Aegon heeft nieuwe financiële doelstellingen voor de middellange termijn vastgesteld, waarbij de nadruk ligt op groei van kapitaalgeneratie en dividend. Door een sterke kapitaalpositie te behouden, kan Aegon miljoenen mensen blijven helpen om in alle fasen van hun leven financiële zekerheid te bereiken.

Voor de jaren 2019-2021 streeft Aegon op groepsniveau de volgende financiële doelstellingen na:

? Kapitaalgeneratie van EUR 4,1 miljard cumulatief; exclusief marktinvloeden en eenmalige posten, en onder aftrek van de kosten van de holding

? Tussen 45% en 55% van gegenereerd kapitaal wordt als dividend uitgekeerd aan aandeelhouders1)

? Rendement op het eigen vermogen van meer dan 10% op jaarbasis

Voor 2019 verwacht Aegon dat de bedrijfsonderdelen EUR 1,5 miljard aan dividend zullen uitkeren aan de holding, inclusief de opbrengst uit de verkoop van bedrijfsactiviteiten. Dit bevestigt de beschikbaarheid van het gegenereerde kapitaal en maakt een duurzaam rendement voor aandeelhouders mogelijk.

Het huidige kapitaalraamwerk en de daaraan gerelateerde beoogde bandbreedtes blijven ongewijzigd voor de jaren 2019-2021:

? De beoogde bandbreedte voor Solvency II ratio blijft 150% tot 200%; in 2018 bedroeg de Solvency II ratio 211%

? Kapitaaloverschot in de holding blijft binnen de beoogde bandbreedte van EUR 1,0 tot 1,5 miljard; ultimo 2018 bedroeg dit overschot EUR 1,3 miljard

? Een brutoschuldratio van tussen de 26% en 30%; eind 2018 bedroeg deze ratio 29,2%

? Een kapitaalpositie behouden die vereist is voor een AA- rating

Vanaf het tweede halfjaar 2018 past Aegon een aangepaste definitie voor zijn kapitalisatie toe. Om beter aan te sluiten bij de definities van andere verzekeraars en rating agencies heeft Aegon met terugwerkende kracht zijn interne definitie gewijzigd voor het aangepast eigen vermogen. Dit eigen vermogen wordt gebruikt om het rendement op het groepsvermogen, het rendement op kapitaal voor bedrijfsonderdelen en de brutoschuldratio te berekenen. Het eigen vermogen wordt niet langer aangepast voor de herwaardering van Aegon’s eigen pensioenregelingen. Hierdoor neemt de brutoschuldratio met 2,2 procentpunt toe vergeleken met de oude definitie. Dit maakt het behouden van een brutoschuldratio van 26-30% effectief een meer conservatieve doelstelling.

Toelichting van Alex Wynaendts, voorzitter Raad van Bestuur

“De nieuwe financiële doelstellingen die we vandaag hebben aangekondigd, bouwen voort op de resultaten die we hebben bereikt met de voorgaande driejarige doelstellingen. In de toekomst blijft de nadruk gericht op het genereren van kapitaal en het bieden van een aantrekkelijk rendement voor aandeelhouders. Door een proactief beheer van onze bedrijfsonderdelen wordt onze kapitaalgeneratie verder versterkt. We hebben de activiteiten onderverdeeld in drie duidelijk onderscheiden categorieën – ‘waarde-optimalisatie’, ‘stimuleren van groei’ en ‘opschalen voor de toekomst’. De eerste categorie bestaat uit bedrijven met voldoende schaalgrootte, die voornamelijk spread-based zijn, en die we beheren om op een duurzame manier waarde te creëren. We zullen veruit het meeste investeren in de categorie 'stimuleren van groei'. Deze activiteiten vormen de kern van onze strategie, omdat ze in de toekomst kapitaal generen. Het derde deel van onze portefeuille – ‘opschalen voor de toekomst’ - betreft de activiteiten die zijn gericht op het benutten van nieuwe kansen.

Deze benadering stelt ons in staat winstgevend te groeien en daarmee waarde te creëren voor al onze stakeholders, inclusief klanten en aandeelhouders. Op deze manier kunnen wij mensen helpen om in alle fasen van hun leven financiële zekerheid te bereiken.”

