Key figures (in EUR million)

2019 2018 Change Revenu 37.3 36.0 4%

EBITDA*) 5.3 4.3 23%

Operating profit 3.4 2.4 42%

Free cashflow 2.1 0.8 162%

Profit, attributable to shareholders of Koninklijke Brill nv 2.1 2.3 -9%

Profit per share in EUR 1.10 1.23 -10%

Underlying profit 2.5 1.8 39%

Underlying profit per share in EUR 1.34 0.96 40%

Dividend (proposed 2019) 0.50 0.85 -41%

Key Financial Performance Indicators

Organic growth 2.9% -0.1%

ROIC 10.5% 7.8%

EBITDA Margin*) 14.2% 11.9%

*) 2018 EBITDA and EBITDA margin restated for comparative reasons to adjust for the impact of IFRS 16.

These figures are unaudited. The audited financial statements will be published on our website www.brill.com on April 7th, 2020.

Summary

• Revenue up by 4%, EBITDA by 23% (2018 restated for IFRS 16 impact)

• Underlying net profit, excluding one-off restructuring costs and one-off tax impact, increased by 39%

• US sales showed full recovery

• Strong growth in eBook sales and Open Access income

• 56% of revenue comes from digital publications

• Profit improvement plan developing in line with expectations

• AGM postponed until 25 June, 2020

Peter Coebergh, CEO commented:

“Driven by our renewed mission and strategy we achieved growth above our expectations, resulting in clearly improved revenue and EBITDA. In 2019 we made significant strategic and operational progress and we will continue along this path in order to reach our long-term financial objectives and yield sustainable value for all our stakeholders. However, the recent Covid-19 crisis casts considerable uncertainty on our markets and thus on our ability to reach our objectives in 2020, but it is too early to quantify the financial impact. Brill has prepared additional measures to mitigate the impact on Brill and its stakeholders .”

Developments in 2019

Strategic progress

Brill’s new mission statement, which underlines the relevance of humanities research in today’s world, is being promoted and shared online with all our stakeholders through blogs, podcasts and interviews and is very well received.

Strategic progress is reflected in the further increase of our digital revenue, by the expansion of our Open Access publishing program, and the launch of a new in-house developed open source text editions platform. Brill expanded its portfolio by acquiring several journals from competitors and by launching a range of new reference works and primary sources. Furthermore, we started a collaboration with Jus Mundi, a start-up company that has developed a specialized search engine in the field of international law, which will strengthen our digital capabilities. The German imprints Schöningh & Fink have developed their portfolio to include more English language publications, journals and Open Access books and starts to generate a growing part of its revenue from digital publications.

Operational progress

Due to the successful migration to the new Brill.com platform, we were able to retire our old platform and make an end to double costs we had to bear in 2018. At the end of the year we launched a new project to perform a company-wide digital health check. The objective of this project is to make sure that our digital and IT infrastructure is future-proof and will be able to support us to reach our strategic objectives. Our gross margin increased yet again to 70 %. Our profit improvement plan, launched in 2018, delivered savings as planned, which helped us in restoring profitability to our ambition level.

Financial development (all numbers in Euro)

IFRS 16

As reported earlier, our financial statements reflect the implementation of IFRS 16 - Leasing which rules that leased assets must be treated as if they were purchased and financed by Brill instead of by the leasing contract partner. This causes significant reclassifications of costs within the statement of profit or loss and the addition of balance sheet items for Right of Use assets and associated lease debt. In 2019 IFRS 16 had a positive effect of 0.7 million on EBITDA and a nearly equal and opposite impact on depreciation and interest charges.

Revenue

In 2019, Brill’s organic revenue growth was 2.9%. Total organic book sales grew by 3.6% with growth in eBook sales offsetting the ongoing gradual decline in print book sales. Total organic journal sales grew due to continued growth in subscription value, improved renewal management, new journal contracting, and new internal journal title development.

