Breukelen, the Netherlands, November 2nd, 2016

TIE Kinetix N.V. announces that it has received a non-binding offer for all of its activities amounting to € 25-28.8 million payable with a vendor note to be issued to TIE Kinetix NV.

The non-binding offer was made by DW Vastgoed Holding BV (“DW”), a long term TIE Kinetix shareholder owning 25.8% of the shares, and includes:

1. TIE Kinetix NV sells all of its subsidiaries and activities to a newly incorporated holding (‘Newco’) owned by DW;

2. All of the subsidiaries and activities are valued at € 25 million, to be increased with the effects of dilution caused by the future exercise of currently outstanding warrants and other instruments that could amount to € 3.8 million (together referred to as ‘the Purchase Price’);

3. The Purchase Price will be entirely paid with a vendor note, to be issued by Newco to TIE Kinetix NV;

4. At future exercise of the outstanding warrants and other instruments, the proceeds thereof will flow to Newco and will be added to the vendor note. The Purchase Price and vendor note could as a result increase up to € 28.8 million;

5. The vendor note has a 7 year tenor and carries a fixed interest component and a variable interest component. The fixed interest component is set at 2% per annum and the variable interest component is set at 0-6% per annum, and depends on the future performance of the acquired activities. The vendor note will be secured with a pledge on the acquired activities.

6. Existing shareholders in TIE Kinetix NV may elect to exchange their shares in TIE Kinetix NV into a direct ownership in the note (% ownership in TIE Kinetix NV exchanged for a similar percentage ownership in the Note).

7. DW will convert its current shareholding in TIE Kinetix NV into equity of Newco, therewith reducing the value of the vendor note with 25.8%. The security of pledge on the acquired activities will not be changed as a result of this conversion.

TIE Kinetix is examining this offer and will provide more information when practically possible.

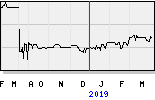

TIE Kinetix is a public company listed at Euronext Amsterdam with 1,592,704 shares currently outstanding excluding 435,135 warrants and other instruments (NYSE Euronext: TIE Kinetix).

This document may contain expectations about the financial state of affairs and results of the activities of TIE Kinetix as well as certain related plans and objectives. Such expectations for the future are naturally associated with risks and uncertainties because they relate to future events, and as such depend on certain circumstances that may not arise in future. Various factors may cause real results and developments to deviate considerably from explicitly or implicitly made statements about future expectations. Such factors may for instance be changes in expenditure by companies in important markets, in statutory changes and changes in financial markets, in the EU grant regime, in the salary levels of employees, in future borrowing costs, in future take-overs or divestitures and the pace of technological developments. TIE Kinetix therefore cannot guarantee that the expectations will be realized. TIE Kinetix also refuses to accept any obligation to update statements made in this document.

tijd 09.10

Tie EUR 11,40 +1,70 vol. 2.374