1) Uitgaande dat markten zich ontwikkelen in lijn met de verwachtingen van management, geen ingrijpende wijzigingen in toezicht,

en geen materiële eenmalige posten anders dan de al aangekondigde herstructureringsprogramma’s

Tweede halfjaar 2018

Net income declines to EUR 253 million reflecting unfavorable market movements and other charges

Underlying earnings decrease by 8% to EUR 1,010 million, as lower Retirement Plans earnings in the US more than offset business growth and higher margins in Europe, and expense savings

Fair value losses of EUR 257 million mainly driven by unfavorable market movements in the US, which are partly offset by positive real estate revaluations and hedging gains in the Netherlands and the UK

Other charges of EUR 581 million, mostly due to the previously announced legal settlement in the US and book loss on the divestment of the last block of US life reinsurance business as well as model & assumption changes in the Netherlands, and restructuring expenses

Return on equity increases to 10.2% resulting from lower taxes, in part due to US tax reform. Internal definition of adjusted shareholders' equity changed to align closer with that of peers and rating agencies

Lower net deposits and new life sales; positive trend in external third-party asset management inflows

Net outflows of EUR 8.5 billion mainly due to outflows in the US Retirement Plans business. In full-year 2018, Asset Management achieved another year of positive external third-party net inflows

New life sales decline to EUR 398 million, impacted by lower indexed universal life and term life sales in the US.

Lower new life sales in Asia due to reduced customer demand as short-term interest rates rose

Accident & health and property & casualty insurance sales down 56% to EUR 155 million, mostly as a result of the previously announced strategic decision to exit travel and stop loss insurance in the United States

Increasing dividend to shareholders based on strong capital position and normalized capital generation

Proposed final 2018 dividend per share of EUR 0.15; full year dividend increases by 2 cents compared with 2017

Solvency II ratio remains well above target range at 211% despite unfavorable market movements. Capital ratios of the main units remain at the upper end or above target zones

Capital generation in the units of EUR 39 million, including unfavorable market impacts of EUR 1,040 million and favorable one-time items of EUR 106 million

Holding excess cash remains within target range at EUR 1.3 billion

Gross financial leverage ratio improves by 160 basis points to 29.2% in the second half year 2018 following EUR 700 million deleveraging, and based on a more conservative internal definition of adjusted shareholders' equity

Statement of Alex Wynaendts, CEO

"The second half of 2018 was challenging, as we experienced a significant decline in the markets towards the end of the year. This impacted the value of our customers' investments, and thereby the results of our administration and services businesses. We have broad initiatives in place to provide additional, value-added services and drive sales growth in order to increase these results. Net income was also affected by previously announced transactions such as the divestment of the last block of life reinsurance in the United States.

"At the same time, we continue to simplify the organization, strengthen relationships with our customers and advisors, and enhance our service levels. This year's extension of our partnership with Atos in the UK and the new partnership with TCS in the US allow us to modernize our administration systems, and provide faster and better propositions to our customers. I am also pleased that the service levels in our UK platform business returned to target levels following the actions we have taken. These are the actions that allow us to fulfil our purpose to help many more people achieve a lifetime of financial security, and puts us in a strong position to grow our business.

"In the second half of 2018, we successfully maintained a strong capital position despite adverse market movements and the impact of the previously announced settlement in the United States. Together with our confidence in our ability to grow capital generation in a sustainable way, this allows us to raise our full year dividend per share by 2 cents, an increase of 7% compared with 2017."

Strategic highlights

Aegon Americas is well-positioned for growth as highlighted at the Analyst & Investor conference

Aegon Americas eliminates Variable Annuity captive leading to significant benefits to its capital position

Aegon extends partnership with Atos in the UK for administration services

Aegon and Banco Santander expand their successful partnership in Portugal

Seventh consecutive full year of external third-party net inflows at Aegon Asset Management

Aegon's strategy

Aegon's purpose – to help people achieve a lifetime of financial security – forms the basis of the company's strategy. The central focus of the strategy is to further transform Aegon from a product-based to a customer needs-driven company. This means serving diverse and evolving needs across the customer life cycle; being a trusted partner for financial solutions that are relevant, simple, rewarding, and convenient; and developing long-term customer relationships by providing guidance and advice, and identifying additional financial security needs at every stage of customers' lives.

