Publication of Offer Memorandum and Position Statement – Acceptance Period

commences on 20 April 2017 – Offer will be discussed at TMG’s general meeting of

shareholders on 1 June 2017

Transaction Highlights

? Recommended public cash offer by Mediahuis and VP Exploitatie for all the issued and

outstanding (depositary receipts for) ordinary shares and priority shares (“Shares”) of TMG, at an offer price of € 6.00 (cum dividend) per Share (the “Offer”).

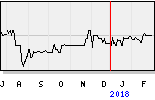

? The Offer Price represents a premium of 73% to the closing price of the Shares of € 3.48 on 13 December 2016 and a premium of 69% to the average closing price of the Shares of € 3.56 over the 3 month period up to and including that date.

? The Supervisory Board of TMG, also acting in its temporary capacity as acting Executive Board of TMG, fully and unanimously supports the Offer and unanimously recommends the Shareholders to accept the Offer and tender their Shares under the Offer.

? The Combined Group will continue to focus on its core news division, increasing investments in content, technology and innovation.

? The Combined Group will be led by new leadership, with Mr. M. Vangeel as the new CEO and Mr. C.G. Boot as the new CFO.

? The Central Works Council of TMG supports TMG’s recommendation and support for the Offer.

? The acceptance period for Shareholders to tender their Shares commences on 20 April 2017 at 09:00 CET, and ends on 15 June 2017 at 17:40 CET, unless extended (the “Acceptance Period”).

? TMG today convenes its extraordinary general meeting of shareholders to be held on 1 June 2017 at 13:00 CET at Passenger Terminal Amsterdam, Piet Heinkade 27, 1019 BR

Amsterdam, the Netherlands, in which meeting, among other matters, the Offer will be discussed. TMG will combine this extraordinary general meeting of shareholders with its annual general meeting of shareholders (the “AGM”).

? The Offer is subject to satisfaction or waiver of the Offer Conditions set out in the Offer

Memorandum, including a minimum acceptance level of 70% of the Shares. The Offeror may,

in its sole discretion, waive this Offer Condition.

? Mediahuis and VP Exploitatie together own approximately 59.98% of the Shares.

? In the event that Mediahuis and VP Exploitatie acquire 95% of the Shares following the

Settlement Date, Mediahuis and VP Exploitatie will, as soon as possible, initiate buy-out

proceedings in order to acquire the remaining Shares.

? Completion of the Offer is expected in July 2017.

With the publication of the Offer Memorandum today, and with reference to the joint press releases

of Mediahuis, VP Exploitatie and TMG on 5 March 2017, Mediahuis, VP Exploitatie, Gerald BidCo B.V.

and TMG hereby jointly announce the launch of the Offer.

Jan Nooitgedagt, Acting Chairman of the Supervisory Board TMG: “Today, we publish our Position

Statement, in which we, as the Supervisory Board, confirm that we support and recommend the offer of

Mediahuis and VP Exploitatie. With this transaction a leading Dutch-Belgian news company will be created.

We have a strong position and great brands, and together we can invest further in content, technology and

innovation. We are very pleased that the Central Works Council supports and follows the recommendation

of the Supervisory Board and strongly believe such advice serves as the starting point for a solid future for

TMG. During the past months we have had to make difficult choices and decisions. However, we are glad

that we can announce today that TMG will have new management. Subject to completion of the offer, Marc

Vangeel and Koos Boot will be appointed as CEO and CFO, respectively. Both are experienced

professionals with deep knowledge of the media sector. We have strong confidence that this will help secure

a solid future for TMG and its employees.”

Gert Ysebaert, CEO Mediahuis: “Today we announce that the offer for TMG, as planned, is formally

launched and we expect to complete the transaction before the summer. We are now entering the final stage

of the bidding process. As agreed with the Works Council (COR) of TMG we will assess in the coming time,

together with the teams of TMG, how we can quickly build a successful, stable and leading Dutch-Belgian

multimedia company. I am looking forward to the cooperation with our new colleagues and especially their

energy. Together we will give the company and its brands a strong position in the fast changing media

landscape”.

Guus van Puijenbroek, VP Exploitatie: “With the publication of the Offer Memorandum, supported by the

Works Council (COR), we have set an important step towards a safe haven for TMG. The new combination

will become an attractive and reliable employer that will safeguard strong independent journalism, with

distinctive news brands, like De Telegraaf. My family has been involved since the 1950’s and we are

convinced that TMG will further develop within the combination with Mediahuis in the best possible way. In

Mediahuis we have found a partner with the same values and vision.”

