Today, Unilever announced its results for the third quarter of 2018, which show underlying sales growth increased to 3.8% with growth accelerating across all three Divisions.

Third quarter results 2018 love beauty and planet packaging

Underlying sales growth 3.8% with volume 2.4% and price 1.4%

Price growth in Argentina is excluded from Q3 USG due to hyperinflationary status. Reported growth would otherwise have been 4.5%

Growth was high quality with an improvement in all three Divisions and strong volume growth in Asia AMET RUB

Turnover was impacted by an adverse translational currency impact of 5.2%

The net impact of acquisitions and disposals, which included the spreads disposal, reduced turnover by 3.3%

Commenting on the results, CEO Paul Polman says: “Growth accelerated in the third quarter across all Divisions. We were able to increase prices while still maintaining good volume growth which reflects the strength of our brands and quality of our innovation programme. Our focus on building our business for the long-term continues to deliver high quality growth.

“We are progressively reaping the benefits of our Connected 4 Growth programme, which is now well embedded throughout the organisation, making us simpler, faster and better connected with our consumers. It is helping us accelerate growth in Asia AMET RUB, manage through the economic volatility in Latin America and shift our portfolio into faster growing segments and channels in all of our markets. Our innovation pipeline continues to strengthen and in the third quarter alone we have launched four new brands. We have now successfully completed the disposal of our spreads business and continue the acceleration of our efficiency programmes.

“We continue to expect underlying sales growth in the 3% - 5% range, an improvement in underlying operating margin and strong cash flow. We remain on track for our 2020 goals.”

Our markets

In the markets in which we operate growth improved slightly with a higher contribution from price as a result of rising commodity costs in local currencies, particularly in emerging markets. There has been significant devaluation in Argentina and the economy is now considered to be hyperinflationary, so price growth from Argentina is excluded from underlying sales growth from 1 July 2018 onwards.

Unilever overall performance

In the third quarter, underlying sales growth increased to 3.8% with growth accelerating across all three Divisions. Price growth picked up as expected, and volume remained strong reflecting the strength of our brands and our accelerated innovation programme.

Underlying sales in emerging markets grew by 5.6% led by competitive growth in Asia AMET RUB. Growth in Latin America was adversely impacted by significant volume decline in Argentina, while price growth, which would have contributed 70bps to total Unilever, has been excluded from USG. Brazil recovered after the truckers’ strike that severely affected sales in the second quarter.

Turnover decreased 4.8% to €12.5 billion, which included an adverse currency impact of (5.2)% and (3.3)% from acquisitions and disposals mainly driven by the disposal of spreads.

Beauty & Personal Care

Beauty & Personal Care underlying sales growth of 4.0% was helped by improved price growth.

Skin care continued with strong growth momentum, helped by innovations including Citra’s new naturals range. Pond’s launched new premium formats such as a cleansing balm to remove make-up and moisturise. Skin cleansing performed well driven by the continued success of premium formats including the launch of foaming shower gels.

In deodorants, price returned to growth and volumes were helped by purpose-led campaigns on Dove Men+Care and Rexona.

In hair care, while promotional intensity remained high, Dove had a good quarter driven by the roll-out of a new naturals range and the launch of ‘super’ conditioners to reduce hair damage in just one minute.

In oral care, sales were slightly down as market conditions remained challenging in France, Indonesia and Brazil.

Growth in prestige accelerated with double-digit growth in Hourglass, Kate Somerville, Living Proof and REN. Love, Beauty and Planet, the largest of our new brand launches, was extended into deodorants and skin care this quarter and the new brand K-Bright was launched in South East Asia to address the fast-growing Korean beauty trend.

Home Care

Home Care underlying sales growth in the quarter was 4.5%. Growth was broad-based, helped by stronger pricing and the recovery from the truckers’ strike in Brazil.

Home and hygiene performed well, driven by good performances from Cif premium sprays and Sunlight, which was relaunched with more natural ingredients.

In fabric solutions, growth was driven by strong performance of liquids in emerging markets, including the continued success of Surf Excel Matic in India and we also launched a new brand Day 2, an innovative dry wash spray.

Growth in fabric sensations was led by continued momentum in key markets India and China, the launch of Comfort into Germany and innovations such as Comfort Perfume Deluxe in South East Asia and the UK.

Foods & Refreshment

Foods & Refreshment underlying sales growth in the quarter improved to 3.2%.

Ice cream delivered strong growth led by innovations including the new Kinder® ice cream and the new Magnum Praline variant.

In tea, our emerging markets growth was driven by good performance on our core brands like Brooke Bond in India. In developed markets, black tea continues to be challenging. However, the ongoing transformation of our portfolio is helped by our acquisitions TAZO and Pukka, and innovations like our organic Lipton range.

Growth in foods was driven by cooking products and our food service business which caters to professional chefs. Knorr continued to modernise the portfolio with more ‘organic and natural’ innovations including a new ‘soup in glass’ range, while our snacking brands Red Red, Prepco and Mãe Terra performed well.

In dressings, Hellmann’s was helped by a campaign to activate its purpose to ‘fight food waste’ but growth was held back by continued promotional intensity in the US. Sir Kensington’s performed well and we launched Del Huerto, a new tier three dressings brand in Colombia.

ENDStijd 09.29

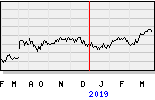

Unilever EUR 45,715 -70,5ct vol. 771.000