Aegon is focused on reducing complexity, eliminating duplication and increasing automation in order to realize cost efficiencies, thereby enabling it to invest and become a more digitally enabled and customer-centric company. Furthermore, the company is dedicated to driving scale and establishing strong positions in its current markets, adhering to strict standards to ensure the efficient use of capital by all of its businesses. Four key strategic objectives that enable the company to execute its strategy are embedded in all of Aegon's businesses: Optimized portfolio, Operational excellence, Customer loyalty and Empowered employees.

Americas

On December 6, 2018 Aegon hosted an Analyst & Investor conference specifically focused on the US business. During the conference, the management team of Aegon Americas highlighted to analysts and investors how the organization is well-positioned to capture market opportunities in the United States, and detailed broad actions to accelerate organic growth. These actions include improving the company's competitive position, attracting new customers, strengthening existing customer relationships and increasing customer retention.

As part of Aegon's ongoing process to simplify the legal structure of its business, Aegon eliminated its Variable Annuity captive in the US in the second half of 2018. The rationale behind setting up the Variable Annuity captive in 2015 was the need to manage the volatility of the US RBC ratio as a consequence of misalignment between reserve movements and hedging within the existing variable annuity capital framework. Recently, the National Association of Insurance Commissioners (NAIC) proposed improvements to the existing variable annuity capital framework. These reduce the non-economic volatility of the RBC ratio, and for this reason the use of a variable annuity captive was no longer required. As a result of the merger of two legal entities, Aegon realized a one-time benefit to capital generation of approximately USD 1 billion in the second half of 2018. This benefit was offset by the impact of tax reform on the RBC ratio in the second half of 2018.

Europe

On September 11, 2018, Aegon closed the acquisition of Robidus, a leading Dutch income protection service provider. This transaction fits the company's strategic objective to grow its fee-based businesses. Aegon acquired approximately 95% of the company with the remainder being retained by Robidus' management team. Robidus continues to operate on a standalone basis under its own brand name. The acquisition was financed from holding excess cash.

In the United Kingdom, Aegon's platform offering and omni-channel distribution strategy have established Aegon as the leading platform provider in the market with a personal and workplace pension, investment, and protection offering. In the second half of 2018, assets across Aegon UK's platform business reached GBP 128 billion. The first half of 2018 saw the migration of two portfolios of the Cofunds business by moving GBP 57 billion of institutional assets to Aegon technology in March, followed by GBP 28 billion of retail assets in May. A program was established to address service issues associated with the retail migration. Core trading and service levels have now returned to target levels. The focus now is to continually improve the platform, further increasing functionality and ease of use.

The final phase of the Cofunds integration will take place in the first half of 2019 with the migration of assets related to Nationwide. To date, Aegon has realized GBP 40 million annualized expense savings from integrating the Cofunds business, a figure which will rise to GBP 60 million following the Nationwide integration.

The digitization of Aegon's protection business in the United Kingdom in the first half of 2018 has made it simpler and quicker for advisers to apply for cover for their clients and has led to a significant uptick in business, with new protection customer numbers up 36% in 2018 compared with the previous year.

Aegon announced on November 20, 2018, that it had strengthened its existing partnership with Atos, signing a 15-year contract to service and administer its Existing Business (non-platform customers) in the United Kingdom. The extension of the partnership will further improve customer service for 1.4 million customers. Since 2016, Atos has successfully serviced and administered Aegon's 500,000 protection customers in the UK, and has an excellent understanding of Aegon's business, culture and ways of working. The agreement, to be effective as of mid-2019, is initially expected to lead to annual run-rate expense savings for Aegon of approximately GBP 10 million, growing to approximately GBP 30 million over time. Total transition and conversion charges are estimated to amount to approximately GBP 130 million, and are expected to be recorded over the first three years of the agreement.

Consistent with Aegon's strategic objective to optimize its portfolio and capital allocation across its businesses, Aegon has successfully completed the sale of its businesses in the Czech Republic and Slovakia for EUR 155 million on January 8, 2019. This is a further step in rationalizing Aegon's geographical footprint and focusing resources on Aegon's key markets.

On December 21, 2018, Aegon expanded its partnership with Banco Santander in Portugal. The transaction with Banco Santander in Portugal comprises the life and non-life in-force books owned by Banco Popular within the scope of the partnership and generated by the Banco Popular franchise as well as other channels (mainly agents and brokers). In addition, it includes the life and non-life new business within the scope of business of the partnership distributed through the former Banco Popular franchise, which Banco Santander acquired in 2017. Aegon has paid an upfront consideration for the expansion of the partnership in Portugal of EUR 14 million and will pay an additional amount of up to EUR 6 million, depending on the performance of the partnership.