The Offer

The Offeror is making the Offer on the terms and subject to the conditions and restrictions set forth in the

offer memorandum dated 19 April 2017 (the “Offer Memorandum”). Shareholders tendering their Shares

under the Offer will be paid a consideration in cash for each Share validly tendered (or defectively tendered,

provided that such defect has been waived by the Offeror) and transferred under the Offer, and which has

not been validly withdrawn, of € 6.00 (the “Offer Price”).

Terms not defined herein shall have the meaning as set out in the Offer Memorandum.

The Offer Price includes any (interim) dividend that is or may be declared or paid in respect of any Share

on or prior to the Settlement Date. If TMG were to declare or pay any (interim) dividend on the Shares on

or prior to the Settlement Date, the Offer Price will be reduced by deducting any pre-tax amounts so

declared or distributed on a Share from the Offer Price.

3

The Offer values 100% of the Shares at approximately € 278 million, and represents a 73% premium to the closing price of the Shares of € 3.48 on 13 December 2016, being the day prior to the announcement issued by Mediahuis and VP Exploitatie on 14 December 2016, a 69% premium to the volume weighted

average price of the Shares of € 3.56 over the 3-month period up to and including 13 December 2016 and a 61% premium to the volume weighted average price of the Shares of € 3.72 over the 12-month period up to and including 13 December 2016.

Mediahuis and VP Exploitatie reconfirmed on 5 March 2017 that they have sufficient funds available to fulfil

the Offeror’s obligations under the Offer and will pay the aggregate Offer Price and any considerations due

under the Offer using debt financing.

Strategic rationale for the Offer

The joint strategy of the combination of TMG and the Offeror and their respective affiliates (the “Combined

Group”) is based on strong and trusted brands. The Combined Group will be a Dutch-Belgian media group

with a focus on long-term value creation. The Combined Group’s 24/7 multimedia strategy is aimed at

news and entertainment reaching the consumer across channels (e.g. online, mobile, print, video/OTT and

radio) and formats (e.g. video, text, pictures and VR). It focuses on delivering the right content at the right

moment through the right channel in the best possible user experience, based on the strength of strong

and trusted media brands, leading to increased and more diversified revenues per customer.

The Combined Group will continue to build a portfolio of digital only content, classified and e-commerce

brands and platforms that will fuel future growth and sustainability of the Combined Group. It will provide

advertisers with efficient solutions on the back of data, user targeting and cross-media offering, including

video. Strategic win-win partnerships on technology, content and commercialisation will be key to the

success of the Combined Group.

The Combined Group will continue to focus on its core news division, and the increased scope will

ultimately lead to a lower cost level, turning the operations healthy again. This will create ample room for

substantial investments in content, technology and innovation to support the longer term sustainability and

growth of the company. The Combined Group will further strengthen and increase the profitability of the

digital brands through cross-border expansion and sharing of technology and data. With a view to this

increased focus, in the (near) future, a divestment of Keesing may be pursued by TMG, allowing for

Keesing’s further international development under new ownership.

The key elements of the strategic rationale for the Combined Group include the substantially increased

market position of the Combined Group resulting in:

? a strengthening of the Combination’s position towards old and new competitors;

? the facilitation of the introduction of new consumer and content models;

? the offering of a broader palette of multi-media consumer reach to advertisers that will also benefit

from a larger data pool and brand coverage;

? an increase of the attractiveness for potential partners and new talent because of a the larger set of

brands, activities and international opportunities;

? the possibility to share knowledge and data, thereby creating better products and supporting top line

growth in consumer as well as advertising markets;

? substantially increased economies of scale in technology, industrial activities, supporting services and purchasing power, reducing overall cost and turning the core news division into a healthy operation.

Governance of TMG as from the Settlement Date

With reference to the section of this press release headed ‘Annual general meeting of shareholders of

TMG’, certain changes to the governance of TMG are subject to the approval of the Shareholders at the

AGM.

Executive Board as from the Settlement Date

It is envisaged that as from the Settlement Date, the Executive Board will be composed as follows:

i. Mr. M. Vangeel, with the title of Chief Executive Officer; and

ii. Mr. C.G. Boot, with the title of Chief Financial Officer.

The Central Works Council has been informed regarding the envisaged appointment of Mr. M. Vangeel

and Mr. C.G. Boot and has rendered a positive advice in respect of such appointments in accordance with

article 30 of the WOR.

Supervisory Board as from the Settlement Date

It is envisaged that, as from the Settlement Date, the Supervisory Board will be composed as follows:

i. three members nominated by the Offeror, being Mr. A.R. van Puijenbroek, Mr. G. Ysebaert and Mr. P.

Verwilt; and

ii. two independent members, being Mr. J.J. Nooitgedagt and Ms. S.G. Brummelhuis.

