B&S Group S.A. (“B&S Group” or the “Group”), a fast-growing, global distribution partner for consumer goods, today announces its half year 2019 results.

Highlights HY 2019 (compared to HY 2018)

• Overall turnover growth of 17.1% to € 898.3 million;

• Organic turnover growth throughout the Group of 7.4%

• Health & Beauty category of HTG including last year acquired FragranceNet.com was main contributor to turnover growth;

• EBITDA grew to € 52.9 million;

• Net debt / EBITDA stood at 2.9;

• Inventory in days down to 98 from 103 last year;

• Working capital in days down to 100 from 107 last year;

• Well positioned for a strong second half year 2019 with present inventory levels reflecting our growth expectations

Bert Meulman, CEO; “We are pleased that we once again realised double-digit growth in turnover in the first half of 2019. All segments contributed but growth was fuelled by the performance of HTG and more particular by the Health & Beauty category, where we further strengthened our international positions, intensified our relationships in value retail and increased our focus on the online platform business. Synergies that originated from combined sourcing further boosted the performance of this category. Our investments over the past years in the HTG infrastructure combined with the technology already operational at FragranceNet.com, gives us a robust robotised logistics platform that allows us to expand our position in the Health & Beauty category further.

The B&S Segment performed as expected at current levels given the market conditions with modest growth and the extra costs we endured before the new warehouse got into operation mid-June. During our Capital Markets Day we communicated the € 4 million additional costs in H1; a clear performance improvement trend was noticeable in the second quarter with modest turnover growth foreseen in the third quarter. With our logistics operations fully on track, we are now preparing the integration of the Lagaay activities into the B&S operations. The results of Lagaay will be consolidated from the closing in July onwards.

Our retail segment performed as expected. We are on track for further new shop openings in the second half of 2019.

Overall, the trade war between China and the USA did not impact our turnover. A slightly higher gross margin could have been realised should the Chinese currency not have depreciated against the US dollar and Euro. For the coming period our focus is on expanding our e-commerce platform business, the roll out of FragranceNet.com outside the USA, the integration of Lagaay into the B&S Segment and on capturing further opportunities for organic growth.”

Key figures1, 2, 3

€ million (unless otherwise indicated)

HY 2019 reported HY 2019 pre IFRS 16 HY 2018 reported ? (%) reported Profit or loss account

Turnover 898.3 898.3 766.9 17.1%

Gross profit 126.3 126.3 105.3 19.9%

EBITDA 52.9 48.1 45.9 15.2%

Depreciation & Amortisation 12.1 7.6 4.4

Profit before tax 35.1 35.5 38.4 (8.6%)

Profit for the year from continuing operations 28.2 28.4 31.4 (10.1%)

EPS (in euro) 0.27 0.32

Inventory in days 98 103

Working capital in days 100 107

Financial position Solvency Ratio 33.7% 37.3%

Net Debt 329.8 277.0

Net Debt/EBITDA 2.9 2.7

1 HY 2019 figures are unaudited

2 The HY 2019 results are reported including IFRS 16, with the exception of our financial position and ratios related thereto. IFRS 16 is having an effect of 0.5 on the Net debt / EBITDA ratio.

3 Due to the international nature of our business, significant portions of our turnover and expenses are denominated in currencies other than the Euro, including the US dollar. Consequently, our results from operations are affected by translational foreign exchange risk and currency translation can affect the comparability of our consolidated financial results. To explain the impact of currency volatility on our consolidated financial results, in this press release we include some constant currency disclosure, which is calculated by translating current balances at prior rates. The average EUR/USD FX rate for HY 2019 is 1.1298 (vs.1.2104 for HY 2018).

The HY 2019 results are reported including IFRS 16, with the exception of our financial position and ratios related thereto. As from 2020 onwards, all reported figures will be presented including IFRS 16.

Financial performance

Turnover

Turnover in HY 2019 increased by 17.1% at reported rates4 to € 898.3 million. Organic growth was mainly driven by the Health & Beauty category in all regions, and the Liquor business in Europe, with business in Asia remaining flat. FragranceNet.com contributed 9.7% acquisitive growth to our top line.

Gross Profit

Gross profit came in at € 126.3 million, an increase of 19.9% at reported rates5. As a percentage of turnover, gross profit increased to 14.1% (HY 2018: 13.7%). This was primarily the result of increased demand in the Health & Beauty category and further boosted by the sourcing synergies within this category.

