Philips delivers strong sales growth, profitability and cash flow; raises full-year outlook.

Third-quarter highlights

Group sales increased 11% on a comparable basis to EUR 4.5 billion

Income from operations at EUR 224 million, compared to a loss of EUR 1,529 million in Q3 2022

Adjusted EBITA increased to EUR 457 million, or 10.2% of sales, compared to EUR 209 million, or 4.8% of sales, in Q3 2022

Comparable order intake was -9% compared to Q3 2022; order book remains strong

Operating cash flow improved to EUR 489 million, compared to an outflow of EUR 180 million in Q3 2022

Restructuring and productivity plans on track with total savings of EUR 258 million in the quarter

Outlook for full-year 2023 raised to 6-7% comparable sales growth and an Adjusted EBITA margin of 10-11%

Roy Jakobs, CEO of Royal Philips:

“Our improved operational performance was driven by our focus on execution to enhance patient safety and quality, strengthen our supply chain reliability and establish a simplified operating model.

The order book remains strong, and we are taking the necessary actions to improve order intake by shortening lead times from order to delivery and building on the positive impact we are making with our innovations, for example in predictive data analytics and artificial intelligence across our portfolio, to help improve the quality and efficiency of care delivery.

Completing the Philips Respironics recall remains our highest priority, with the remediation of the sleep therapy devices almost complete and remediation of the ventilators ongoing.

Based on our improved performance, we are further raising the outlook for both sales and profitability for the full year 2023, although recognizing uncertainties remain in an increasingly volatile geopolitical environment. The progress we are making reinforces our confidence in delivering on the three-year plan to create value with sustainable impact.”

Group and segment performance

Sales for the Group increased 11% on a comparable basis to EUR 4.5 billion, driven by growth in all segments and geographies. Adjusted EBITA increased to EUR 457 million, or 10.2% of sales, mainly driven by increased sales, pricing and productivity measures. Operating cash flow and free cash flow increased to EUR 489 million and EUR 333 million respectively in the quarter, driven by higher earnings and improved working capital management.

Comparable order intake (the order book covers around 40% of Group sales) was 9% lower than in Q3 2022. This was mainly due to a high comparison base related to the exceptionally high levels in 2021, lower orders in China, and longer order lead times. The necessary actions are being implemented to enhance supply chain reliability, reduce order lead times, and leverage our innovations to improve comparable order intake. The order book remains around 20% higher than in the period before the global supply chain challenges and will continue to support growth.

Diagnosis & Treatment comparable sales increased 14% in the quarter, with double-digit growth in all businesses. The Adjusted EBITA margin increased to 12.7% from 10.4% in Q3 2022, mainly driven by increased sales, pricing and productivity measures. Comparable order intake was double-digit lower than in Q3 2022 due to long order lead times, a high comparison base related to the high order intake in Q3 2022, and lower orders in China.

Connected Care comparable sales increased 10% in the quarter, with double-digit growth in Monitoring and mid-single-digit growth in Enterprise Informatics. The Adjusted EBITA margin improved to 3.7% compared to -7.5% in Q3 2022, mainly driven by increased sales and productivity measures. Connected Care comparable order intake was mid-single-digit lower than in Q3 2022 due to a high comparison base in Hospital Patient Monitoring related to the expansion and renewal of the installed base in the last few years.

Personal Health delivered quarter-on-quarter performance improvement, with comparable sales increasing by 7%, driven by high- single-digit growth in Personal Care and Oral Healthcare. The Adjusted EBITA margin increased to 18.7%, compared to 14.1% in Q3 2022, due to increased sales, pricing and productivity measures.

Productivity

Supported by significant change management efforts, to date Philips has reduced the workforce by around 7,500 roles, out of 10,000 roles in total planned by 2025. Operating model productivity savings amounted to EUR 142 million in the quarter. Procurement savings amounted to EUR 59 million, and other productivity programs delivered savings of EUR 57 million, resulting in total savings of EUR 258 million in the quarter.