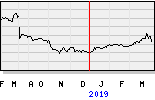

(EUR million)

2019 2018 Organic Growth Reported Growth

Print books 14.3 14.7 -2.4% m 2.7%

eBooks 11.1 9.9 11.8% 12.1%

Journals 10.6 10.2 3.6% 3.9%

Primary Sources 1.2 1.2 1.7% 2.3%

Total 37.3 36.0 2.9% 3.6%

Revenue generated through digital products was 21 million or 56% of total, versus 19 million or 53% in 2018. Subscription income as a percentage of total declined from 41% to 38%, mainly through the recovery of eBook sales results in the US which were mostly non-subscription products.

Revenue growth originated mostly from North America (+8% organic growth), which showed a full recovery from last year’s disappointing sales, by reaching out to new customers. Asia Pacific declined by 6% due to some larger 2018 deals that proved hard to replace. Western Europe showed a steady growth of 3%.

In 2019, we had less revenue from large sales deals, however, we were more than able to compensate with a large number of smaller deals with a wider customer group. We did successfully close some large deals with new and existing clients in the US, Canada and China. As expected, some of these deals included renewals from deals closed with these customers in previous years, as well as new business.

Cost of goods sold and operating expenses, EBITDA The cost of goods sold decreased by 0.3 million or 3%, despite the growth in revenues. This positive development results from double online platform costs contained in last year’s number. Also, we continue to see lower expenses from stock depreciation as our stock value continues to reduce due to our POD policy. Finally, we revised our estimation method of economic use of our title investments, translating into lower cost of content amortization. Combined with the growth in revenue this resulted in a gross margin of 69.9% versus 67.8% in 2019.

Operating expenses were at a similar level as in 2019. Despite a significant decline in expenses as a result of the reclassification of lease expenses (due to IFRS 16), costs increased due to regular salary increases for all staff, higher non-recurring consulting fees related to the quality improvement in Finance as well as higher costs for audit fees.

The above resulted in EBITDA of 5.3 million in 2019 (2018: 4.3 million restated for IFRS 16). The EBITDA margin came in at 14.2%. In 2019, we recorded 0.1 million in restructuring costs related to our profit improvement plan. These exceptional costs are excluded from EBITDA. Total savings from the profit improvement plan are developing in line with our expectations although not all projects have been fully executed yet.

Depreciation and amortization, and financing revenues and costs

Depreciation and amortization, other than recognized in cost of goods sold, were higher than 2018. This increase is attributable to the implementation of IFRS 16 and the full year amortization of assets that were capitalized in the course of 2018 (mainly Brill.com). Financing results amounted to -0.2 million (2018: -0.2 million), with lower foreign exchange expenses countered by higher interest expenses of our long-term loan and the impact of IFRS 16.

Profit and profit per share

In summary, operating profit and profit before tax increased due to the growth in revenues and the reduced costs as result of the profit improvement plan.

As in 2018, net profit was impacted by corporate income tax movements. Firstly, we incurred a partial reversal of the 2018 tax benefit. In 2019, the Dutch government decided to partly reverse the decrease of future corporate income tax rates, and as a result, the deferred tax liability increased by 0.2 million. Additional amortization charges resulted in a beneficial effect on the tax charge. Due to advance payments to the tax authorities and the above net positive effect on the tax payable, a tax receivable resulted of 1.1 million.

Consequently, in our statement of financial position, our deferred tax liability increases by 0.5 million and the tax charge in our statement of profit or loss reverses from an income of 0.1 million in 2018 to a cost of 1.1 million in 2019.

Underlying net profit, excluding one-off restructuring costs and one-off tax impact, amounted to 2.5 million in 2019, an increase of 37% compared to 2018 (1.8 million). This translates into an underlying earnings per share of EUR 1.34 for 2019. Reported net profit for 2019 came in at 2.1 million (2018: 2.3 million).

see & read more on

https://brill.com/fileasset/downloads_static/static_investorrelations_brill_press_release_annual_results_2019.pdf