Mr. J.J. Nooitgedagt will serve as independent chairman of the Supervisory Board.

Compensation for the members of the Boards

The resigning members of the Supervisory Board will be duly compensated in accordance with TMG’s

current remuneration policy for the Supervisory Board.

As from 5 March 2017, Mr. Van der Snoek and Mr. Epskamp have been suspended from their respective

positions as Chief Executive Officer and Chief Financial Officer of the Company.

There are no other payments to be made to, nor compensation arrangements made with, members of the

Boards in connection with declaring the Offer unconditional. On 19 April 2017, the suspended members

of the Executive Board entered into a settlement agreement with TMG in which the members of the

Executive Board agreed to tender their resignation as member of the Executive Board with immediate

effect. Mr. Van der Snoek and Mr. Epskamp will receive a severance payment in line with their respective

contract for services, irrespective of the Offer being declared unconditional.

Non-Financial Covenants

Mediahuis, VP Exploitatie and TMG have agreed to certain non-financial covenants with regard to corporate governance, financing, customary protection of minority shareholders, editorial independence, organisation and brands, employees and strategy that will continue to apply until 31 December 2019 (the “Non-Financial Covenants”), provided that certain specific covenants will apply for a longer period of time.

The topics covered under these non-financial covenants include TMG’s organisation and legal structure, editorial independence, employees, financing and distributions, minority shareholders, corporate social responsibility, brands and strategy. A detailed explanation regarding the non-financial covenants on these topics are disclosed in the Offer Memorandum and Position Statement (as defined below) of TMG that have been published today.

Unanimous recommendation of the Supervisory Board, also acting in its

temporary capacity as Executive Board

After careful consideration, the Supervisory Board, also acting in its temporary capacity as Executive

Board, believes that the Offer Price is a fair price for Shareholders and it has come to the conclusion that

the contemplated transaction is in the best interest of TMG, the sustainable success of its business and its

stakeholders.

With reference to the Position Statement (as defined below), the Supervisory Board, also acting in its

temporary capacity as Executive Board (i) fully supports the Offer, (ii) recommends the Shareholders to

accept the Offer and to tender their Shares pursuant to the Offer and (iii) recommends voting in favour of

all resolutions set out in the below section of this press release headed ‘Annual general meeting of

shareholders of TMG’.

On 5 March 2017, each of ABN AMRO Bank N.V. and Coöperatieve Rabobank U.A. has issued a fairness

opinion to the Supervisory Board and Executive Board of TMG and N M Rothschild & Sons Limited issued

a fairness opinion to the Supervisory Board which stated that on such date and subject to the factors and

assumptions set forth in each such fairness opinion, the Offer Price is fair, from a financial point of view, to

the Shareholders. The full text of such fairness opinions, each of which sets forth the assumptions made,

procedures followed, matters considered and limitations on the review undertaken in connection with each

such opinion, are included in the Position Statement.

Annual general meeting and extraordinary general meeting of shareholder of TMG

TMG today convenes the AGM in which, among other things, the Offer will be discussed. The AGM shall

be held at 13:00 CET on 1 June 2017, at Passenger Terminal Amsterdam, Piet Heinkade 27, 1019 BR

Amsterdam, the Netherlands.

At the AGM, among other things, the Offer will be discussed in accordance with article 18, paragraph 1 of

the Decree. In connection with the Offer, the Shareholders are being asked to adopt resolutions to (i) grant

a full and final discharge to each resigning member of the Boards with respect to his/her duties and

obligations performed and incurred in his/her respective capacity as a member of a Board and (ii) appoint

Mr. G. Ysebaert and Mr. P. Verwilt as members of the Supervisory Board, effective as per the Settlement

Date and (iii) re-appoint Mr. Nooitgedagt as member of the Supervisory Board, effective as per 1 June

2017.

A position statement providing further information to the Shareholders as required pursuant to article 18,

paragraph 2 of the Decree (the “Position Statement”), including the agenda for the AGM (and explanatory

notes thereto), is made available by TMG as of today.

Central Works Council of TMG

The Central Works Council has resolved to support TMG’s support and recommendation of the Offer and

all transactions contemplated therewith. In connection with its advice, the Central Works Council entered

into an agreement with TMG, Mediahuis, VP Exploitatie and the Offeror in which more detailed

arrangements were made with respect to various Non-Financial Covenants, including co-determination,

governance and prudent financing. Such arrangements are summarised in TMG’s position statement. As

part of that agreement, the Central Works Council agreed to with withdraw the request for an appeal it had

filed at the Enterprise Chamber on 15 March 2017.

