Luxembourg, February 7, 2019 - ArcelorMittal (referred to as “ArcelorMittal” or the “Company”) (MT (New York, Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading integrated steel and mining company, today announced results[1] for the three-month and twelve-month periods ended December 31, 2018.

2018 highlights:

Health and safety performance improved in FY 2018 with annual LTIF rate of 0.69x vs. 0.78x in FY 2017

FY 2018 operating income of $6.5bn (+20.3% YoY); operating income of $1.0bn in 4Q 2018 (-15.6% YoY)

FY 2018 EBITDA of $10.3bn (+22.1% YoY); EBITDA of $2.0bn in 4Q 2018 (-8.9% YoY)

FY 2018 net income of $5.1bn, +12.7% higher as compared to $4.6bn for FY 2017

FY 2018 steel shipments of 83.9Mt (-1.6% YoY); 4Q 2018 steel shipments of 20.2Mt (-3.6% YoY)

FY 2018 crude steel production of 92.5Mt (-0.6% YoY); 4Q 2018 crude steel production of 22.8Mt (stable YoY)

FY 2018 iron ore shipments of 58.3Mt (+0.7% YoY), of which 37.6Mt shipped at market prices (+5.5% YoY); 4Q 2018 iron ore shipments of 15.7Mt (+9.8% YoY), of which 10.0Mt shipped at market prices (+18.2% YoY)

Gross debt of $12.6bn as of December 31, 2018. Net debt of $10.2bn as of December 31, 2018, lower as compared to $10.5bn as of September 30, 2018 and broadly stable as compared to $10.1bn as of December 31, 2017

FY 2018 cash flow from operating activities of $4.2bn less capex of $3.3bn for free cash flow (FCF) of $0.9bn despite working capital investment of $4.4bn, premium to repay bonds ($0.1bn) and litigation fines ($0.1bn)[3]

Strategic progress in 2018:

Improved asset portfolio through the completed acquisitions of Votorantim in Brazil and Ilva in Italy, as well as being selected as the successful bidder for Essar Steel India Limited (ESIL) in partnership with Nippon Steel & Sumitomo Metal Corporation Group (NSSMC), which subject to completion, would provide improvement potential and growth optionality

Continued progress as the leader in innovation including the LanzaTech carbon capture and conversion project at Gent, Steligence® and new products and solutions to address the automotive platforms of the future

Improvement in leverage ratio: FY 2018 net debt/EBITDA of 1.0x vs.1.2x in FY 2017

Cash needs of the business in 2018 were limited to $5.0bn, below the guidance of $5.8bn provided in mid-year. Capex of $3.3bn was below our guidance of $3.7bn due to timing of payments which will therefore be carried over to 2019. Net interest of $0.6bn was in line with our guidance. “Taxes, pension and others” came in at $1.1bn, below our guidance of $1.5bn, due to the combined effects of: certain cash tax settlements being deferred from 2018 to 2019; higher than anticipated dividends received from our investments in associates; and net gains on other accounts

Achieved the primary financial objective of an investment grade rating with all 3 credit rating agencies

Limited Action 2020 progress in 2018, with ongoing cost/mix gains (+$0.4bn) offset in part by volumes losses (-$0.3bn) following operational disruptions during the year. As a result, cumulative savings 2016-2018 of $1.6bn achieved; ongoing focus and execution to deliver target of $3bn savings by 2020

Capital allocation: Continued focus on deleveraging and investment in high return projects

An investment grade credit rating remains ArcelorMittal’s financial priority, with a target to reduce net debt to below $6bn, to support solid investment grade metrics at all points of the cycle

The Company is capitalizing on opportunities to invest which will enhance future returns, including Ilva (asset revitalization), Mexico hot strip mill (mix improvement) and Vega HAV (Brazil mix improvement)

