Topics analyst day

Randstad Holding nv hosts its analyst & investor conference in Paris today. In the morning session CEO Ben Noteboom will provide an update on our strategic agenda. CFO Robert-Jan van de Kraats will elaborate on targets and financial modeling. Thereafter executive board member Brian Wilkinson will provide an update on the organizational changes that have taken place recently in the UK. François Béharel, managing director Randstad France, will handle the integration and the way forward in France. Frans Cornelis, managing director Group Communications and Marketing, will provide an update on branding and internet initiatives.

Strategic agenda – focus on organic growth to extract the value of the new Randstad

Our strategic agenda is straightforward. The integration in staffing has been completed and the cost synergies have been realized. Now the time has come to extract the value of the new Randstad and to fully exploit the commercial synergies. If market circumstances permit, we will focus on the organic roll-out of staffing specialties and inhouse services over the enlarged footprint. In the professionals segment we have defined best practices in the main verticals such as Engineering, IT and Finance & Accounting. As a first step, these blue prints will be used to improve the existing businesses. Thereafter, they will be used to organically expand our professionals offering, across segments and across geographies. All current financial targets remain in place. We will not announce any new financial targets.

Current trading

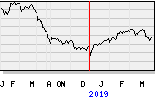

The trends that have been discussed in our Q3 2009 presentation have so far continued into Q4 2009. In October revenue per working day decreased by 21% (year on year, organically), compared to a decline of 26% in September. In November the revenue trend keeps improving, evidently against an easier comparison base. In most markets, staffing and inhouse services improve whilst the professionals businesses are stabilizing. The latter is also the case regarding perm fees. Geographically, trends are maintained as well. Our combined US staffing and inhouse services business has continued to improve and since two weeks the number of temps at work is ahead of the number of last year. In Europe, Germany and our combined UK staffing and inhouse businesses keep improving, whilst our businesses in Poland, Portugal, Denmark and Sweden have returned to growth. The revenue decline in our Dutch business, which is more late-cyclical, is rather stable. Regarding other continents, we note a visible improvement in Australia, while our businesses in Chile and Brazil have returned to growth. On average, gross margin remains under pressure, as flagged with the Q3 2009 results.