The trade unions involved with TMG and the secretariat of the Social Economic Council (SociaalEconomische

Raad) have also been informed in writing of the Offer in accordance with the SER

Fusiegedragsregels 2015 (the Dutch code in respect of informing and consulting of trade unions).

Editorial Boards of TMG

The consultation process with the Editorial Boards was completed on 18 April 2017 in accordance with the Editorial Statutes. As a consequence, the corresponding Offer Condition set out in Section 5.8.1(f) of the Offer Memorandum has been satisfied.

Antitrust Clearance

On 24 March 2017, the Offeror formally notified the Dutch Authority for Consumers and Markets (Autoriteit

Consument en Markt) regarding the acquisition of sole control by Mediahuis of TMG as a result of the

Offer.

Acceptance Period

The Acceptance Period will commence at 09:00 hours CET on 20 April 2017 and will expire on 15 June

2017 (the “Acceptance Closing Date”) at 17:40 hours CET, unless the Acceptance Period is extended,

in which case the Acceptance Closing Date shall be the date on which the extended Acceptance Period

expires.

Shares tendered on or prior to the Acceptance Closing Date may not be withdrawn, subject to the right of

withdrawal of any tender of Shares during the Acceptance Period in accordance with Section 4.2.6 (I) of

the Offer Memorandum.

Acceptance by Shareholders

Acceptance by holders of Shares held through intermediaries

Shareholders who hold their Shares through an intermediary are requested to make their acceptance

known through their custodian, bank or stockbroker no later than 17:40 hours CET on the Acceptance

Closing Date, unless the Acceptance Period is extended. The custodian, bank or stockbroker may set an

earlier deadline for communication by Shareholders in order to permit the custodian, bank or stockbroker

to communicate its acceptances to ING Bank N.V. (the “Exchange Agent”) in a timely manner.

Intermediaries may tender the Shares for acceptance only to the Exchange Agent and only in writing. In

submitting the acceptance, Intermediaries are required to declare that (i) they have the tendered Shares

in their administration, (ii) each Shareholder who accepts the Offer has irrevocably made the

representations and warranties as set out in Section 4.2.2 (Shares held through Intermediaries) of the Offer

Memorandum and (iii) they undertake to transfer these tendered Shares to the Offeror prior to or ultimately

on the Settlement Date, provided that the Offeror declares the Offer unconditional.

Acceptance by holders of Shares individually recorded in TMG’s shareholders register

Holders of Shares individually recorded in TMG’s shareholders register, wishing to accept the Offer in

respect of such Shares must deliver a completed and signed acceptance form to the Exchange Agent in

accordance with the terms and conditions of the Offer, no later than 17:40 hours CET on the Acceptance

Closing Date. The acceptance forms are available upon request from the Exchange Agent. The acceptance

form will also serve as a deed of transfer (akte van levering) with respect to the Shares referenced therein.

Declaring the Offer unconditional

The Offer is made subject to the satisfaction or waiver (either in whole or in part and at any time) of the

offer conditions as set out in Section 5.8 (Offer Conditions, waiver and satisfaction) of the Offer

Memorandum (the “Offer Conditions”). The Offer Conditions may be waived, to the extent permitted by

law or by agreement, as set out in Section 5.8 (Offer Conditions, waiver and satisfaction). Extension of the Acceptance Period may in any event occur one time (extension for more than one period is subject to dispensation from the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten, the “AFM”), which will only be given in exceptional circumstances).

No later than on the third business day following the Acceptance Closing Date, such date being the “Unconditional Date”, the Offeror will determine whether the Offer Conditions have been satisfied or are to be waived and announce whether (i) the Offer is declared unconditional, (ii) the offer will be extended in accordance with article 15 of the Decree or (iii) the Offer is terminated as a result of the Offer Conditions not having been satisfied or waived, all in accordance with article 16 of the Decree.

Extension

If one or more of the Offer Conditions is not satisfied by the Acceptance Closing Date, the Offeror may, in

accordance with article 15, paragraphs 1 and 2 of the Decree, extend the Acceptance Period for a minimum

period of 2 weeks and a maximum period of 10 weeks in order to have such Offer Conditions satisfied or

waived.

In addition, the Acceptance Period may be extended if the events referred to in article 15, paragraphs 5 or

9 of the Decree, occur. Further extensions are subject to dispensation from the AFM, which will only be

given in exceptional circumstances.

If the Acceptance Period is extended, so that the obligation pursuant to article 16 of the Decree to announce

whether the Offer is declared unconditional is postponed, a public announcement to that effect will be made

ultimately on the third business day following the Acceptance Closing Date in accordance with the

provisions of article 15, paragraphs 1 and 2 of the Decree. If the Offeror extends the Acceptance Period,

the Offer will expire on the latest time and date to which the Offeror extends the Acceptance Period.