ArcelorMittal intends to progressively increase the base dividend paid to its shareholders, and, on attainment of the net debt target, return a percentage of free cash flow annually. Accordingly, the Board proposes an increase in the base dividend for 2019 (paid from 2018 earnings) to $0.20 per share which will be proposed to the shareholders at the AGM in May 2019

Outlook and guidance:

ArcelorMittal expects global steel demand to slightly expand in FY 2019 as compared to FY 2018

Steel shipments are expected to increase, supported by improved operational performance

The Company expects certain cash needs of the business (including capex, interest, cash taxes, pensions and certain other cash costs but excluding working capital changes) to increase in 2019 to approximately $6.4bn. Capex is expected to increase to $4.3bn (versus $3.3bn in FY 2018) including $0.4bn carried over from 2018, the impact of Ilva ($0.4bn) and the continued investment in high returns projects in Mexico and Brazil. Interest is expected to be stable at $0.6bn while cash taxes, pensions and other cash costs are expected to increase by $0.4bn primarily on account of certain cash tax settlements deferred from 2018 and non-recurrence of certain gains on other accounts

Financial highlights (on the basis of IFRS[1]):

(USDm) unless otherwise shown

4Q 18 3Q 18 4Q 17 12M 18 12M 17

Sales 18,327 18,522 17,710 76,033 68,679

Operating income 1,042 1,567 1,234 6,539 5,434

Net income attributable to equity holders of the parent 1,193 899 1,039 5,149 4,568

Basic earnings per share (US$)[2] 1.18 0.89 1.02 5.07 4.48

Operating income/ tonne (US$/t) 51 76 59 78 64

EBITDA 1,951 2,729 2,141 10,265 8,408

EBITDA/ tonne (US$/t) 96 133 102 122 99

Steel-only EBITDA/ tonne (US$/t) 79 119 89 107 82

Crude steel production (Mt) 22.8 23.3 22.7 92.5 93.1

Steel shipments (Mt) 20.2 20.5 21.0 83.9 85.2

Own iron ore production (Mt) 14.9 14.5 14.4 58.5 57.4

Iron ore shipped at market price (Mt) 10.0 8.5 8.4 37.6 35.7

Commenting, Mr. Lakshmi N. Mittal, ArcelorMittal Chairman and CEO, said:

“2018 was a year of positive momentum for ArcelorMittal characterized by important strategic and financial progress. Operating in a healthy market environment, the Company enjoyed a strong financial performance, delivering substantial profitability improvement. Having considerably strengthened our balance sheet in recent years, we also regained our investment grade credit rating.

With an established leadership position in many regions, ArcelorMittal targets specific growth opportunities to complement our existing global presence. The acquisitions of Votorantim and Ilva, both completed in 2018, provide us with enhanced leadership positions in key markets. Meanwhile our bid for Essar can provide us with a quality, scalable presence in the rapidly expanding India steel market.

Delivery against our Action 2020 targets is an important focus for the Group in 2019. We did not perform at an optimum level operationally in 2018 and will seek to minimize operational disruption this year to ensure we meet our volume targets.

Although the issue of global overcapacity persists and there are well publicised macro-economic risks, we expect further, moderate global steel demand growth this year. Having considerably strengthened the Company in recent years, we are in a strong position to generate healthy levels of free cash and prosper through the cycle.”

AND

ArcelorMittal announces share buyback program

7 February 2019 - ArcelorMittal today announces a share buyback program (the ‘Program’) under the authorization given by the annual general meeting of shareholders held on May 5, 2015 (the ‘AGM Authorization’).

The shares acquired under the Program are intended to meet ArcelorMittal's obligations arising from employee share programs. ArcelorMittal intends to repurchase between 11 February 2019 and 31 December 2019 up to 4 million shares for an aggregate maximum amount of US$113.424 million in accordance with the AGM Authorization and applicable market abuse regulations.

ENDS

tijd 09.48

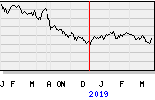

Arcelor EUR 21.00 -27ct vol.1,5 milj.