· Substantial progress made toward European Commission clearance of FedEx offer

· Reported revenue growth of 2.3%; underlying revenue growth of 3.6%

· Continued growth of revenues from SMEs; improved service performance

· Adjusted operating income of €13m includes Outlook-related transition costs

· Capex investments of €62m (3Q14: €41m) in Q3; Outlook investment programme on track

· Completed outsourcing of IT infrastructure to selected partners

· Net cash position of €223m

Amsterdam, The Netherlands, 26 October 2015 – TNT today reported third quarter revenues of €1,674 million, up 2.3% year-on-year, and a negative operating income of €27 million, compared with a negative operating income of €51 million for the third quarter of 2014.

Currency comparable revenue growth was 1.8%. Underlying revenue growth, excluding currency effects and the negative impact of lower fuel surcharges, was 3.6%, reflecting higher revenues from SMEs, particularly in the International Europe segment. The economic volatility in Australia, China and Brazil weighed on TNT’s revenues and overall performance in these parts of the world.

Operating income includes net one-off charges of €40 million, including restructuring charges of €23 million.

TNT’s adjusted operating income was €13 million in the third quarter, compared with €46 million for the same period of last year. Operating result was affected by pricing pressures, Outlook-related transition and

project costs (€8 million), and costs to enhance service capabilities. TNT experienced lower margins in France in particular.

Capital expenditures increased to €62 million (or 3.7% of revenues) in the third quarter of 2015 from €41 million (2.5% of revenues) in the same period of 2014. During the quarter, TNT successfully opened

three new automated sorting facilities in Madrid, Swindon and Eindhoven, while upgrading existing ones as part of its Perfect Depot project.

The net cash position of €223 million at quarter-end (2Q15: €261 million) reflects the investments made as part of the Outlook strategy.

Tex Gunning, TNT’s Chief Executive Officer, said: “Substantial progress has been made in the recommended acquisition of TNT by FedEx: TNT shareholders have approved the resolutions of the Extraordinary General Meeting. We have been informed by the European Commission that it will not issue

a Statement of Objections. We continue to support FedEx in obtaining all necessary approvals and expect the transaction to close in the first half of 2016. At the same time we remain focused on executing our

Outlook strategy to transform and turn TNT around. Revenue growth from SMEs continued in the third quarter. Service performance and customer satisfaction further improved. Our investments in IT and productivity are on track. As said, time is needed for these profound transformations to influence the bottom

line. 2015 is a transition year for TNT. We expect to see year-on-year margin improvements from 2016 onwards.”

Summary: Consolidated results

in million euros and @ respective rates

Notes 3Q15 3Q14 %chg 3Q15 3Q14 %chg

Revenues 1,674 1,637 2.3 1,674 1,637 2.3

Operating income/(loss) (2) (27) (51) 47.1 13 46 -71.7

Operating income margin (%) -1.6 -3.1 0.8 2.8

Profit/(loss) equity holders of the parent (49) (55) 10.9

Cash generated from operations 32 86 -62.8

Net cash from/(used in) operating activities 1 71 -98.6

Net cash from/(used in) investing activities 13 (33) 0.0

Net cash 223 414 -46.1

Notes: Non-GAAP adjustments

(1) As f rom year-end 2014 the definition of adjusted operating income has changed from constant foreign exchange rate to respective foreign exchange rate

(2) 3Q15: €23m restructuring related, €10m PP&E impairment, €2m fair value adjustment f leet Brazil, €6m other cost, €(1)m profit on sale of SSC Mauritius

(2) 3Q14: €37m restructuring related, €9m implementation cost, €1m sof tw are impairments, €50m provision French competition case

International Europe segment

in million euros and @ respective rates 3Q15 3Q14 %chg YTD'15 YTD'14 %chg

Revenues 6 93 6 64 4.4 2,075 2,020 2.7

Comparable revenue growth (%)(1) 4.4 1.7 1.9 1.6

Operating income/(loss) (2) 7 19 52 -63.5

One-offs 16 15 6.7 31 44 -29.5

Adjusted operating income/(loss) 14 22 -36.4 50 96 -47.9

Adjusted operating income margin (%) 2.0 3.3 2.4 4.8

Average consignments per day ('000) 2 38 2 24 6.3 2 44 2 37 3.0

Revenue per consignment (€)(2) 4 4.9 4 5.5 -1.3 4 4.8 4 5.1 -0.7

Average kilos per day ('000) 8,419 7,825 7.6 8,532 8,092 5.4

Revenue per kilo (€)(2) 1 .27 1 .31 -3.1 1 .28 1 .32 -3.0

(1) based on reported revenues @ constant fx

(2) based on reported revenues @avg14

International Europe’s revenues were €693 million, up 4.4% from last year’s third quarter.

Currency comparable revenue growth was also 4.4%. Adjusted for the negative impact of lower fuel surcharges (-2.1%), the segment’s underlying revenue growth was 6.5%, driven primarily by higher revenues from SMEs, but revenue growth remains uneven across Europe. Average daily consignments grew 6.3%. Revenue per consignment was down 1.3% due to lower fuel surcharges and price pressures in some markets.

International Europe’s adjusted operating income for the third quarter of 2015 was €14 million, down from €22 million a year ago. The decrease reflects transition and Outlook project costs (€2 million), the costs of

introducing new services or upgrading existing ones, such as the expansion of TNT’s air network coverage and pre-noon delivery service in the Nordic countries. The stronger US dollar led to higher air network costs than prior year.

