Signs of cautious recovery in several cable market segments

(€ million, unless stated otherwise) H1 2010

H1 2009 ∆%

Revenues 1,143.9 1,021.8 12

Revenues at constant copper prices 1,099.1 1,111.5 (1)

EBITDA, excluding non-recurring items[2] 65.1 71.8 (9)

Operating result, excluding non-recurring items[2] 34.0 41.0 (17)

Operating result 12.2 23.1 (47)

Result for the period, excluding non-recurring items[2,3] 20.0 19.4 3

Result for the period[3] 1.5 6.0 (75)

Earnings per share, excluding non-recurring items (€)[2,4] 0.36 0.41 (12)

Cash flow from operating activities (17.3) 74.7 -

Revenues up 12%, mainly due to higher copper prices (+13%). Volume was 0.6% negative in H1 2010 but turned to 0.9% positive in Q2 2010 (first volume growth since H1 2008).

Operating result, excluding non-recurring items, € 34.0 million, down 17% compared with H1 2009 but comparable with H2 2009 figure. Underlying improvement since Q2 2010 driven by volume growth.

Energy & Infrastructure and Industry & Specialty posted lower operating results, but Communications reported a 76% increase.

Cost-reduction programmes on schedule; additional savings of around € 15 million expected in H2 2010.

Result for the period, excluding non-recurring items, € 20.0 million (+3%).

Operating working capital ratio 16.6% (H1 2009: 15.8%), due to higher copper prices and exchange-rate effects. Return of normal seasonal pattern resulted in higher working capital and, consequently, lower cash flow from operating activities.

Tentative signs of recovery with respect to industrial related cable activities, construction related cable activities in Asia and communication cable activities. The positive effects are expected to show in Draka's results from H2 2010.

Comment by Frank Dorjee, Chairman and CEO of Draka Holding N.V.: 'While demand stabilized on most of Draka's end-user markets in the first half of 2010, there was no relief from the highly competitive pressure, but further cost savings compensated for its effects and the operating result was close to that for the second half of 2009.

The still fragile international economic recovery which started in 2010 is expected to benefit Draka's end-user markets and results as from the second half of this year. As we pursue our strategy of taking full advantage of market opportunities while exerting rigorous cost control, we expect the operating result (excluding non-recurring charges) in the second half to show an improvement on the first six months of 2010, provided the restoration of international market confidence is sustained.'

[1] All figures in this press release are unaudited.

[2] Excluding non-recurring items. Total non-recurring items in H1 2010 were € 21.8 million negative (or € 18.5 million net) and related to restructuring costs. Non-recurring items in H1 2009 were € 17.9 million negative

[3] Attributable to the equity holders of the Company.

[4] Per ordinary share after preference dividend of € 2.7 million.

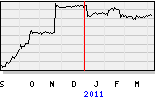

tijd 11.06

Draka moet inleveren op EUR 10,72 -34ct en 95.000 sts omzet.