investment with an upward potential. Movir, which offers individual disability insurance to business professionals in the Netherlands, successfully launched a campaign to inform clients about the option to align their individual disability insurance to their pension age, resulting in additional recurring premium income. NN Bank continues to grow its customer base, attracting almost 8,000 new clients in the second quarter. Through cross-selling efforts, another 4,500 insurance customers became clients of NN Bank. In the second quarter, NN Bank grew its mortgage portfolio from EUR 10.9 billion to EUR 11.4 billion and its customer savings from EUR 8.6 billion to EUR 9.3 billion.

Multi-access distribution

NN Group serves its customers through multiple channels, comprising tied agents, bancassurance partners, brokers and direct channels. Bancassurance COLI sales in Japan increased by 54% compared with the same quarter in 2015, excluding currency effects, driven by the expansion of the bank distribution network.

The acquisition of Notus Financial Advisors, a leading financial broker in Poland, which was announced in the second quarter, was completed in July 2016. The acquisition will further strengthen and diversify the distribution network of Nationale-Nederlanden Poland.

Effective and efficient operations

NN Group aims to make its processes as efficient and effective as possible across all segments, and is sharpening its client focus tailored by type and country, making the organisation more agile. For example, during the severe storm and flooding in Belgium this quarter, an NN Mobile Office was used to help customers settle their claims. This temporary office and the service provided were highly valued by customers.

In the Netherlands, the strategy is centred around providing digital, personal and relevant services with the aim of enhancing customer experience. Nationale-Nederlanden has combined various individual customer communication channels, making it easier for clients to communicate with the company, while reducing costs at the same time. New functionalities are continually being implemented to meet the growing customer demand for 24/7 services and solutions, while at the same time wanting to be recognised and treated as an individual customer. For example, customers logging into the NN portal receive a personal message alerting them when the fixed rate period of their mortgage will end within four months.

Our asset manager, NN Investment Partners, is making good progress with its 'focus, simplify and optimise' initiatives. The fund rationalisation project is well on track. Investment boutiques have been aligned with growth opportunities, capturing economies of scale in the product portfolios.

Innovation

By investing in innovation, NN Group aims to improve customer satisfaction, intuitive interaction and efficiency at the same time. NN Group announced in July that it entered into a three-year partnership with StartupBootcamp, a growth accelerator, which helps fintech start-ups expand into full-grown businesses. The programme aims to increase the speed of innovation and strengthen customer centricity. In addition to providing financial support, NN Group will offer professional assistance to fintech start-ups by providing employee mentors. Also, through internships, our employees are given the opportunity to gain insights and hands-on experience in fintech product innovation.

Furthermore, Sparklab (NN Non-life's innovation lab) introduced its 'Ab Concept' in the Dutch market. This is a pilot in which prevention services are combined with residents' participation and new technology, with the aim of increasing safety in residential areas.

NN's broker in Turkey, Sigorta Cini, is executing a 'clicks & bricks' strategy, enabling the company to become a 'top 3' online aggregator.

NN Group believes that mind-set is crucial in creating businesses that nurture innovation. In order to further foster this mind-set, all NN Life managers have participated in a programme focusing on stimulating innovation, entrepreneurship and accountable leadership.

Other events

In the second quarter of 2016, NN Group became a constituent of the FTSE4Good Index Series. This inclusion demonstrates that the company has met stringent environmental, social and governance criteria, and is well positioned to capitalise on the benefits of responsible business practice.

NN Group's sport sponsorship policy focuses on running, an activity that unites different generations and is accessible to everyone. This way we want to contribute to people's health and wellbeing. NN Group has been the main sponsor of large running events across Europe and in Japan, including marathons in Athens and Rotterdam, and the San Silvestre race in Madrid, Spain. This quarter, NN Group was the official sponsor of the 2016 European Athletics Championships, the largest sports event in the Netherlands in 2016.

tijd 09.05

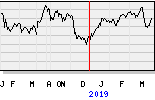

NN Groep EUR 25,88 +1,47 vol. 134.000