International AMEA segment

in million euros and @ respective rates 3Q15 3Q14 %chg YTD'15 YTD'14 %chg

Revenues 242 228 6.1 732 648 13.0

Comparable revenue growth (%)(1) -3.9 -16.3 -2.5 -17.5

Operating income/(loss) 11 7 57.1 39 29 34.5

One-offs 3 - 5 1

Adjusted operating income/(loss) 14 7 44 30 46.7

Adjusted operating income margin (%) 5.8 3.1 6.0 4.6

Average consignments per day ('000) 55 57 -3.5 56 59 -5.1

Revenue per consignment (€)(2) 61.9 61.2 1.1 60.2 58.5 2.9

Average kilos per day ('000) 1,218 1,147 6.2 1,234 1,140 8.2

Revenue per kilo (€)(2) 2.77 3.06 -9.5 2.73 3.01 -9.3

(1) based on reported revenues @ constant fx

(2) based on reported revenues @avg14

International AMEA revenues rose 6.1% to €242 million, mainly due to favourable currency effects.

Currency comparable revenue growth was -3.9%. Adjusted for positive currency effects and the negative

impact of lower fuel surcharges (-4.0%), the segment’s underlying revenue growth was roughly flat

compared with last year.

The segment’s revenues were affected by the drop in China’s exports, especially to Europe, as exports

products make up for more than 70% of TNT’s revenues in Greater China, the segment’s largest unit.

Service quality continued to improve over last year, with on-time delivery performance 6 percentage points

higher than in the third quarter of 2014. The segment also continued to grow revenues from SMEs.

As in the first half of 2015, International AMEA transported fewer but heavier consignments compared to

the prior year. Average daily weights rose by 6.2%, which reflects the growth of higher weight Economy

freight shipments and a continued trend of falling document volumes. Revenue per consignment rose

slightly year-on-year (1.1%).

Adjusted operating income increased by €7 million to €14 million, supported by cost management

initiatives.

Domestics segment

in million euros and @ respective rates 3Q15 3Q14 %chg YTD'15 YTD'14 %chg

Revenues 615 632 -2.7 1,891 1,857 1.8

Comparable revenue growth (%)(1) -0.3 1.7 0.1 -0.6

Operating income/(loss) (19) 7 (34) (11)

One-offs 16 16 0.0 26 69 -62.3

Adjusted operating income/(loss) (3) 23 (8) 58

Adjusted operating income margin (%) -0.5 3.6 -0.4 3.1

Average consignments per day ('000) 608 593 2.5 645 620 4.0

Revenue per consignment (€)(2) 15.9 16.4 -3.0 15.3 15.8 -3.2

Average kilos per day ('000) 12,713 12,778 -0.5 12,989 13,025 -0.3

Revenue per kilo (€)(2) 0.76 0.76 0.0 0.76 0.75 1.3

(1) based on reported revenues @ constant fx

(2) based on reported revenues @avg14

The Domestics segment reported revenues of €615 million, down 2.7% from last year, as lower revenues in

Brazil and Australia more than offset revenue growth in Europe.

Underlying revenue growth, excluding currency effects and the negative impact of lower fuel surcharges, was 0.6%.

Revenues from SMEs improved year-on-year in all units, supported by better service quality. On-time delivery performance was 2 percentage points higher than in 2014.

Domestics average daily consignments increased by 2.5%. Revenue per consignment improved sequentially, but declined 3.0% year-on-year due to pricing pressures, lower fuel surcharges and customer mix effects.

Adjusted operating income decreased by €26 million to €(3) million. The decline is attributable to lower sales in Brazil and Australia, lower yields -particularly in France and Australia- and Outlook-related transition and project costs. To adjust to the economic recession, Brazil management took cost-reduction measures, which helped protect margins. TNT’s performance in France was affected by competitive pressures and higher B2C delivery cost. TNT also faced competitive pressures in Australia, compounded by the drop in commodity markets, and the ongoing cost of modernising the Australian infrastructure.

During the fourth quarter, TNT will ramp up activities at two new hubs in Melbourne and Brisbane to enhance service to customers and productivity.

Unallocated segment

in million euros and @ respective rates 3Q15 3Q14 %chg YTD'15 YTD'14 %chg

Revenues 127 117 8.5 362 376 -3.7

Comparable revenue growth (%)(1) 8.5 -19.9 -3.7 -10.9

Operating income/(loss) (17) (72) 76.4 (43) (103) 58.3

One-offs 5 66 -92.4 12 78 -84.6

Adjusted operating income/(loss) (12) (6) (31) (25) -24.0

Adjusted operating income margin (% of tot. TNT rev.) -0.7 -0.4 -0.6 -0.5

(1) based on reported revenues @ constant fx

The Unallocated segment consists of Other Networks (TNT Innight), Central Networks and corporate head office functions.

The segment’s revenues were up 8.5% year-on-year to €127 million. Adjusted operating income was minus €12 million, compared with minus €6 million in the third quarter of 2014. This result includes transition costs of €4 million related to the establishment of Global Business Services, a three-year, strategic Outlook project.

Guidance

TNT reiterates its current financial year and longer-term guidance.

TNT expects 2015 to be a challenging year of transition marked by the progressive ramp-up of new and upgraded facilities and other transformation projects, such as the outsourcing of IT.

TNT anticipates restructuring charges of about €10 million in the fourth quarter of 2015.

see more on

http://www.tnt.com/content/dam/corporate/pdfs/Archive/Quarterly%20reports/2015/Q3/tnt-express-3Q15-press-release.pdf

tijd 09.22

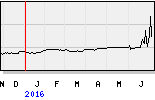

TNT EUR 7,683 +2ct vol. 91.123