highlights

•revenue +3% to EUR 2,841 million (organic +1.1%)

•operating profit (EBITA) EUR 362.6 million with an EBITA-margin of 12.8%

•net profit before amortisation EUR 267.4 million; per share EUR 2.42 (-3%)

•free cash flow EUR 312.1 million; ROCE 15.1% (before IFRS 16)

•increased investments in organic growth and innovation initiatives

•portfolio optimisation: acquired PPC and Applied, annual revenue USD 62 million; divested STAG and HFI, annual revenue EUR 30 million

•updated strategy ‘focused acceleration’, presented December 2019

CEO statement

“WE DELIVERED A SOLID AND RESILIENT PERFORMANCE. In the course of the year we faced more difficult market circumstances in the automotive and several industrial niche end markets, due to market uncertainty, postponement of orders and inventory reduction. This was compensated with growth and innovation initiatives in the end markets eco-friendly buildings, sustainable transportation and semicon efficiency, resulting in overall organic revenue growth. Our EBITA performance was impacted by the revenue mix. Besides this, 2019 included less incidental benefits compared to 2018.

Overall, our performance was solid and resilient, due to our sustainable business model, focused business teams, many organic revenue growth, innovation initiatives and cost reductions. We continued our focus on the operational excellence projects. There is still a lot to gain the coming years.

To facilitate the many good business plans, we increased our investments and further optimised our portfolio. Our updated strategy ‘focused acceleration’ 2018-2022 was presented during our Capital Markets Day (CMD) in December.”

dividend

We propose a cash dividend of EUR 0.80 per share (2018: EUR 0.75) to the General Meeting, an increase of 7%.

outlook

We will accelerate our actions as presented during our CMD. We remain confident in realising our organic growth and innovation plans and operational excellence projects, achieving our strategic objectives.

financial development

Revenue increased by EUR 82.4 million to EUR 2,841.3 million. Overall we realised an organic revenue growth of EUR 29.1 million with a mixed picture. We faced an organic revenue decline of EUR 21.2 million in our European surface technologies activity (part of material technology) and a EUR 50.3 million organic revenue growth in the other Aalberts activities. The 2018 and 2019 (PPC & Applied) acquisitions caused a positive revenue effect of EUR 78.2 million. Divestments in 2018 and 2019 (HFI & STAG) caused a negative revenue effect of EUR 59.4 million. Currency translation | FX impact amounted to EUR 34.5 million positive (mainly US Dollar).

Overall, operating profit (EBITA) decreased by EUR 2.9 million to EUR 362.6 million. 2018 EBITA was positively impacted by incidental benefits of EUR 10.6 million (holding | eliminations). We realised an organic EBITA decline of EUR 3.6 million, divided into EUR 17.1 million EBITA decline in our European surface technologies activity (incl. restructuring | one-off costs) and EUR 13.5 million EBITA growth in the other Aalberts activities. IFRS 16 impact on EBITA is EUR 0.7 million positive. Further in 2019 there was a positive effect of EUR 14.8 million from 2018 and 2019 (PPC & Applied) acquisitions. Divestments in 2018 and 2019 (HFI & STAG) had a negative impact of EUR 6.3 million. Currency translation | FX impact amounted to EUR 2.8 million positive (mainly US Dollar).

Net profit before amortisation decreased by EUR 7.5 million to EUR 267.4 million, per share by 2.8% to EUR 2.42 (2018: EUR 2.49). Earnings per share was impacted with EUR 0.04 negative by a 1.5% higher effective tax rate compared to 2018 and EUR 0.01 negative by IFRS 16.

Free cash flow (before interest and tax) was equal to 2018 at EUR 312.1 million, despite increased capital expenditure cash out of EUR 38.5 million and a positive IFRS 16 impact of EUR 33.9 million. Working capital slightly increased to 61 days or EUR 490 million (2018: 60 days or EUR 464 million) with a stable DIO, despite all new product launches. FCF conversion ratio was 63.2% (2018: 67.6%), IFRS 16 impact was 2.7% positive.

ROCE (before IFRS 16) decreased from 16.6% to 15.1%. Capital employed was impacted by IFRS 16 with EUR 165 million. Total equity remained at a solid level of 53.0% of the balance sheet total (2018: 53.2%), despite a negative IFRS 16 impact of 2.7%. Net debt amounted to EUR 755 million (2018: EUR 586 million) and was impacted by EUR 167 million lease liabilities (IFRS 16). Net debt before IFRS 16 increased by EUR 2 million to EUR 588 million, despite increased capital expenditure and two acquisitions. The leverage ratio before IFRS 16 remained stable at 1.3, well below the bank covenant of < 3.0.

see & read more on

https://aalberts-website.s3.eu-west-1.amazonaws.com/media/App/Models/Download/000/000/271/attachment/original/FY2019.pdf

tijd 10.31

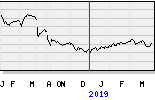

Aalberts EUR 36,79 - 2,73 vol. 250.492