Key figures (in EUR million) 2017 2016

Revenue 36.4 32.2

EBITDA 4.2 4.5

Operating Profit 3.3 3.7

Free cash flow (0.0) 2.3

Net Profit 2.3 2.8

Profit per share in EUR 1.21 1.49

Dividend (proposed 2017) 1.32 1.32

Extraordinary dividend (proposed 2017) 3.00 0.0

Key Performance Indicators

Organic growth (adjusted for excess returns issue) 3.1% 3.9%

ROIC 11.0% 13.0%

EBITDA Margin 11.4% 14.0%

EBITDA Margin adjusted for non-recurring items 13.5% 15.6%

Average number of FTE 161 132

These figures are taken from the unaudited financial statements 2017. The audited financial statements will be published on our website www.brill.com on April 5th, 2018.

• Progress on all strategic areas; market expansion into Germany and Social Sciences, buildup of sales footprint and completion of most of our investment program.

• Revenue up 13%; organic growth 2%

o Digital products up by 7% driven by e-books which were up 20% in the Americas and 9% overall

o Total sales grew by 40% in China

o Recurring revenue up by 3%, record output journal issues

• EBITDA down by 8%; EBITDA margin down to 11% from 14% due to significant one-off expenses and newly acquired business. This leads to lower Profit and Earnings Per Share.

• Continued strong cash generation despite major investments in technology and acquisitions.

• Proposed total dividend per share EUR 4.32 consisting of EUR 1.32 ordinary dividend and EUR 3.00 extraordinary dividend. The proposal is supported by committed credit facilities.

Developments in 2017

2017 saw clear progress on all aspects of our strategy.

We expanded our market presence by our first major acquisition in the German speaking countries, Schöningh & Fink and this position could be expanded at the end of the year by signing the acquisition of mentis Verlag, effective January 1st, 2018. By acquiring Sense Publishers as of 1 July, we entered a new market segment: Educational Sciences. With this acquisition we can further strengthen our presence in the field of Social Sciences.

We also developed our market reach. In August, our Asian presence in Singapore was expanded by opening a representative office in Beijing to support our sales activities in China. These steps, in addition

to enhancements in our marketing process and some key new hires in the sales team allow us to capture more commercial opportunities.

We made progress on our strategic investment program to further develop towards a digital first business. This includes the build of a new web presence (www.brill.com) which went live early March 2018 in a first release. We will continue to enhance the site over the remainder of the year. This new platform will improve access to, search through and purchase of our entire content base in a state of the art responsive application.

The development in our publishing program was marked by a significant expansion of our annual title output due to the two acquired companies. Annual output now stands at around 1,400 books and over 270 journals. Open Access again showed strong growth and shows that we are well positioned in the market of Open Science.

Financial development

2017 was a record year in terms of revenue. Economies of scale will help us achieve structural improvements in profitability going forward. However, we also experienced several significant non-recurring items. The net result is that EBITDA and net profit came out lower compared to 2016.

In 2017 we elected to change the classification of our investment in product development costs from Inventories (under IAS 2) to Intangible Assets (under IAS 38). This is intended both to provide the user of our financial statements with greater transparency as to our investment level and to bring reporting more in line with the new business paradigm. This is foremost a digital first vision meaning that the content is an asset that can be employed both to produce print books and to sell digital licenses. The change is only a reclassification and has no impact on results.

Furthermore, following the two acquisitions made in 2017, we assessed our approach towards accounting for newly acquired intangible assets. Consequently, we amortize acquired intangible assets in line with their useful life, based on our best estimates. Pursuant to this change, an amount of EUR 82 thousand was recognized as amortization in the 2017 income statement.

Revenue

In 2017, Brill’s revenue increased by 13% to EUR 36.4 million (2016: 32.2 million). This growth, breaking down into 2% organic (3% adjusted for the returns issue reported earlier) and 11% acquisition, compares to 4% reported growth in 2016. Key drivers for our organic growth in 2017 were digital publications including e-books, major reference works, journal subscriptions and primary sources, whereas print books declined due to excess returns (EUR 0.2 million) and changing market preferences.

