Highlights:

High sales activity in closing and pursuing monopile projects for 2019-2021 timeframe

Appointment and start of CEO Fred van Beers

Production resumed in August after 4-month black-out period

Successful testing of blue piling innovation

Material supplies and load-outs delayed beyond Sif's control

Key figures:

Year-to-Date contribution decreased to €57.0 million (€104.7 million YTD 2017)

Adjusted EBITDA Year to Date fell to €13.0 million (€44.9 million YTD 2017)

Operating Working Capital at end of Q3 2018 €28.4 million (€32.7 million at end of Q2 2018)

Net Debt at end of Q3 2018 €43.1 million (€52.5 million at end of Q2 2018)

Throughput of 19 Kton brings Year to Date production to 100 Kton (167 Kton YTD Q3 201

74% for offshore wind

26% for offshore oil & gas & other

Order book 45 Kton for Q4 2018, 200 Kton for 2019 and 90 Kton for 2020

In € million YTD 2018 YTD 2017 Change YoY Q3 2018 Q3 2017

Contribution 57.0 104.7 -45.6% 11.4 30.3

EBITDA (adjusted) 13.0 44.9 -71.0% -1.1 11.2

Kton production 100.0 167.0 -40.1% 19.0 59.0

Order book in Kton end of Q3 2018

For remainder 2018 For 2019 For 2020

and beyond

Contracted 45 125 10

Exclusive negotiation 0 75 80

Total for the year 45 200 90

Comment from Fred van Beers, CEO of Sif-group:

Tendering activity across various countries and continents provides an indication of estimated production levels between now and 2026. During the first two quarters of 2018, the high level of tendering activity resulted in orders totaling approximately 200 Kton in production for 2019 and 90 Kton in production for 2020 and beyond. This included, among other things, the Borssele 3+4 (2018-2019), Borssele 1+2 (2019), Triton Knoll (2019) and Tyra (2019) projects.

With a production level of 19 Kton, the capacity utilization remained somewhat low in Q3, due in part to delays in the supply of steel and the extremely low water levels in various rivers. The Borssele 3+4 and Tyra projects accounted for the bulk of production. We expect production levels for the full year 2018 to reach around 145 Kton.

During this period, I took advantage of the opportunity to learn more about the specific knowhow and skills of Sif employees and the company’s position in the supply chain. I am impressed by the dedication of Sif’s employees and by the expertise accumulated by people in the company and how the management has successfully preserved this expertise during this challenging year. I will be focusing on further expanding and optimizing our knowhow and core processes. My second priority is to take maximum advantage of the current strong market for offshore wind energy, without losing sight of opportunities in the offshore oil and gas markets.

Q3 2017 Results

Contribution

Contribution for the first 9 months of 2018 added up to €57.0 million, mainly due to underutilization in the production facilities during the second and third quarters. This equates to a YTD contribution per Kton of €570. Contribution for the quarter totaled €11.4 million, based on a production of 19 Kton. The discount granted in order to bring forward the start date for the Borssele 3+4 project only marginally impacted the YTD contribution per ton. Only some 10% of production for this project was realized in the first 9 months of 2018.

The delay in delivery of steel has so far caused a 7 weeks set- back in production. This will also impact the anticipated margin and production flow in the remainder of 2018 and in 2019.

is Contribution is calculated as revenues minus cost of raw materials, subcontracted work, logistics and other external projectrelated

charges, and is a key financial indicator for Sif. EBITDA (adjusted)

Adjusted EBITDA in Q3 2018 amounted to €-1.1 million compared to €11.2 million in Q3 2017.

YTD‘s EBITDA suffered from low margins on projects in execution, from later than planned start of Borssele 3+4 and from a relatively high absence rate due to illness, all factors resulting in higher than anticipated labor costs. Sif will seek compensation for the financial consequences of factors beyond its control.

Adjusted EBITDA is calculated as profit before finance expenses, tax, depreciation, amortization and IPO-related costs.

Net debt

Net debt decreased from €52.5 million at the end of Q2 2018 to €43.1 million at the end of Q3 2018. The company remained within the agreement with the banks since a Covenant Holiday was already agreed with the banking consortium at the end of 2017.

Outlook

For the Full Year 2018 we anticipate total production of 145 Kton.

A total of 200 Kton has been booked for 2019 or is under exclusive negotiations. Our confidence in the future positioning of Sif depends on our own visibility of the sales and contract pipeline, and third-party projections for European offshore wind farms, indicating compound annual growth in the mid-single digits for the period until 2026.

Increased coating requirements as specified by clients require Sif to expand its coating facilities to prevent these from becoming a production bottleneck. The associated CAPEX in 2019 will come in at around €10 million in addition to annual maintenance CAPEX of €6- 8 million. The company is currently considering the impact of the 2018 PISA design rules and requirements on the trend of larger diameters in combination with lower wall thicknesses. This trend could create an additional business opportunity, but would require additional investments of up to €40 million in the coming years.

tijd 09.33

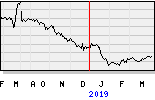

De Smallcap 970,76 +3,88 +0,40% SIF Holding EUR 14,14 -86ct vol. 15.940