B&S Group S.A. (“B&S Group” or the “Group”), a fast-growing, global distribution partner for consumer goods, today publishes its trading update for the first nine months of 2018.

Highlights 9M 2018

Turnover YTD increased compared to the same period last year by 10.1% to €1,173.4 million at reported rates (12.5% to €1,198.7 million on a constant currency basis);

Each of the business segments contributed to the turnover growth;

Further build out market positions with the acquisition of 75% of FragranceNet.com successfully completed while agreement was reached on increasing our stake in JTG by 8% to 75%;

Interim dividend for 2018 of €10.9 million or €0.13 per share, payable on 29 November 2018;

We reiterate our outlook of continued underlying turnover growth, complemented by growth in turnover and EBITDA from the recently acquired FragranceNet.com.

Bert Meulman, CEO: “We have shown another quarter of turnover growth, positioning us well for a strong second half of the year. We have seen strong underlying growth in line with our seasonal patterns, with all of our business segments contributing to this growth.

The acquisition of the 75% stake in FragranceNet.com was completed and we are already realising the first identified synergy potential proving the great strategic fit within B&S Group. This acquisition is a first step towards a substantial footprint in North America for the Health & Beauty category. We will continue to focus on scale effects, efficiency improvements and integrating acquired businesses, to boost our cost leadership and strategic growth, both autonomously and via acquisitions. We look forward to the remainder of the year 2018 with confidence.”

9M results

In the first 9 months of 2018 turnover increased compared to the same period last year by 10.1% to €1,173.4 million at reported rates (9M 2017: €1,065.9 million). On a constant currency basis, growth amounted to 12.5%, with turnover of €1,198.7 million over the same period.

All our segments contributed to the growth and we experience an ongoing demand for our FMCG products. In Asia, we saw a slight slowdown of growth in the third quarter, however we do expect this to be a temporary effect. In line with our seasonal patterns, we have realised an increase in turnover of over 10% in the third quarter of the year. While airport retail and our maritime business peak in summer, our Health & Beauty and Liquor business are generating the vast majority of its turnover and profitability in the second half of the year. Based on the sales in the first period of Q4, we conclude that the flow over of turnover from Q3 into the fourth quarter was somewhat stronger this year.

We have further build out our market positions, and successfully concluded the acquisition of the 75% stake in FraganceNet.com, through JTG. Our cooperation already leads to the identification of purchasing synergy effects and we are positive about the outlook. At the same time, we reached an agreement to increase our stake in JTG from 67% to 75% by acquiring shares from a passive shareholder.

The impact of the adverse development of the EUR/USD exchange rate we experienced in the first half of the year, did not materially change in Q3 but continued to have an impact on our 9M turnover.

Dividends

In line with our dividend policy, we will pay an interim dividend of € 10.9 million, or € 0.13 per share, in cash (subject to withholding tax if applicable). The total interim dividend amount represents 40% of the semi-annual 2018 group results attributable to the owners of the Group.

The interim dividend will be paid on November 29, 2018.

Outlook

Based on the current market outlook and in line with seasonal patterns, we expect our growth trend to continue in the remainder of the year, complemented by growth in turnover and EBITDA from the acquisition of FragranceNet.com.

Further objectives are based on the medium to long-term objectives as indicated at the IPO in March 2018.

Management will continue to focus on scale effects, efficiency improvements and integrating FragranceNet.com into the Group, as well as capitalising on the synergy effects resulting from the acquisition.

Financial calendar

November 22, 2018 Ex-dividend date

November 23, 2018 Record date

November 29, 2018 Payment date

February 25, 2019 Full Year 2018 results

tijd 09.33

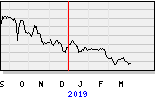

De Smallcap 943,29 +5,37 +0,57% B&S EUR 15,948 +66ct vol. 1.015 stelt niet veel voor deze omzet.