Maintaining high pace in implementing Aegon's strategy

Net loss of EUR 206 million driven mainly by a non-economic loss on interest rate hedges in the US

Operating result of EUR 429 million, which is a decrease of 11% on a constant currency basis compared with the third quarter of 2021. Benefits from expense savings, growth initiatives, and an improvement in claims experience are more than offset by lower fees due to adverse markets

The capital ratios of all three main units remain above their respective operating levels. Group Solvency II ratio amounts to 212%

Cash Capital at Holding decreases to EUR 1,368 million, reflecting EUR 273 million dividends paid and second EUR 100 million tranche of previously announced EUR 300 million share buyback

Transamerica Life Bermuda (TLB), Aegon's high-net-worth business, reinsured a closed life insurance portfolio with Transamerica in October. This frees up surplus capital and strengthens Transamerica’s capital position

Aegon takes action to substantially reduce the capital sensitivity of its US variable annuity portfolio to equity markets and further increase the predictability of free cash flows; a third-party transaction will not be pursued in the near-term

Statement of Lard Friese, CEO

"In recent months, we have made great strides in the transformation of Aegon and the acceleration of our strategy. We have made substantial progress on our operational improvement plan, and have taken additional actions to maximize the value of both our US variable annuity book and TLB, Aegon’s high-net-worth insurance business. Most recently, we announced a transaction with a.s.r. in the Netherlands to create a leading Dutch insurance company.

In the third quarter, our operating result declined by 11% on a constant currency basis as adverse market conditions more than offset an improvement in claims experience in the United States, expense savings and the benefit from growth initiatives. Despite inflationary headwinds, we made considerable progress with our expense savings program. We achieved additional EUR 50 million expense savings compared with last quarter, increasing the reduction in our annual addressable expenses to EUR 300 million compared with the base year 2019. The growth initiatives, aimed at improving our customer service and expanding our distribution network, positively impacted our commercial and financial results.

We also made solid progress on our ambition to grow our strategic assets, despite continued financial market volatility and political unrest. Life insurance sales were up 24% in the United States and 16% in our Growth Markets, supported by our growing distribution capabilities. The retirement businesses across the United States, the Netherlands and the United Kingdom all reported growth in net deposits, reflecting the strength of the labor market. Commercial results in Asset Management, the UK Retail business and our US mutual fund platform were under pressure as a result of our customers’ reduced propensity to invest in the current uncertain environment.

We continue to take actions to maximize the value of our financial assets. Based on extensive analysis, we have concluded that the best option with respect to the US variable annuity portfolio is to continue to own and actively manage it, at least in the near term. In October, we finalized an internal reinsurance transaction between TLB and Transamerica that freed up USD 600 million in excess capital for Transamerica. Part of this will be used to create a buffer that will substantially reduce the capital sensitivity of our US variable annuity book to equity markets.

The recent action we have taken to combine our Dutch pension, life and non-life insurance, banking, and mortgage origination activities with those of a.s.r., is pivotal to the transformation of our company and reflects our goal to build advantaged businesses in our chosen markets. The transaction enables us to accelerate the return of capital to shareholders and is in line with our strategy to release capital from mature businesses, and create leading positions in markets where Aegon is well positioned for growth.

I appreciate the hard work and dedication of all our colleagues to support our customers’ needs in challenging times. Thanks to the efforts of our employees, we are able to continue to improve our operational performance and accelerate our strategy. While economic volatility will likely persist, our strong balance sheet, disciplined risk management, and focused strategy make me confident about the opportunities the future will bring."

Strategic highlights

Financial highlights

Press releases

View in Dutch

Contact

Media relations contacts

Investor relations contacts

Newsletter sign up

Press release PDFs

English version 3Q 2022

Nederlandse versie 3Q 2022

Results documentation

Sign up for the webcast (9:00 CET)

Presentation 3Q 2022

Financial Supplement 3Q 2022

Interim Financial Statements 3Q 2022

Infographic 3Q 2022

About us

Governance

Our businesses

Contact Aegon

see & read more on

https://www.aegon.com/investors/press-releases/2022/3q-2022-results/

tijd 14.59

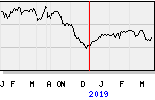

Aegon EUR 4,686 -6,1 ct vol. 5,2 miljoen.