During an extension of the Acceptance Period, any Shares previously tendered and not withdrawn in

accordance with article 15 paragraph 3 of the Decree or otherwise withdrawn in accordance with the

Decree will remain subject to the Offer.

Post-Closing Acceptance Period

In the event that the Offeror announces that the Offer is declared unconditional, the Offeror shall, in

accordance with article 17 of the Decree, publicly announce a Post-Closing Acceptance Period (as defined

in the Offer Memorandum) of two weeks to enable the Shareholders who did not tender their Shares during

the Acceptance Period to tender their Shares under the same terms and conditions as applicable to the

Offer.

Settlement

In the event that the Offeror announces that the Offer is declared unconditional, Shareholders who have

tendered and transferred their Shares for acceptance to the Offeror pursuant to the Offer on or prior to the

Acceptance Closing Date will receive the Offer Price in respect of each Tendered Share. The Settlement

Date shall be no later than three business days after the Unconditional Date.

Liquidity, delisting and initiation of Buy-Out Proceedings

The purchase of Shares by the Offeror pursuant to the Offer will, among other things, reduce the number

of Shareholders and the number of Shares that might otherwise be traded publicly, and (i) will thus

adversely affect the liquidity and (ii) may affect the market value of the remaining Shares not tendered.

Subject to the Offer being declared unconditional, the Offeror and TMG intend to procure the delisting of

the Depositary Receipts from Euronext Amsterdam, to the extent permitted, as soon as possible after

Settlement.

Without prejudice to the Offeror’s obligation to declare the Offer unconditional in accordance with its terms,

it is the intention of the Offeror to ultimately acquire 100% of the Shares and/or full ownership of TMG.

In the event that the Offeror (together with its group companies) holds 95% or more of the issued share capital of TMG following the Settlement Date, the Offeror will, as soon as possible, initiate buy-out proceedings in accordance with article 2:92a or 2:201a of the Dutch Civil Code or takeover buy-out proceedings in accordance with article 2:359c of the Dutch Civil Code in order to acquire the remaining Shares not tendered and not held by the Offeror or TMG.

If the Offeror declares the Offer unconditional, the Offeror shall have the right to effect or cause to effect any of the Post Closing Measures as referred to in Section 5.19.3 (Other Post-Closing Measures) of the Offer Memorandum.

Announcements

Any further announcement in relation to the Offer will be issued by press release. Any joint press release

issued by Mediahuis, VP Exploitatie, Gerald BidCo B.V. and TMG will be made available on the websites

of Mediahuis (www.mediahuis.be), VP Exploitatie (www.vpexploitatie.eu) and TMG (www.tmg.nl). Subject

to any applicable requirements under the applicable rules and without limiting the manner in which

Mediahuis, VP Exploitatie or the Offeror may choose to make any public announcement, Mediahuis, VP

Exploitatie and the Offeror will have no obligation to communicate any public announcement other than as

described above.

Offer Memorandum, Position Statement and further information

The Offeror is making the Offer on the terms and subject to the conditions and restrictions contained in the

Offer Memorandum, dated 19 April 2017, which is available as of today. In addition, as of today, TMG

makes available the Position Statement, containing the information required by article 18, paragraph 2 and

Annex G of the Decree in connection with the Offer.

This announcement contains selected, condensed information regarding the Offer and does not replace

the Offer Memorandum and/or the Position Statement. The information in this announcement is not

complete and additional information is contained in the Offer Memorandum and the Position Statement.

Shareholders are advised to review the Offer Memorandum and the Position Statement in detail and to

seek independent advice where appropriate to reach a balanced judgment in respect of the contents of the

Offer Memorandum and the Position Statement and the Offer itself. In addition, Shareholders may wish to

consult with their tax advisors regarding the tax consequences of tendering their Shares under the Offer.

Digital copies of this Offer Memorandum are available on the websites of Mediahuis (www.mediahuis.be),

VP Exploitatie (www.vpexploitatie.eu) and TMG (http://www.tmg.nl). The websites of Mediahuis, VP Exploitatie and TMG do not constitute a part of, and are not incorporated by reference into, the Offer Memorandum. Copies of the Offer Memorandum are also available free of charge at the offices of TMG and the Exchange Agent at the addresses mentioned below.

TMG:

Telegraaf Media Groep N.V. (Attention: [Martijn Jonker])

Basisweg 30

1043 AP Amsterdam

tijd 10.12

TMG EUR 6,20 -9,9ct vol. 213