Solid growth of revenue and adjusted EBITDA despite

higher costs for customer services

Continuing growth in broadband internet with 20,000 net adds in Q3

Ziggo Mobile records 32,000 new subscriptions in Q3 to reach a total

of 116,000 for its SIM-only proposition

Solid demand for B2B services with 2,300 bundle net adds and double

digit organic revenue growth in Q3

Outlook for 2014 reconfirmed

Operational highlights Q3 2014

• Total internet subscribers up 20,000 in Q3 to a total of 1.99 million, representing 1.0% sequential growth and 6.2% y-o-y growth; penetration reaches 73.7% of our consumer customers

• All-in-1 bundle subscribers stable in Q3 (incl. 2,000 triple play business bundles) at a total of 1.56 million, resulting in 2.9% y-o-y growth; penetration reaches 57.8% of our consumer customers

• Telephony usage stable y-o-y following a revised fixed telephony rate plan, resulting in strong

growth in subscriptions to our flat-fee telephony bundles

• Digital pay TV revenue slightly down by 1.4% y-o-y due to a decline in subscribers, partly

offset by an ARPU increase and an uptake in VOD

• Consumer ARPU for the quarter up 6.0% y-o-y to €44.61

Financial highlights Q3 2014

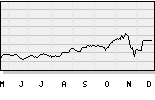

• Revenue up 2.9% y-o-y to €402.6 million; up 4.2% y-o-y excluding ‘revenue from other sources’

• Adjusted EBITDA at €228.0 million, up 3.4% y-o-y

• Net result of €2.7 million from €86.5 million in Q3 last year due to non-cash fair value losses on

hedges and revaluation of loans (€71.1 million), and amortization of customer relationships (€30.0 million)

• Net debt amounts to €3.2 billion, stable compared to year-end 2013

• Leverage ratio of 3.59x, up from 3.50x at year-end 2013

CEO René Obermann:

“We are pleased to have another quarter of solid performance in what continues to be a competitive marketplace. The on-going growth for Ziggo Mobile and B2B, combined with the continuing increase in the number of customers with a subscription to our internet products, confirms the attractiveness of our product portfolio. Our customers fully appreciate Ziggo’s capability to offer the highest internet speeds and best quality throughout our service area. In addition, we noticed that the increase in mobile-only households in the Dutch market stimulates interest for our dual play services (TV + internet).

Supported by this operational performance, Ziggo again managed to post solid revenue and EBITDA growth in the third quarter. Particularly strong revenue growth was reported for broadband internet and mobile services, which, in combination with the price increase as at April 1, resulted in a rise in total consumer revenue excluding revenue from other sources of 3.6%. Total revenue growth excluding revenue from other sources came in even higher at 4.2%, due to ongoing double digit revenue growth for our business services.

Until the closing of the acquisition by Liberty Global, which is expected to happen in Q4, we will run Ziggo as a completely independent company. Our management team continues to be committed to delivering the targeted financial results.”

Outlook

The outlook has not changed. For 2014, we expect adjusted EBITDA to be flat compared to last year, and Capex around €370 million.

Recommended offer by Liberty Global

On October 10, Liberty Global plc and Ziggo announced that regulatory approval has been obtained from the European Commission for the recommended public offer (the “Offer”) by a subsidiary of Liberty Global to all holders of issued and outstanding ordinary shares (the “Shares”) in the capital of Ziggo. As a result, the condition on competition clearance for completion of the Offer, as detailed in the Offer Memorandum dated June 27, 2014 (the “Offer Memorandum”) and the U.S. prospectus/offer to exchange (the “U.S. Prospectus”) dated August 19, 2014, has now been satisfied.

Subject to the terms and conditions of the Offer, as further described in the Offer Memorandum, tendering shareholders will receive €11.00 in cash, 0.2282 Liberty Global Class A ordinary shares and 0.5630 Liberty Global Class C ordinary shares for each Ziggo share. Further information on the Offer is available in the Offer Memorandum and in the press release dated June 27, 2014, which are both available on our website.

Extraordinary General Meeting of Shareholders (EGM)

In relation to the recommended public offer by Liberty Global, Ziggo N.V. held its Extraordinary General Meeting of Shareholders on August 26. All voting items were adopted, including the conditional Asset Sale and Liquidation, conditional amendments to Ziggo’s articles of association and conditional changes to the Management and Supervisory Boards. Further information is available on the Ziggo Corporate website (www.ziggo.com).