Operational Highlights and Key Figures for H1 2017

Operational highlights:

Contract wins for Norther and Hohe See in Q1 and for Borkum II and Albatros in Q2

Delivery of monopiles and transition pieces for Galloper and Rentel offshore wind parks

Delivery of pinpiles for Beatrice and Sverdrup jacket foundations

Production expansion program in Rotterdam (Maasvlakte 2) and Roermond on schedule for increase of capacity from 225 Kton to 300 Kton per annum by the end of 2017

Total throughput of approximately 108 Kton steel (97 Kton in HY1 2016)

91% for offshore wind (88% HY1 2016)

9% for offshore oil & gas (12% HY1 2016)

Key figures:

Contribution increased by 14.1% to € 74.4 million (HY 2016: € 65.2 million)

Higher set- up and start- up expenses both recurring and non- recurring had an impact on EBITDA; EBITDA normalized for IPO costs reached € 33.7 million (HY 2016: € 36.9 million)

Revenue decreased to € 156.2 million (HY 2016: € 205.3 million)

Operating working capital stood at € 18.1 million (YE 2016: € 8.3 million)

Net debt totaled € 47.7 million (YE 2016: € 42.0 million)

Order book of 109 Kton signed contracts for 2018

CEO Jan Bruggenthijs:

"Sif once again contributed to some of the most prominent energy projects in Northwest Europe in the first half of 2017 through deliveries for Sverdrup, Rentel and Galloper. The commissioning of the first production line at our new Rotterdam-based facilities played a crucial part in being able to complete the products for these projects on time. Production increased by more than 11% in the first half of 2017 compared to the same period of last year. Contribution rose 14% vis-à-vis the first half of 2016. The costs of commissioning the new production facilities and start- up expenses were, however, higher than anticipated and production efficiency was less than in the first half of 2016, which was strong on the back of exceptional project results. This placed pressure on EBITDA in this reporting period. For the second half of 2017 we anticipate that these start- up issues will gradually be resolved. We anticipate that the EBITDA shortfall in the second half of 2017, compared to the second half of 2016, will be roughly half of the shortfall in EBITDA for the first half of 2017 compared to the first half of 2016.'

The order book and the pipeline are the main performance indicators for the future. Projects such as Albatros and Borkum II have increased our order book for 2018 to 109 Kton. Other projects, including St Nazaire and Courseulles in France and Fryslan in the Netherlands, scheduled for 2018 have been shifted to 2019 primarily relating to environmental issues. Some projects, such as Borssele in the Netherlands, have been pushed back for other reasons. With annual capacity of 300 Kton from 2018 and only few remaining opportunities for production in 2018, we anticipate some underutilization of production facilities, which demonstrates the volatility of the project-driven industry of which Sif is a part. Momentum for offshore wind has, however, accelerated with unsubsidized contract wins, decreased LCOE for offshore wind in Europe, increasing interest in the United States and the Far East and contracts for the first projects for 2019 under negotiation."

zie en lees verder op

http://hugin.info/174277/R/2128882/813048.pdf

tijd 10.53

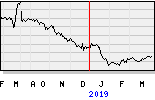

De Smallcap 999,07 -4,13 -0,41% SIF EUR 17,80 -2,30 vol. 172.406