With the publication of the Offer Memorandum today, and with reference to the joint press releases dated 25 February 2019 and 25 March 2019 by CACEIS S.A. and KAS BANK, CACEIS and KAS BANK hereby jointly announce that CACEIS is making a recommended public offer for all Securities of KAS BANK at an offer price of EUR 12.75 (cum dividend) in cash per Security.

Sikko van Katwijk, Chairman of the Managing Board of KAS BANK

“We are excited to announce the next step in the development of KAS BANK with the formal launch of the Offer today. At KAS BANK we service clients such as pension funds, insurance companies, wealth managers, asset managers, private family offices and investment companies. We will grow these market segments together with CACEIS, having much more power and scale together. We look forward to the integration of our businesses and becoming CACEIS’ global centre of excellence for the pension fund business, managing, expanding and innovating the offering in the Netherlands and across other international markets.

With CACEIS' track record, financial strength and way of doing business we believe the Offer secures the longer-term interests of KAS BANK, our shareholders, employees and customers in the best possible way."

Jean-François Abadie, CEO of CACEIS

"We are delighted to be taking these steps towards strengthening our market share in the Netherlands, Germany and the UK. This transaction is an excellent opportunity to bring significant pension fund servicing expertise into the CACEIS group, together with the professional staff who know the servicing needs of their institutional investor clients. Furthermore, with CACEIS’ extensive geographical footprint and broad scope of services, clients stand to benefit from being part of one of Europe’s largest asset servicing groups.

At every step in the process, clients are our number one priority. Leveraging our extensive migration experience, we will ensure uninterrupted client service and a smooth business migration once regulatory approvals are received."

Highlights

• Today, CACEIS has published the Offer Memorandum launching the recommended all-cash

public offer by CACEIS for KAS BANK of EUR 12.75 per Security (the "Offer Price"), valuing

KAS BANK at EUR 187 million1.

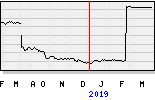

• The Offer represents a premium of 110% over the closing price of KAS BANK on Friday, 22

February 2019, immediately prior to the announcement of the Offer and 111% over the average

volume weighted price for the 3 months prior to and including the announcement of the Offer.

• The Managing Board and Supervisory Board of KAS BANK unanimously support and recommend

the Offer.

• CACEIS will finance the transaction from its own funds.

• A position statement providing further information to the Securityholders is made available on

the corporate website of KAS BANK.

• The combination will make CACEIS a leading asset service provider in the Netherlands.

• KAS BANK will become a branch of CACEIS, exporting its expertise in servicing institutional

investors such as pension funds to all the European markets CACEIS is currently servicing.

• KAS BANK and CACEIS have agreed on an integration plan and non-financial covenants for the

period after completion of the Offer.

• The Works Council of KAS BANK has rendered an unconditional positive advice in relation to the

transaction.

• Stichting Administratiekantoor Aandelen KAS BANK and Stichting Preferente Aandelen KAS BANK

have irrevocably undertaken to cooperate with inter alia the Offer.

• The offer period commences on Monday 29 July 2019 at 09:00 hours CET and ends on Monday

23 September 2019 at 17:40 hours CET, unless extended.

• KAS BANK will hold an Extraordinary General Meeting of Securityholders at 15:00 hours CET on

12 September 2019, during which, the Offer will be discussed.

• The process of obtaining all necessary regulatory approvals is on track.

• The Offer is expected to be completed in the second half of 2019 and is subject to customary

conditions as set out in the Offer Memorandum, including a minimum acceptance level of 95%

of the Securities (the "95% Condition") and approvals from the Dutch and European Central

Bank ("DNB" and "ECB").

• If after completion of the Offer, CACEIS holds at least 95% of the Securities it will proceed to

delisting of the Securities and commence a statutory squeeze-out procedure.

• CACEIS may waive the 95% Condition. If after completion of the Offer, CACEIS holds less than

95% of the Securities CACEIS may elect to implement a demerger and liquidation, the terms of

which the Offeror and KAS BANK have agreed upon.

Paris, France and Amsterdam, the Netherlands, 26 July 2019

1 Based on 15,594,990 securities issued and outstanding, minus 916,363 treasury securities.

The Offer

CACEIS is making the Offer on the terms and subject to the conditions and restrictions contained in the Offer Memorandum. Securityholders tendering their Securities under the Offer will be paid in consideration for each Security validly tendered (or defectively tendered provided that such defect has been waived by the Offeror) pursuant to the Offer prior to or on the Acceptance Closing Date (each a "Tendered Security") an amount in cash of EUR 12.75 (cum dividend) (the "Offer Price").

The Offer values 100% of the Securities at EUR 187 million. CACEIS S.A. has confirmed in the joint press release dated 25 February 2019 that it will be able to finance the aggregate consideration of the Offer from its available cash resources. Similar to the confirmation given by CACEIS S.A., the Offeror hereby confirms it will finance the transaction from its own funds and will at the settlement of Offer be able to pay the aggregate Offer Price and to comply with all its financial obligations.

Strategic rationale for the Offer

The Dutch market for asset servicing is attractive due to its asset volume, complexity and high pension savings to GDP ratio. The market is known for its pension funds, private equity and real estate funds among others, resulting in a significant size. KAS BANK is a local champion, with an expertise in servicing institutional investors. For KAS BANK’s business, being part of a large and well capitalised player, revenues are expected to grow while costs synergies will lead to increased profitability.

