Rotterdam/Amsterdam/Maarsbergen, the Netherlands, 14 July 2021

The Offeror increases the Offer Price to EUR 14.90 (cum dividend) in cash per Share, adjusted to EUR 14.50 (cum dividend) in cash per Share for the dividend of EUR 0.40 per Share

Invesco commits to tender its Shares under the Offer, resulting in 8.8% irrevocably committed by Invesco, and approx. 40% irrevocable commitments in total

The Executive Board and Supervisory Board of ICT Group fully support the Transaction and unanimously recommend the Offer

All proposed EGM resolutions in connection with the Offer have been adopted on 9 July 2021, under the condition precedent that the Offeror declares the Offer unconditional

All other Offer conditions to remain in place

Reference is made to (i) the joint press release issued by ICT Group and the Consortium led by NPM Capital on 28 May 2021 regarding the publication of the Offer Memorandum for the public offer by the Offeror for all the issued and outstanding ordinary shares in the capital of ICT Group (the “Shares”) at an offer price of EUR 14.50 (cum dividend) in cash per Share, adjusted to EUR 14.10 (cum dividend) in cash per Share for the dividend of EUR 0.40 per Share and (ii) the Offer Memorandum.

Offeror increases Offer Price to EUR 14.90 (cum dividend) in cash per Share

The Offeror announces that it increases the Offer Price to EUR 14.90 (cum dividend) in cash for each Share, adjusted to EUR 14.50 (cum dividend) in cash for each Share for the dividend of EUR 0.40 per Share (the “Increased Offer Price”). The Offeror has decided to increase the Offer Price and by doing so obtained the support of a large shareholder of the Company in the form of an irrevocable undertaking to tender its Shares under the Offer for the Increased Offer Price. With the commitment of this large shareholder, approx. 40% of the Shares are now irrevocably committed under the Offer, including the commitment of Teslin.

The Increased Offer Price represents:

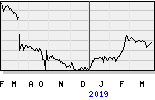

a premium of approx. 35.5% to the ICT Group closing share price on Thursday, 4 March 2021;

a premium of approx. 57.0% to the 6-month average daily volume weighted share price; and

a premium of approx. 75.6% to the 12-month average daily volume weighted share price.

By offering the Increased Offer Price, the Offeror aims to achieve an acceptance level of at least 95% of the Shares and to terminate the listing of the Shares on Euronext.

The consideration for the Shares already tendered under the Offer will, if the Offeror declares the Offer unconditional, also amount to the Increased Offer Price. All other terms of the Offer remain the same as set out in the Offer Memorandum.

Financing of the Offer

The Offer, with the Increased Offer Price, now values 100% of the Shares at approx. EUR 144.5 million. The Offeror has received a binding equity commitment letter from NPM Capital for the additional amount of approx. EUR 3.9 million required as a consequence of the Increased Offer Price. The Offeror is also in a well advanced stage of discussions with financing banks with respect to the debt financing it intends to take out prior to Settlement.

Invesco commits to tender its Shares into the Offer

Invesco Limited, holding 853,371 Shares (representing approx. 8.8% of the total number of issued and outstanding Shares), has entered into an irrevocable undertaking with the Offeror to tender all Shares held by it prior to the Closing Date under the Offer on the same terms and conditions as the other Shareholders. Invesco did not receive any information relevant for a Shareholder in connection with the Offer that is not included in the Offer Memorandum or this press release. The irrevocable undertaking contains certain customary undertakings and conditions. At the date of this press release, the Offeror on the one hand, and Invesco on the other hand, do not hold shares in each other’s capital.

Further announcements and Timetable

Any further announcements in relation to the Offer, including whether or not the Offeror declares the Offer unconditional, will be made by press release. Any joint press release issued by the Offeror and ICT Group will be made available on the website of ICT Group (www.ictgroup.eu) and NPM Capital (www.npm-capital.com). Any press release issued by the Offeror will be made available on the website of NPM Capital (www.npm-capital.com).

The indicative timetable for the Offer remains as announced on 28 May 2021. The Offer Period will expire at 17:40 hours CEST on 23 July 2021.