Asia

In India, Aegon Life launched a new guaranteed return insurance plan, called POS GRIP (Point of Sale Guaranteed Return Insurance Plan). The product is in line with Aegon's philosophy of launching simple, easy to understand products. POS GRIP provides dual benefits of protection and savings. The benefit which a customer will receive at the end of the policy term is guaranteed and is stated up-front when buying the policy. The guaranteed additions accrue at the end of every year throughout the policy term and include a one-off loyalty booster payable at the end of the policy term.

In China, Aegon THTF launched an upgrade of its award-winning platform for agents that was unveiled in October last year. The platform features professional marketing, smart recruitment, and differentiated service, serving as the smart personal assistant to agents. Aegon THTF has been increasing investments into digitalization in pursuit of its digital development strategy.

Asset Management

Growing external third-party assets is an important element of the growth strategy of Aegon Asset Management. 2018 was the seventh consecutive full year of positive external third-party net inflows. This reflects Aegon Asset Management's competitive performance, together with management's ability to leverage scale and capabilities from the general account and third-party affiliate businesses.

The continued strong commercial momentum in the Netherlands was underlined by strong inflows into the Dutch Mortgage Funds, which grew to EUR 16 billion of assets under management in the second half of 2018.

Operational highlights

Underlying earnings before tax

Aegon's underlying earnings before tax decreased by 8% compared with the second half of 2017 to EUR 1,010 million. Expense savings in all regions and higher earnings in Spain & Portugal, the Netherlands and the UK platform business from business growth and higher margins were more than offset by the divestment of UMG in the Netherlands, and lower Retirement Plans earnings and adverse claims experience in the United States. Underlying earnings from the Americas decreased by 16% to EUR 614 million driven by lower Retirement Plans earnings and adverse claims experience, which more than offset expense savings. The second half year of 2018 included EUR 14 million unfavorable claims experience compared with EUR 62 million favorable claims experience over the same period last year. Unfavorable mortality experience in Life and Retirement Plans was partly offset by favorable claims experience in Accident & Health. Retirement Plans earnings decreased significantly, which was mainly driven by lower fee income from lower asset balances, a lower investment margin, and investments in operations and technology.

Underlying earnings before tax from Aegon's operations in Europe increased by 12% to EUR 404 million. This was the result of growth in all regions, most notably in Spain & Portugal driven by better underwriting results, and expense savings. Furthermore, earnings growth was supported by a higher investment margin in the Netherlands from the shift to higher-yielding assets, lower funding costs for the bank and growth of the bank's balance sheet, as well as growth of the Digital Solutions business in the United Kingdom. This was partly offset by the divestment of UMG in the Netherlands.

Aegon's underlying earnings in Asia decreased by EUR 3 million to EUR 23 million driven by lower earnings from the joint-venture in China, as a result of investments in growth, and lower earnings from the direct marketing business, which is in run-off.

Underlying earnings before tax from Aegon Asset Management were up by 3% to EUR 69 million in the second half of 2018. This increase was a result of higher earnings in the Americas and in Europe driven by an increase in management fees and lower expenses, which were partly offset by lower performance fees from Aegon's Chinese asset management joint venture Aegon Industrial Fund Management Company (AIFMC).

The result from the Holding declined by EUR 17 million to a loss of EUR 100 million, as a result of interest expenses on USD 800 million Tier 2 securities issued in April 2018 to replace perpetual securities. Interest expenses for these Tier 2 securities are taken through the P&L, while the interest expenses for the perpetuals were recognized directly through equity.

Net income

Net income declined to EUR 253 million in the second half of 2018, and mainly reflects fair value losses as a result of market movements, and an increase in Other charges.

Fair value items

The loss from fair value items amounted to EUR 257 million. Gains from fair value items in Europe, Asia and at the Holding totaled EUR 281 million, and mainly resulted from hedging gains in addition to real estate revaluations in the Netherlands. These were more than offset by losses in the United States of EUR 538 million largely from underperformance of alternative investments and the impact of declining equity markets on reserve movements net of hedging. The loss was higher than expected, mainly due to lower than anticipated gains as a result of the lack of

implied volatility movements during the equity market decline.2H2018

Realized losses on investments

Realized losses on investments totaled EUR 10 million, as losses from the sale of US treasuries more than offset gains as a result of portfolio optimization in the United Kingdom.