Outlook

Based on Philips’ improved performance year-to-date, the strong order book, and the ongoing actions, the company is further raising the outlook for the full year 2023, although recognizing uncertainties remain in an increasingly volatile geopolitical environment. Philips now expects to deliver 6-7% comparable sales growth and an Adjusted EBITA margin of 10-11% for the full year 2023, with free cash flow at the upper end of the target range of EUR 0.7-0.9 billion. This reinforces Philips’ confidence in delivering on its three-year plan to create value with sustainable impact.

Customer, innovation and ESG highlights

Philips signed a 10-year, EUR 100 million Enterprise Monitoring as a Service agreement with one of the largest health systems in the US, covering 20 hospitals with over 3,000 beds. The agreement provides the health system with constant access to the latest technology, including software and services, while lowering initial investments.

Philips launched its new Image Guided Therapy Mobile C-arm System 3000. Its workflow-enhancing features and excellent image quality enable surgeons to deliver enhanced care to more patients, helping alleviate the staff shortages faced by many hospitals.

Philips launched its ambulatory monitoring offering in Japan, combining Philips ePatch Holter monitors with ECG analysis through AI and advanced algorithms. This innovative approach aims to reduce clinician workload and improve the patient experience.

Leveraging its leadership in driving sustainable healthcare, Philips completed a hospital-wide joint action plan for Tampere Heart Hospital in Finland to decarbonize its clinical operations. Following similar action plans at Vanderbilt University Medical Center and Champalimaud Foundation, Philips co-developed a roadmap to reduce carbon emissions in patient throughput, technology use, and use of consumables.

Philips successfully launched the Sonicare DiamondClean 7900 Series electric toothbrush in China on major online shopping channels Alibaba and JD.com. Highlighting increasing customer demand, it claimed the number-one position in the high-end toothbrush category on Alibaba’s Tmall.

Philips Respironics field action for specific sleep therapy and ventilator devices

Globally, over 99% of the sleep therapy device registrations that are complete and actionable have been remediated, while the remediation of the ventilator devices remains ongoing.

Based on the test results to date, Philips Respironics and third-party experts concluded that use of the sleep therapy devices is not expected to result in appreciable harm to health in patients. Following ongoing communications with the FDA, Philips Respironics has agreed with the agency to implement additional testing to supplement current test data.

In October 2023, Philips Respironics received preliminary court approval for the settlement agreement to resolve all economic loss claims in the US Multidistrict Litigation (MDL) related to the recall, for which Philips had recorded a provision of EUR 575 million in Q1 2023. The settlement does not include or constitute any admission of liability, wrongdoing, or fault by any of the Philips parties.

The previously disclosed litigation, including the personal injury and medical monitoring claims, and investigation by the US Department of Justice related to the Respironics field action are ongoing, as are the discussions on a proposed consent decree.

Capital allocation

In the third quarter, Philips issued EUR 500 million fixed-rate notes due 2031 under its European Medium Term Note (EMTN) program. The issue of the notes further strengthened the debt maturity profile and had a debt-neutral effect. See here for more information on Philips' current debt structure.

During the quarter, Philips settled a number of forward purchase transactions entered into under its EUR 1.5 billion share buyback program for capital reduction purposes announced on July 26, 2021, thereby acquiring a total of 4.2 million shares for a total amount of approximately EUR 154 million. Following further settlements in Q4 2023, Philips intends to cancel approximately 15.1 million shares acquired and to be acquired under this program, before year-end. See here for more information on the share buyback program.

see & read more on

https://www.philips.com/a-w/about/news/archive/corpcomms/news/press/2023/philips-third-quarter-results-2023.html

tijd 09.37

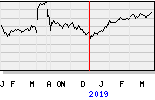

Philips EUR 16,95 -45 ct vol. 305.152