Both parties believe that the combination will lead to an enhanced positioning of CACEIS as service provider to European institutional investors. The extensive knowledge and expertise of CACEIS will be available to Dutch investors. The strength of CACEIS’ parent company, Crédit Agricole, will offer a solid financial position, business continuity and support business development. KAS BANK will evolve into CACEIS' Dutch branch.

As a result of the acquisition of KAS BANK, the Offeror will significantly upgrade its position in the Dutch market both in set-up and market presence. In addition, the Offeror will enable KAS BANK to further enhance its expertise in servicing pension funds, which is the largest client segment in the Netherlands and a key strength of KAS BANK, on a global level.

The parties believe that the combination has several strategic benefits including:

• Excellent complementarity in clients, markets and knowledge;

• Centred around client empowerment and operational excellence;

• Data driven and innovative organisations;

• Digitally oriented European asset servicing company;

• Comparable corporate values.

Governance as per the Settlement Date

As from the Settlement Date, the Managing Board will consist of the current members: Sikko van Katwijk as chairman and Mark Stoffels as Chief Financial Risk Officer (the "Managing Board Members").

Subject to the relevant resolutions being adopted at the EGM, it is envisaged that as from the Settlement date the Supervisory Board will consist of six members:

• three of the current Supervisory Board members, being Peter Borgdorff, Pauline Bieringa and Hans Snijders (the "Continuing Members"). The Continuing Members qualify as independent within the meaning of the Corporate Governance Code; and

• three members upon nomination of the Offeror, being Jean-François Abadie, Catherine Duvaud and Joseph Saliba.

KAS BANK will continue to adhere to the Corporate Governance Code by way of complying or explaining any deviations in accordance with the provisions of the Corporate Governance Code, until

elisting from Euronext Amsterdam.

Non-financial covenants

CACEIS and KAS BANK have agreed certain non-financial covenants, which will apply during the period starting on the Settlement Date and ending one year after the transformation of KAS BANK into the Dutch branch of CACEIS.

The Company and its business CACEIS supports the strategy of KAS BANK and its business. KAS BANK and its business will act as CACEIS' global centre of excellence for pension fund services, defending, expanding and innovating CACEIS' pension fund offering in the Netherlands and across other international markets. KAS BANK and its business will operate as CACEIS' Dutch business base, keeping the client base materially intact and respecting and improving the client service levels.

The employees

The existing rights, benefits, pension rights, (collective) agreements and social plans applicable to the employees of KAS BANK will be respected or replaced with equivalent arrangements. The Offer shall not have an impact on such currently existing agreements. The existing arrangements with the Works Council, trade unions and employee consultation processes will be respected. CACEIS will aim to ensure that the employees of KAS BANK have increased career opportunities, personal development and training.

The governance

KAS BANK will evolve into CACEIS' Dutch branch, who will maintain local Dutch management and expertise. CACEIS will maintain and respect the operating of the Managing Board and Supervisory Board until the Dutch branch has been launched successfully.

The integration

The Integration is aimed at strengthening the KAS BANK's local product and service offering to all its clients. The Integration aims at using CACEIS' centers of excellence in the most efficient way, avoiding double work. CACEIS will aim to avoid redundancies wherever it can and respect the agreed social plan of KAS BANK in case of redundancy.

Recommendation by the Managing Board and the Supervisory Board

After careful and extensive deliberation by the Managing Board and the Supervisory Board of the Company (together the "Boards") and in consultation with their financial and legal advisors, taking into account all aspects and consequences of the Offer, including strategic, financial, operational and social points of view, the Boards considered that the Offer is in the best interest of KAS BANK and its stakeholders.

Subject to the terms and conditions of the Offer Memorandum and the Merger Protocol, the Boards fully support and unanimously recommend the Offer for the acceptance to the holders of Securities of the Company and recommend the holders of Securities to vote in favour of all Resolutions (the "Recommendation").

Extraordinary General Meeting

On 12 September 2019 at 15:00 hours CET, KAS BANK will hold an Extraordinary General Meeting ("EGM") at the offices of KAS BANK at De Entrée 500, 1101 EE, Amsterdam, the Netherlands. In accordance with section 18 paragraph 1 of the Decree on public offers Wft (Besluit openbare biedingen Wft, the "Takeover Decree"), the Offer will be discussed at the EGM.

In addition, certain Resolutions in connection with the Offer will be proposed to the Securityholders.

Subject to the terms and conditions of the Offer Memorandum and the Merger Protocol, the Boards fully support and unanimously recommend the holders of Securities to vote in favour of all Resolutions.

Pursuant to article 18 of the Decree, KAS BANK will publish a Position Statement which sets forth the Recommendation and provides additional information to Securityholders in relation to the Offer and the fairness of the Offer Price.

Works Council of KAS BANK

On 23 April 2019, the Works Council has rendered its unconditional positive advice in respect of the transaction.

see & read more on

https://www.kasbank.com/media/2512/press_release_kas_bank__caceis_launch_of_recommended_public_offer_in_cash_by_caceis_for_all_securities_26072019.pdf