(in EUR million)

Revenue % of total Growth Year on Year Growth

Revenue 2016 32.2 100.0%

Acquisitions 3.5 11.0% n.a.

Print books -0.4 -1.2% -3.1%

e-Books 0.8 2.5% 9.4%

Journals 0.2 0.7% 2.4%

Primary Sources 0.1 0.4% 10.8%

Other -0.0 -0.1% n.a.

Revenue 2017 36.4 113.1% 113.1%

Revenue generated through digital products was EUR 18.2 million or 50% of total, versus EUR 17.0 million or 53% of total in 2016; an increase of EUR 1.2 million or 7%. The acquisition of Schöningh & Fink brought the percentage of digital product down as this company is in its early stages of publishing e-books. Revenue generated through subscriptions was EUR 13.8 million or 38% of total, up from EUR 13.4 in 2016; an increase of EUR 0.4 million or 3%.

Across combined print and digital formats, books grew by 18% and journals by 2% reflecting acquisitions, successful sales efforts but also continued new book title output, growth in subscription value and new journal title development. A persistent trend in the print monograph format remains hyper-specialization where it becomes harder to achieve the same print runs per title as before. In other words, we need more title output to realize the same level of revenue.

The balance of major sales deals (i.e. over EUR 100 thousand per order) versus last year was neutral. We successfully closed deals with new clients, for example in Canada and South America but also with existing e-book customers – notably in China.

Growth in Asia was particularly strong. Growth in the Americas was impacted by excess book returns due to erroneous over-ordering by one of our largest distributors in 2016 and 2017. Corrected for this effect, underlying total growth in the Americas was 8% and for total Brill 3%. e-Book sales showed double digit growth in our core markets North America, Western Europe and Asia.

Cost of goods sold, personnel costs, and other operating costs

Total Cost of goods sold increased by 12% from EUR 11.2 million to EUR 12.5 million mostly due to acquisitions, growth in product development costs and content digitization costs. In addition, we updated our amortization schedule to reflect a persistent, market driven shift in the phasing of the sales pattern of book titles, leading to accelerated, non-cash costs of EUR 0.3 million. Despite underlying volume growth of 10%, journal costs were flat versus 2017 because of typesetting savings. Overall, we saved EUR 0.4 million in cash typesetting spend versus 2016, an achievement that is already showing in our investment level and which will benefit profits in years to come.

Cost of goods sold was impacted by significant non-recurring items of EUR 0.4 million. These items partly originate from integration expenses made for digitizing content of acquired businesses, from additional royalty obligations, and from the accelerated amortization of content and inventory. Going forward we expect the growth of content amortization to abate because of savings in typesetting.

Personnel costs increased by EUR 1.5 million or 16% in 2017 (2016: 3%). The increase was caused by 13% acquisition effects, and 3% organic increases in salary costs (a total of changes in FTE, Collective Labor Agreement adjustments and mix).

Other operating costs increased by EUR 1.7 million or 24% mainly due to acquisitions (EUR 1.1 million). The organic increase of EUR 0.6 million or 8% is caused by operational expansion (office costs, IT, support cost) but also by non-recurring items of EUR 0.2 million which include acquisition related expenses, corporate governance related costs and increased audit fees.

Depreciation and amortization, and financing revenues and costs

At EUR 0.8 million, depreciation and amortization were 7% higher than 2016. The new approach towards amortization of newly acquired publishing rights represents most of the increase.

Financing income reversed into financing cost because of foreign currency results relating to our non-hedged balance sheet positions (mainly receivables) amounting to EUR -0.2 million (2016: EUR +0.1 million).

Profit and profit per share

The above developments had an adverse impact on EBITDA, which ended at EUR 4.2 million, 8% below last year. As mentioned above, EBITDA was impacted by significant non-recurring items in revenue and cost which total EUR 0.8 million.

The lower EBITDA, higher amortization and adverse exchange rate results resulted in lower Net profit. Net profit amounted to 6% of revenue (2016: 9%).

The number of outstanding shares remained the same relative to 2016. Consequently, earnings per share amounted to EUR 1.21, down by 20% from 2016 (EPS 2016 EUR 1.49).