EBITDA

EBITDA increased 15.2% in HY 2019 compared to HY 2018 to € 52.9 million, with an EBITDA margin almost equal to HY 2018. Further growth in EBITDA was held back by the earlier communicated additional costs in the B&S segment, with a clear positive improvement trend in the second quarter when the automated warehouse became operational. Overall staff costs slightly increased following the FragranceNet.com acquisition and general company growth.

Result for HY 2019

Depreciation of right-of-use assets increased with € 4.6 million, offsetting the € 4.8 million positive effect on EBITDA as a result of IFRS 16. Amortisation of intangible fixed assets increased to € 4.2 million from € 1.4 million, being the effect of the acquisition of FragranceNet.com. As communicated before, FragranceNet.com realises over 60% of EBITDA in the second half of the year and as such the straight-line amortisation of intangible fixed assets relating to FragranceNet.com is having a material impact on the contribution to results in the first six months from FragranceNet.com.

Financial expenses increased by € 0.6 million resulting from IFRS 16 and an increased USD lending rate (average USD LIBOR interest rate at 2.38% in HY 2019 compared to 1.61% in HY 2018).

The effective tax rate stood at 19.7% compared to 18.3% HY 2018. This is mainly attributable to the inclusion of FragranceNet.com which significantly increases our business in the US, a higher tax jurisdiction.

4 15.1% on a constant currency basis.

5 17.9% on a constant currency basis.

As a result, net profit came in at € 28.2 million (HY 2018: € 31.4 million). Net profit attributable to the owners of the company amounted to € 22.8 million (HY 2018: € 26.8 million).

Financial position

With solvency at June 30, 2019 being close to 34% and the net debt / EBITDA ratio standing at 2.9 - well within agreed bank covenants - the financial position of the Group continued to be within pre-determined objectives.

The increase in working capital was mainly related to increased inventory levels, which supports our growth expectations for the second half of the year. The number of inventory days decreased in HY 2019 to 98 (HY 2018: 103). Trade receivables increased compared to HY 2018 in line with the growth of the company.

Net debt increased to € 329.8 million (HY 2018: € 277 million), resulting to a large extend from the acquisition of FragranceNet.com for which financing amounted to € 75.6 million and from the acquisition of the airport shops in Rotterdam and Weeze. Furthermore, net debt was affected by the increase in working capital. Working capital in days decreased from 107 to 100.

Dividends

B&S Group will announce the interim dividend for HY 2019 on November 4, 2019, together with the 9M 2019 trading update. The interim dividend will be paid on December 4, 2019.

Notice of change to timing of dividend payments

For practical reasons, the Group will propose to the shareholders in the May 2020 Annual Meeting to shift from semi-annual payment of dividend to an annual payment.

This change will be effective from 2020 onwards, where a year-end dividend pay-out for the FY 2020 period is anticipated in H1 2021. The earlier indicated dividend policy will further remain intact.

Outlook

Based on the current outlook on the markets, we are confident that we will continue our top line growth trend in the second half of the year. We anticipate a particularly strong last quarter in HTG which expectations are reflected in HY 2019 inventory levels. New business opportunities are being identified in our B2B distribution to value retailers and ecommerce platforms, while demand in the online B2C business of FragranceNet.com continues to grow. All in all, we foresee the seasonality in our business to be further amplified and expect continuation of the trend we saw last year with sales shifting towards late Q4.

With the warehouse in the B&S Segment being operational and a clear trend in improved performance noticeable in the second quarter, we are now well underway towards realising growth in this segment. Our focus for H2 is to realise turnover growth and – over time – improve profitability at stable margins. Additionally, the integration of Lagaay is expected to have a positive effect on our maritime and remote business in the second half of the year.

We are expecting continued growth from our retail operations with new shop openings contributing to turnover and profitability, and we will continue to invest in new tenders and concessions to further build our store portfolio.

Over the past years, we have consistently and conclusively developed our future proof business strategy with investments in IT, our logistics platform and selective M&A to further leverage our scale and our extended role in the value chain. Combined with current market developments, we believe this will accommodate further growth of current positions in the unique channels and markets we serve. We will continue our focus on growing our business profitably, not only in the remainder of this year but also in the years thereafter.

Financial calendar

November 4, 2019

9M 2019 trading update

November 7, 2019

Ex-dividend date

November 8, 2019

Record date

December 4, 2019

Payment date

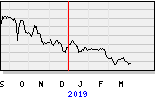

tijd 10.04

B&S EUR 12,86 -34ct vol. 56.770