Profit before tax increases significantly year-on-year to €2,866 million; CET1 ratio rises to 15.2%

Strong performance in both Retail and Wholesale Banking and 4-quarter rolling RoE improves to 13.8%

Increase of 181,000 primary customers in the third quarter, with growth in almost all markets

Strong interest income combined with higher fee income

Operating expenses remain under control and risk costs are low, reflecting strong asset quality

Announcement of €2.5 billion share buyback programme as we continue to align our capital to our target level

CEO statement

“ING recorded another strong set of results in the third quarter of 2023, with net result more than doubling on the prior year", said Steven van Rijswijk, CEO of ING. “Notwithstanding the cooling economy and amid polarising geopolitical developments, which impacted business and consumer confidence, both our Retail and Wholesale Banking businesses posted strong results. Their interest income benefited from the positive rate environment and fee income also increased, especially in Retail Banking, driven by daily banking and investment products.

“I’m proud that we gained another 181,000 primary customers to reach a total of 15.1 million. This growth occurred across almost all of our 10 retail markets, especially in Germany, Australia and Türkiye, further supporting our future value creation. Customers value our services, as shown in our net promoter scores, where we maintained our number one position in five of our 10 Retail Banking markets. A superior customer experience is a pillar of our ‘making the difference’ strategy. An example is digital onboarding. In many markets we now onboard most of our new retail customers fully digitally: 75% in the Netherlands, 72% in Australia and 63% in Germany – percentages that are all growing.

“The cycle of recent central bank rate hikes, which helped the recovery of our profitability after a prolonged period of negative rates, appears to have paused. We are conscious of the public discussions on saving rates and, depending on developments in the competitive landscape, our liability margins may reduce somewhat from current levels. Overall income will be supported by our strong and diversified businesses, especially when loan demand recovers.

“Wholesale Banking showed solid income growth as continued rates increases resulted in improved margins for Payments & Cash Management, and Financial Markets benefited from strong trading results. We focused on further optimising our capital usage and margins while decreasing risk weights, prioritising own origination of high-quality loans.

“Expenses remained under control with year-on-year cost growth (excluding incidentals) below 5%. Risk costs were again low – a testament to the quality of our loan book and our prudent credit risk management. We remain vigilant, given global economic growth is slowing down.

“In October, we published our Climate Report, setting out our progress on the path to net zero, including how we engage with clients. We also explain our work to assess climate risks and how we take action to mitigate them. One of the key challenges we face is balancing the world’s need for urgent action with helping drive economic progress and supporting the transition. We are proud of how we are using our financing to help our clients in this, but we can’t do it alone. Next to detailed transition plans for the nine most carbon-intensive sectors in our loan portfolio, the report includes specific calls to action on governments and regulators to guide the transition more firmly.

“We continue to take steps to converge our capital ratios to our target level of around 12.5%, today announcing another share buyback programme. We do this from a position of strength, convinced that operating at the right level of capital is in the best interest of all stakeholders and allows us to support the economy and our more than 38 million customers in over 40 countries.

“These are uncertain times and it is hard to predict the impact of geopolitical conflicts. However, I’m confident that we are well positioned to withstand adverse challenges and continue to make a difference. I would like to thank everyone who contributed to our performance during the third quarter.”

see & read more on

https://www.ing.com/Newsroom/News/Press-releases/ING-posts-3Q2023-net-result-of-1982-million-driven-by-strong-income-in-both-Retail-and-Wholesale-Banking.htm

tijd 10.22

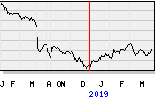

ING laat in een psoitieve markt geld liggen EUR 11,616 -39 ct vol. 8.885.656