Net income of EUR 202 million, reflecting one-time charge from assumption changes in the United States

Underlying earnings before tax decrease by 31% to EUR 700 million caused by adverse mortality and impacts from lower interest rates in the United States. Resilient earnings from other units, supported by lower expenses

Net income of EUR 202 million, down from EUR 617 million

Fair value gains of EUR 680 million. Gain from reduction in the value of liabilities in the Netherlands as a result of wider credit spreads, partly offset by losses in the United States on fair value investments and unhedged risks

Net impairments of EUR 194 million, mainly on the US bond portfolio and unsecured loans in the Netherlands

Other charges of EUR 1,071 million, mainly as a result of assumption changes in the United States, reflecting lower interest rates and updated Life and Long-Term Care assumptions

Aegon withdraws financial targets and rebases interim dividend

On the basis of the first half 2020 results and in light of the uncertain economic outlook, Aegon withdraws its 2019-2021 financial targets. New financial targets will be provided at a Capital Markets Day in December

Solvency II ratio decreases from 201% at end of 2019 to 195% on June 30, 2020 due to adverse market impacts

Normalized capital generation of EUR 466 million, reflecting adverse mortality experience in the United States

Holding excess cash at EUR 1.7 billion reflects the decision to not pay a final 2019 dividend. Transamerica to retain its remittance for the second half of 2020. USD 500 million senior debt to be repaid from holding excess cash in December 2020 to facilitate deleveraging

Interim dividend 2020 reduced to EUR 0.06 per share. Aegon anticipates that gross remittances after holding expenses will be sufficient to cover the rebased dividend, even in reasonable stress scenarios

Net deposits of EUR 1 billion; life insurance sales decline

Net deposits of EUR 1 billion, driven by the UK platform and the online bank in the Netherlands, partly offset by Variable Annuities and Retirement Plans net outflows in the United States

New life sales decrease by 6% to EUR 379 million, reflecting the impact of COVID-19 lockdowns and the exit of the individual life market in the Netherlands

Accident and health insurance sales are up by 6% to EUR 124 million, mainly driven by higher voluntary benefit sales in the United States and higher disability sales in the Netherlands

ga voor meer naar

https://www.aegon.com/investors/press-releases/2020/1h-2020-results/

tijd 09.03

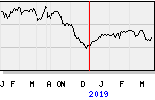

De AEX 573,09 -1,97 -0,34% Aegon EUR 2,767 -24,8ct vol. 2,1 milj.

tijd 15.52

Bezitters Aegon lopen een flinke scheur in den broek op vandaag, nu EUR 2,581 -43,4ct vol. 48,2 milj.