Randstad Holding nv (“Randstad”) and Vedior N.V. (“Vedior”) announce that they have reached conditional agreement to combine Randstad and Vedior to create the second largest HR services company worldwide. The combination will be achieved by means of a public offer for all of the outstanding share capital of Vedior in a mixed cash and share exchange offer, comprising € 9.50 in

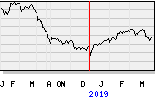

cash and 0.32759 Randstad shares for each Vedior share (the “Offer”). Based on Randstad’s closing share price on 29 November 2007 of € 32.62, the day prior to Randstad and Vedior confirming that they were in discussions regarding a possible combination, the Offer values Vedior at € 20.19 per share implying a 64.1% premium to the closing share price as of 29 November 2007 and a premium

of 51.8% to the volume weighted average share price over the month ended 29 November 2007.

The share component of the Offer provides Vedior shareholders with the opportunity to benefit from the significant upside potential arising from the combination.

The proposed transaction will create:

• The second largest HR services company worldwide, with combined revenues of € 17.3 billion and EBITA of € 883 million (LTM1)

• An industry champion with leading positions in key markets across the world:

o Number 1 positions in Germany, The Netherlands, Belgium, Portugal, Poland, Canada and India

o Number 2 position in Spain

o Number 3 positions in France, Switzerland and Australia

• A global leader in the professionals segment, with € 3.6 billion of revenues (LTM) and offering a broader range of services than any competitor

• Enhanced platform for growth from increased exposure to attractive growth markets with low staffing penetration rates such as India, Japan, Eastern/Central Europe and South America

• A truly diversified geographic mix with no single country contributing more than 23% of revenue and a balanced business mix (21% professionals, 11% inhouse, 66% masscustomized or traditional staffing and 2% HR solutions)

• Significant realizable and tangible synergies

o € 100 million of annual pre-tax run rate cost synergies and tax synergies

• Significant additional upside potential from cross-selling opportunities and sharing of best practices

1 Last Twelve Months up to 30 September 2007

Ben Noteboom, chief executive officer of Randstad: “The combination of Randstad and Vedior represents a unique opportunity to create an industry champion of global size and scale. In this way, we will be able to provide a very complete range of service solutions to our clients and candidates

around the globe. In doing so, we will also deliver enhanced returns to our shareholders. It is a tribute to the knowledge and dedication of our people in both companies that we are now able to make this major step. Because of the hard work of their employees, both companies have been

already very successful in the past, and this deal makes the future prospects for our clients, shareholders and employees even better.”

Tex Gunning, chief executive officer of Vedior: “For Vedior and Randstad this is a historic opportunity to become a global industry leader. Our customers will benefit hugely from having access to a true global powerhouse which will help them deal with the growing challenge of skill shortages. For our

employees the new combination has tremendous career opportunities. The professionals businesses of Vedior will be able to accelerate their global growth strategy, and our generalist staffing companies will benefit from the scale and expertise within the combination. This transaction provides our

shareholders with a very attractive offer and at the same time an opportunity to participate in the future value creation of an industry leader.”

Highlights of the Offer

Randstad intends to acquire all the outstanding shares of Vedior through a mixed cash and share exchange offer for Vedior shares consisting of 0.32759 Randstad shares and € 9.50 in cash per Vedior share.

Based on Randstad’s closing share price on 29 November 2007 of € 32.62, the Offer values each Vedior share at € 20.19 which equals a total equity consideration of € 3.51 billion, representing:

• a 64.1% premium over the Vedior closing share price of € 12.30 as of 29 November 2007

• a 51.8% premium over the Vedior volume weighted average share price of € 13.30 for the month ended 29 November 2007

• an implied P/E multiple of 16.1x and EV/EBITA multiple of 11.9x for the last 12 months to 30 September 2007

• a 33% ownership in the combination for Vedior shareholders

• the ability for Vedior shareholders to participate in future upside of the combination The Offer is cum dividend with respect to any dividend declared and payable for the financial year 2007 of both Randstad and Vedior. The cash element of the Offer would be adjusted for any dividends paid by either company with respect to the 2007 financial year.

Financing of the Offer

The cash consideration of the Offer is € 1.7 billion, assuming 100% acceptances. Randstad intends to refinance all Vedior’s short and long term debt as well as Randstad’s short term debt. As part of the transaction, Randstad plans to refinance its preference shares for a total consideration of € 165.8 million. Randstad has secured fully committed debt financing from ABN AMRO Bank N.V. and ING Bank N.V.

The transaction provides Randstad with the opportunity to optimize its balance sheet efficiency. In total, the pro forma indebtedness of the combination on closing of the transaction will be € 2.6 billion.

Randstad intends to maintain a financial position commensurate with an investment grade rating.

Within 12 months after settlement Randstad expects the leverage ratio (Net Debt / EBITDA) to be below Randstad’s stated financing policy of a maximum of 2.0x.