Net impairments

Net impairments remained low at EUR 19 million and were driven by the impairment of corporate bonds resulting from a bankruptcy filing in the US.

Other charges

Other charges of EUR 581 million were mainly driven by a provision related to the earlier announced settlement of class action litigation with universal life policyholders and a book loss on the sale of life reinsurance business in the United States; model & assumption changes in the Netherlands; and restructuring expenses in the United Kingdom and United States.

In the United States, Other charges of EUR 310 million were largely the result of a provision of EUR 147 million related to the earlier announced settlement of class action litigation with universal life policyholders, a EUR 94 million book loss on the divestment of the last remaining substantial block of life reinsurance, transition and conversion charges of EUR 27 million related to the TCS partnership, and a EUR 26 million addition to a provision for unclaimed property. In January 2019, a court approved the aforementioned settlement with universal life policyholders. Over 99% of affected policyholders participated in the settlement. While less than 1% of policyholders opted out of the settlement, they represented approximately 43% of the value of the settlement fund. The settlement fund was reduced proportionally for opt outs, although Aegon continues to hold a provision for these policyholders.

In Europe, Other charges of EUR 230 million were caused by EUR 138 million charges from updated mortality and lapse assumptions in the Netherlands, EUR 35 million integration expenses for Cofunds and BlackRock's defined contribution business, and EUR 19 million transition and conversion charges related to the agreement with Atos for administration services related to the Existing Business, both in the United Kingdom. Other charges at the Holding amounted to EUR 36 million and were driven by IFRS 9 / 17 implementation expenses for the group.

Run-off businesses

The result from run-off businesses amounted to a loss of EUR 7 million, which was in line with expectations following the divestment of the majority of the remainder of these businesses in 2017.

Income tax

Income tax amounted to a benefit of EUR 117 million, while income before tax amounted to EUR 136 million. The income tax included one-time tax benefits of declining US and Dutch corporate income tax rates of EUR 84 million next to the regular tax exempt income items and tax credits. The effective tax rate on underlying earnings declined from 26% in the second half of 2017 to 12% in the second half of 2018, reflecting the reduction of the nominal corporate tax rate in the United States from 35% to 21%. The effective tax rate on underlying earnings is below the nominal tax rate as a result of tax exempt income and other tax benefits.

Return on equity

To align closer to definitions used by peers and rating agencies, Aegon has retrospectively changed its internal definition of adjusted shareholders' equity used in calculating return on equity for the group, return on capital for its units, and the gross financial leverage ratio. As of the second half of 2018, shareholders' equity will no longer be adjusted for the remeasurement of defined benefit plans. All figures in this press release, including comparatives, are based on the new definition, unless stated otherwise.

Return on equity increased by 50 basis points compared with the same period last year to 10.2% in the second half of 2018 under the current definition. Under the previous definition, return on equity would have been 9.3%. Lower underlying earnings were more than offset by a lower effective tax rate.

Operating expenses

Operating expenses increased by 2% to EUR 1,923 million as expense savings and the divestments of UMG and Aegon Ireland were more than offset by investments in growth in Banking and the Service business in the Netherlands, the acquisition of Robidus, restructuring charges, and IFRS 9 / 17 implementation expenses.

Aegon achieved its target to deliver EUR 350 million in annual run-rate expense savings by year-end 2018 as part of its plans to improve return on equity. Initiatives to reduce expenses have led to annual run-rate expense savings of EUR 355 million since the beginning of 2016. Transamerica achieved expense savings of USD 270 million over the last three years, which was below the USD 300 million target. A significant contributor to these savings was the partnership entered into with TCS earlier in 2018, which generated approximately one third of the total benefit achieved. However, investments within Retirement Plans drove staffing levels and related expenses higher than planned in the second half of 2018, as Transamerica aims to improve the Workplace experience and positions the business to accelerate growth. At a group level, that was compensated by additional expense savings in Dutch life and non-life insurance entities. Digitization of the business, automation of processes and efficiencies in the marketing and sales organization delivered EUR 79 million run-rate expense savings compared with the EUR 50 million targeted for the Netherlands. Expense savings at the Holding totaled EUR 19 million versus a target of EUR 15 million.