Operating Working capital and Cash flow

Excluding acquisition effects, inventories declined further because of our POD policy. Deferred income increased by EUR 0.3 million or 4%. As a result, we could again show a modest improvement in working capital. Tax payments were below last year because of a one-off effect in 2016 relating to settlement of our re-investment reserve.

Investments increased to EUR 7.1 million from EUR 5.8 million last year, mostly due to acquisitions and capital investments. This effect was mitigated somewhat because of lower investments in content – partly a result of lower typesetting expenditure.

Return on Invested Capital

Return on Invested Capital (ROIC) declined to 11.0% versus 13.0% in 2016. Despite the high investment level, asset turnover improved due to the revenue growth and improvements in working capital. Operating margin however declined because of the addition of lower NOPLAT margin revenue (S&F), one-off expense items and project activity.

Solvency and Liquidity

The balance sheet total (EUR 48.9 million) increased relative to 2016 (EUR 47.0 million). Equity amounted to EUR 27.4 million at the end of 2017 (EUR 27.5 million at the end of 2016). Solvency declined to 56.0% in 2017 (2016: 58.6%), so solvency remained at the high end of our target range of 40-60%.

Because of the high investment level, acquisitions and lower results, mitigated somewhat by improved working capital, our liquidity at year end declined from EUR 6.3 million in 2016 to EUR 3.8 million in 2017.

Capital structure and dividend

Review of our capital structure has indicated that within the balanced consideration of stakeholder interests, given the continued high solvency at year end and continued favorable prospects, we have room for an adjustment of our capital structure.

Therefore, we will propose to the AGM to approve a cash distribution of EUR 4.32 total per share. This total amount consists of an ordinary dividend of EUR 1.32 per share which is unchanged versus 2017 and an extraordinary dividend of EUR 3.00 per share.

We have secured additional banking facilities to ensure continuous operation of the business and adequate flexibility to capture business opportunities when they arise. We expect to close our new banking arrangements in due time before payout of the dividend. The company will maintain access to other financing instruments including equity if major attractive investment opportunities arise.

Record date will be 22 May and dividend payment date will be 23 May 2018.

Outlook

Brill’s annual reports do not include numerical statements about future developments in terms of revenue and results. Our focus is on further development of the publishing program and getting the value out of our recent investments in content, markets and technology, whereas longer term we seek to expand and enhance the portfolio in terms of faster growing, recurring revenue streams.

In 2018, compared to 2017, we expect reduced levels of capital investment as we are finishing the largest programs from our strategic roadmap. We expect further increases in amortization of intangible assets given our 2017 investment activities.

In 2018 we will also focus on fully integrating our recent acquisitions, improving productivity and added value per employee, and leveraging our investments in technology and business processes throughout geographies and business units.

Our intended change in capital structure will lead to higher financing charges and redemption obligations going forward; we will seek to redeem our capital loan within six years.

We will continue to invest modest amounts in R&D relating to Digital Humanities, developing concepts that we can realistically market within foreseeable timeframes. As always, revenue will be balanced towards the end of the year and will partly depend on our success in realizing our planned publishing calendar and in landing a few larger orders. It should be noted that the staffing growth we experienced in 2017 and inflationary pressure on salary costs will have a significant impact on our staffing expense in 2018. We expect that the recent weakening of the US dollar will negatively impact our revenue in 2018 however the impact will be dampened somewhat by our hedging policy.

Overall, the company is cautiously optimistic about the future, especially about growing revenue and improving profits in 2018.

Agenda 2018

As of April 5th, the annual report will be posted on Brill’s website www.brill.com. Brill will release a trading update on the first quarter on April 19th. An Analyst & Press meeting will be organized on April 11th in Leiden. On May 17th, 335 years after our company was founded in 1683, the Annual General Meeting will be held at the offices of the company in Leiden.

Leiden, March 15, 2018

Herman Pabbruwe, CEO.

tijd 09.02

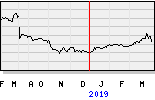

Brill EUR 32,20 +1,00 vol. 800