highlights

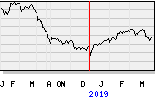

•Q4 2019 organic growth: -2.8%

•Q4 2019 underlying EBITA: € 292m

•Q4 2019 EBITA margin: 4.9%

•Q4 topline in Europe mixed, US slightly easing, both impacted by macro and political uncertainty; strong growth in RoW.

•Q4 gross margin 20.0%, up 20bp YoY; continued support from pricing, mix and digital tools.

•FY 2019 EBITA margin 4.6%, down 10bp YoY; Q4 2019 EBITA margin down 30bp YoY to 4.9% due to digital/IT investments.

•ongoing market share gains in several countries, fueled by digital strategy.

•FY 2019 FCF up 46% YoY to € 915m

•January 2020 revenue decreased by 3%-4% YoY.

"In 2019, we solidified our global No. 1 position as the largest HR services firm in the world", says CEO Jacques van den Broek. "This further strengthens our commitment and responsibility to support people and organizations in realizing their true potential. In fact, we see it as our core business. It has helped us to achieve our leading position, and it will help us in our journey towards our ultimate goal of touching the work lives of 500 million people by 2030."

“Financially, 2019 was a challenging year, but we have been able to demonstrate our resilience once again. Randstad's increasingly diversified portfolio by region and activity paid off. Our Group revenue was slightly down year-on-year organically, reflecting ongoing macro and political uncertainties, primarily in Northern Europe. At the same time, we continued our outperformance in several key geographies. Importantly, we were able to further improve our pricing power and discipline, reflecting increasing scarcity in labor markets and the successful implementation of our digital pricing tools globally. All in all, we protected our full-year 2019 EBITA margin, arriving at a sound level of 4.6%, while at the same time investing significantly in the future. Underpinning the strong resilience of our business model, we generated a record high free cash flow of € 915 million, resulting in a strong balance sheet and additional cash returns to shareholders. For 2019, we propose a record high total cash dividend of € 4.32 per ordinary share, including a special dividend of € 2.23. I would like to thank all Randstad colleagues around the world for their enthusiasm, commitment and dedication to this great company.”

ga voor meer naar

https://www.randstad.com/investor-relations/press-release-downloads/q4-results-2019.pdf

the following events have been added to our events calender:

26 March 2020 - ex-dividend date for regular dividend 2019

27 March 2020 - record date for regular dividend 2019

02 April 2020 - payment date of regular dividend 2019