The abovementioned run-rate expense savings exclude the synergies from the Cofunds integration, which are expected to total GBP 60 million once completed, and the anticipated GBP 30 million savings from the extension of the partnership with Atos to administer the Existing Business in the United Kingdom.

Deposits and sales

Gross deposits decreased by 13% to EUR 58 billion driven by lower deposits on the platform in the United Kingdom and in Asset Management, while the prior period included EUR 6 billion of inflows from a single large mandate won by Aegon's strategic partner La Banque Postale Asset Management (LBPAM). Gross deposits in the Americas increased by EUR 2 billion.

Net outflows amounted to EUR 8.5 billion for the second half, mainly driven by outflows in the United States of EUR 7.6 billion caused by contract discontinuances in Retirement Plans. These were caused by a limited number of large contract losses.

New life sales declined by 7% to EUR 398 million, as a result of lower term life and indexed universal life sales in the United States and lower sales in the Asian High-Net-Worth (HNW) businesses. The latter was impacted by higher cost of premium financing for customers as short-term interest rates rose.

New premium production for accident & health insurance decreased by 69% to EUR 95 million. This was predominantly driven by lower sales in the travel insurance, affinity and stop loss segments in the United States, and resulted from the previously announced strategic decision to exit these segments. New premium production for property & casualty insurance increased by 15% to EUR 60 million, driven by higher sales in Hungary.

Market consistent value of new business

Market consistent value of new business (MCVNB) increased by 37% to EUR 236 million driven by the Americas and Europe. The increase in MCVNB in the Americas mainly resulted from tax reform. In Europe, MCVNB almost doubled, driven by an enhanced sales mix in Spain & portugal and improved margins on pension products on the UK platform.

Revenue-generating investments

Revenue-generating investments decreased by 2% during the second half of 2018 to EUR 804 billion. Net outflows and the impact of unfavorable equity market movements more than offset the inclusion of EUR 18 billion assets related to the acquisition of BlackRock's defined contribution business in the United Kingdom.

Shareholders' equity

Shareholders' equity decreased by EUR 0.9 billion to EUR 19.5 billion on December 31, 2018, primarily driven by a lower revaluation reserve as a result of widening credit spreads in the United States. Shareholders' equity excluding revaluation reserves decreased by EUR 0.4 billion to EUR 16.1 billion – or EUR 7.84 per common share – at the end of the second half 2018. This decrease was largely driven by the strengthening of the US dollar and net income, which were more than offset by dividends paid to shareholders and the impact of adverse market movements on defined benefit obligations.

Gross financial leverage ratio

As of the second half of 2018, Aegon retrospectively changed the definition of shareholders' equity used in calculating the gross financial leverage ratio. The company will no longer adjust shareholders' equity for the remeasurement of defined benefit plans to align its definition closer with those used by peers and rating agencies. Based on this more conservative calculation, the gross financial leverage ratio decreased by 160 basis points to 29.2% in the second half of 2018, which is within the 26 – 30% target range. This resulted from the redemption of EUR 200 million grandfathered Tier 1 securities in July 2018 and the maturity of EUR 500 million senior debt in August 2018. Under the previous definition, the gross financial leverage ratio would have been 27.0%.

Holding excess cash

Holding excess cash decreased from EUR 1,923 million to EUR 1,274 million during the second half of the year driven by EUR 700 million leverage reduction.

The group received EUR 786 million in remittances from subsidiaries, of which EUR 518 million from the United States, EUR 215 million from Europe, EUR 21 million from Asia and EUR 29 million from Asset Management. Capital injections of EUR 57 million in Asset Management, Central & Eastern Europe, Spain & Portugal and Asia were primarily related to investments in business growth.

The acquisition of Robidus led to a cash outflow of EUR 97 million. Furthermore, EUR 410 million cash was deployed for capital return to shareholders in the form of the cash portion of the interim 2018 dividend and the share buybacks to neutralize the final 2017 and interim 2018 stock dividends. The remaining cash outflows of EUR 171 million mainly related to holding funding and operating expenses.

Capital generation

Capital generation of the operating units amounted to EUR 39 million for the second half of 2018. Adverse market movements totaled EUR 1,040 million and favorable one-time items EUR 106 million, bringing normalized capital generation to EUR 973 million. Market impacts were mainly driven by the unfavorable equity market in the United States and the impact of adverse credit spread movements in the Netherlands.

