Media, (Reuters) - China's Xinmao Group moved to dispel doubts over its $1.3 billion offer for Dutch cable maker Draka (DRAK.AS) on Wednesday, saying it had backing from a Chinese bank for its proposed takeover.

Xinmao has lined up "one of the larger banks in China to provide the funds as necessary" and has submitted a letter of commitment to Draka, Joseph Krant of Amsterdam-based Catalyst Advisors, which is advising Xinmao, told Reuters.

Draka has become the darling of the cable making industry, with France's Nexans (NEXS.PA), Italy's Prysmian (PRY.MI) and Xinmao all making approaches as they chase a slice of the market for cables in anything from telecommunications to cars.

A three-way bidding war for Draka remains a possibility even though Nexans said it would not now submit an earlier 15 euros per share offer. The world's largest cable maker also said it would follow progress on the Draka "dossier" very closely.

While Nexans could come back with a fresh bid, analysts were initially skeptical that it would make a move. The company has so far not commented on the higher Prysmian and Xinmao offers.

Asked whether it was considering a raised offer, a Nexans spokeswoman told Reuters: "I'll leave you to your interpretation. We are just going to remain attentive to the progress of what is happening."

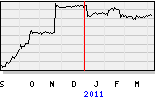

Draka's shares reversed earlier losses on the news and closed 0.4 percent higher at 19.27 euros, some way short of Xinmao's 20.50 euro-per-share cash offer.

Draka is a leader in elevator cables. It designed and provided cables for the 58 lifts of the world's tallest skyscraper, the 828 meter Burj Khalifa in Dubai.

Xinmao's interest came out of the blue, taking Draka shareholders and industry analysts by surprise. While a successful takeover by little-known Xinmao would aid China's "Triple Play" plans to roll out broadband networks, European analysts have questioned the viability of its offer.

"This is a formal offer. Comments that Xinmao is not a serious contender are nonsense. We don't underestimate the Chinese and I would recommend that others do not as well," Krant said.

"We felt if we could acquire it, we could grow this company ... in Asia-Pacific in optical fibers and optical communication, and double the size of the company in three to five years," he added.

ANOTHER HUMMER?

Xinmao's offer values Draka's equity at about 1 billion euros, Tianjin Xinmao Science & Technology (000836.SZ), Xinmao's listed arm, confirmed in a Shenzhen stock exchange filing. Xinmao, founded in 2000 by a former Chinese air force lieutenant, employs around 30,000 people.

Xinmao said the two sides were "in detailed discussions about the deal," although it still needed Chinese government approval. Meanwhile, Draka shifted its position slightly, saying it would begin talks with Xinmao, even as it described Prysmian's offer as a sensible all-European combination.

Xinmao's adviser Krant said he expected due diligence to continue for several weeks, adding the company has had very little contact with Flint Beheer, the secretive family investment fund which holds a 48.5 percent stake in Draka

Xinmao said it had sent its offer to Draka's management board and supervisory committee. Draka executives have said they have only received a press release and no formal offer.

China plans to expand its broadband to integrate TV, Internet and telephone networks by the end of 2015, an effort that could cost between $50 billion and $100 billion.

"Fiber optic cable is something everyone is going to have to put down. Fiber optic cables are cheaper to put down than copper cables because the price of copper has gone up so much," said Paul Wuh, a Hong Kong based analyst with Samsung Securities.

China accounted for 46 percent of global demand for fiber optic cable in 2009, though consumption from Chinese network operators dropped by 11 percent in the first nine months of 2010, according to market research firm CRU.

"The capacity of optic fiber in China doubled in the past year and I can't see any major benefits for buying a foreign fiber cable maker," a Shenzhen-based telecoms analyst said.

"It may be like Tengzhong wanting to buy Hummer -- a purely marketing act," he said. The Chinese heavy equipment group failed in a bid to buy the SUV brand from General Motors (GM.N).

(Additional reporting by Melanie Lee, Michael Smith, Fang Yan, Heng Xie, Shengnan Zhang and Helen Massy-Beresford; Editing by Michael Flaherty, Alexander Smith and Erica Billingham)

By Terril Yue Jones and Greg Roumeliotis

BEIJING/AMSTERDAM | Thu Nov 25, 2010 1:41am EST

Op verzoek, welke niet-gecons. deelneming en joint ventures heeft Draka in China, jaar 2009 2008

1. Yangtze Optical Fibre & Cable Co. Ltd. Joint venture China 37,5% 37,5%

2. Jiangsu YOFC Zhongli Fiber and Cable Co. Ltd. Geassocieerde deelneming China 19,1% 19,1%

3. Yangtze Optical Fiber and Cable Sichuan Co. Ltd. Geassocieerde deelneming China 19,1% 3,6%

4. Draka Comteq SDGI Co. Ltd. Geassocieerde deelneming China 18,4% 55,0%*

* was met Alcatel

5. Tianjin YOFC XMKJ Optical Communications Co. Ltd. Geassocieerde deelneming China 18,4% -

6. Shantou Hi-tech Zone Aoxing Optical Communication

Equipment Co. Ltd. Geassocieerde deelneming China 15,7% 15,7%

7. Yangtze (Wuhan) Optical System Co. Ltd. Geassocieerde deelneming China 11,3% 11,3%