ABN AMRO reports modest loss of EUR 45 million for FY2020

Q4 2020 net profit EUR 54 million, reflecting solid operational performance in a challenging environment

Dutch economy and housing market resilient; FY impairments below guidance, expected to decline in 2021

Good progress on wind-down of CIB non-core; portfolio has declined by around 45% since Q2

Net interest income continues to be impacted by pressure on deposit margins and lower corporate loan volumes

Delivered on cost savings programme of EUR 1.1 billion; further cost savings of EUR 700 million by 2024

Very strong capital position, Basel III CET1 ratio of 17.7% (Basel IV above 15%); well placed to pay FY19 dividend

No dividend proposed over 2020; remain committed to resuming payments of dividend sustainably

Strategy review including targets for the longer term presented in November: a personal bank in the digital age

Robert Swaak, CEO, comments:

‘Net profit in Q4 was EUR 54 million, reflecting solid operational performance and lower impairmentsu nder challenging circumstances. Net interest income continued to be impacted by pressure on deposit margins and lower corporate loan volumes, partly due to the wind-down of CIB non-core. We delivered on a EUR 1.1 billion cost programme, reaching our cost target of EUR 5.1 billion for 2020 (excluding restructuring provisions for the CIB wind-down).

The financial results for 2020 were marked by the impact of Covid-19 and large exceptional client files. We closed the year with a modest loss of EUR 45 million. The resulting ROE for 2020 was an unsatisfactory -0.8% and the cost/income ratio was 66%. Excluding CIB non-core, ROE was around 5%.

I am proud of the commitment we demonstrated to our clients in the past year and the difference our staff have made, true to our purpose ‘Banking for better, for generations to come’. I would like to thank our clients for their continued trust.

In the strategy review presented in November we made clear choices and announced targets for the longer term. We will be a personal bank in the digital age, focused on the Netherlands and Northwest Europe. We are making good progress in the wind-down of CIB non-core as we have reduced the portfolio by around 45% since Q2. I am proud that ABN AMRO has once again achieved a high score in the S&P Global’s SAM Corporate Sustainability Assessment, putting us in the top 10% of most sustainable banks worldwide.

Our capital position remains very strong, with a fully-loaded Basel III CET1 ratio of 17.7% (Basel IV CET1 ratio above 15%). This provides resilience and positions us well to pay FY2019 dividend, conditions permitting. Based on the ECB’s revised recommendation and the loss recorded in 2020, regrettably no dividend will be proposed over 2020. We are committed to resuming payment of dividends, sustainably, taking into account the ECB’s recommendation.

The Dutch economy and housing market remain resilient, as the government’s effective support programmes continue. We expect that the roll-out of the vaccination programme will facilitate a significant lifting of restrictions in Q2, rapidly leading to a strong economic rebound in the second half of the year. We expect lower impairment levels than in 2020. The bank continues to operate from a position of strength, with a distinct profile, clear strategic focus and a very strong capital position. We are cautiously optimistic about the prospects for the bank as we execute on our strategy.’

see & read more on

https://assets.ctfassets.net/1u811bvgvthc/6HdKPr2uuJpLcKoEZcT7u4/0e6d3ea6c78b52d2acfb04a6f7c663fa/ABN_AMRO_Bank_Quarterly_Report_fourth_quarter_2020.pdf

tijd 09.02

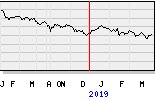

De ABN AMRO EUR 8,45 -10ct vol. 142.059