One-time items were mainly driven by model & assumption changes in the Netherlands, which more than offset the impact of tax changes in the Netherlands and the acquisition of Robidus in the Netherlands. In the United States, several items, including the adverse impact of US tax reform on required capital and the benefit from the elimination of a variable annuity captive, largely offset each other.

Solvency II ratio

Aegon's Solvency II ratio decreased from 215% to 211% during the second half of 2018 as normalized capital generation, favorable one-time items and other items were more than offset by payment of the interim 2018 dividend, adverse market impacts, and the Part VII transfer related to BlackRock's defined contribution business in the United Kingdom.

The estimated RBC ratio in the United States decreased to 465% on December 31, 2018, from 490% on June 30, 2018. This decrease was mainly driven by the unfavorable impact from markets which was partly driven by lower than expected gains from implied volatility movements during the equity market decline. Furthermore, market movements included a negative impact of 10%-points from equity market movements on Transamerica Advisors Life Insurance Company (TALIC), which is planned to merge with Transamerica Life Insurance Company (TLIC) in 2019. One-time items largely offset each other and included the impact of US tax reform, the elimination of a variable annuity captive, the settlement of class action litigation with universal life policyholders, and the release of capital as a result of the previously announced strategic decision to exit the travel insurance, affinity and stop loss insurance segments.

The estimated Solvency II ratio in the Netherlands decreased to 181% on December 31, 2018, from 190% on June 30, 2018. The net positive impact of model & assumption changes was offset by adverse market impacts and the impact of tax changes in the Netherlands. At the end of 2018, Aegon updated its modeling of the dynamic volatility adjustment to align with the guidance from the European Insurance and Occupational Pensions Authority (EIOPA). This model change results in a change in credit sensitivities and increased 1-in-10 year combined sensitivities for the Netherlands, and as a result the company is reviewing the target zones for Aegon The Netherlands. Aegon is considering increasing the mid-point of the target zone by 5%-points to 10%-points. The positive impact from a change in modeling of the dynamic volatility adjustment more than offset other model & assumption changes, including changes to the assumptions regarding mortgages, mortality rates and lapses for individual life policies. For mortgages, Aegon changed a number of assumptions including reflecting changes to market conditions. Adverse market movements were the result of lower interest rates and the adverse impact of credit spread movements on the dynamic volatility adjustment before the aforementioned update to the model.

The estimated Solvency II ratio in the United Kingdom decreased to 184% on December 31, 2018, from 197% on June 30, 2018. The decrease was mainly driven by the completion of the Part VII transfer related to BlackRock's defined contribution business, unfavorable interest rate movements, and the effect from changes in the equity hedging program, which led to an increase in required capital. Assumption changes were on balance positive, mainly as a result of lower expected future expenses resulting from the extended partnership with Atos for administration services related to the Existing Business as well as the favorable impact from mortality updates.

Final 2018 dividend

Aegon aims to pay out a sustainable dividend to allow equity investors to share in Aegon's performance, which can grow over time if Aegon's performance so allows. At the Annual General Meeting of Shareholders on May 17, 2019, the Supervisory Board will, in the absence of unforeseen circumstances, propose a final dividend for 2018 of EUR 0.15 per common share. If approved, and in combination with the interim dividend of EUR 0.14 per share paid over the first half of 2018, Aegon's total dividend over 2018 will amount to EUR 0.29 per common share. This is an increase of EUR 0.02 per share or over 7% compared with the 2017 dividend. The final dividend will be paid in cash or stock at the election of the shareholder. The value of the stock dividend will be approximately equal to the cash dividend. Aegon intends to neutralize the dilutive effect of the final 2018 stock dividend on earnings per share in the third quarter of 2019, barring unforeseen circumstances.

If the proposed dividend is approved by shareholders, Aegon shares will be quoted ex-dividend on May 21, 2019. The record date for the dividend will be May 22, 2019. The election period for shareholders will run from May 28 up to and including June 14, 2019. The stock fraction will be based on the average share price on Euronext Amsterdam from June 10 until June 14, 2019. The stock dividend ratio will be announced on June 19, 2019, and the dividend will be payable as of June 21, 2019.

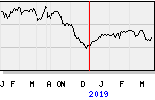

tijd 09.00

Aegon EUR 4,48 -12,5ct vol. 1,1 miljoen