highlights

° revenue +2% to EUR 2,759 million (organic +5%)

° operating profit (EBITA) +9% to EUR 366 million; EBITA-margin improved to 13.3%

° net profit before amortisation +15% to EUR 275 million; earnings per share EUR 2.49 (+16%)

° free cash flow amounted to EUR 312 million; ROCE improved to 16.6%

° continued investments in organic growth and innovation initiatives

° bolt-on acquisitions: PEM, VAF, Co-Planar and RMF; annual revenue of EUR 82 million

° annual revenue of EUR 97 million divested and optimised

key figures in EUR million 2018 2017 delta revenu 2,759 2,694 2%

added-value as a % of revenu 62.6 62.3

operating profit (EBITA) 366 336 9%

EBITA as a % of revenu 13.3 12.5

net profit before amortisation 275 238 15%

earnings per share before amortisation (in EUR) 2.49 2.15 16%

total equity as a % of total assets 53.2 52.0

net debt 586 569 3%

leverage ratio: net debt / EBITDA (12-months-rolling) 1.3 1.3

free cash flow (before interest and tax) 312 310 1%

free cash flow conversion ratio (FCF as a % of EBITDA) 67.6 73.4

capital expenditure 134 119 13%

net working capital 464 455 2%

return on capital employed (ROCE 12-months-rolling) 16.6 16.2

dividend

Aalberts proposes to increase the cash dividend per ordinary share by 15% to EUR 0.75 (2017: EUR 0.65). This proposal will be submitted to the General Meeting to be held on 17 April 2019.

outlook

Looking ahead to 2019 we remain confident in the execution of the many growth and innovation initiatives and investment plans. We will pursue our strategy ‘focused acceleration’ and objectives, drive our profitability further and convert strong operational execution into free cash flow.

Wim Pelsma - CEO

“WE DELIVERED A STRONG PERFORMANCE WITH 5% ORGANIC REVENUE GROWTH, AN IMPROVED EBITA-MARGIN TO 13.3%, A NET PROFIT INCREASE OF 15% AND AN IMPROVED ROCE TO 16.6%.”

We have relentlessly driven forward our updated Aalberts strategy ‘focused acceleration’. Many investments were made in organic growth and innovation initiatives, facilitating the long-term plans and innovation roadmaps of our dedicated and motivated business teams. We further strengthened our market positions and optimised our portfolio through acquisitions and divestments.

Our new Aalberts company passport was launched during the year and we worked on many operational improvements through our Aalberts’ networks to further professionalise our organisation. We will propose to the General Meeting a cash dividend of EUR 0.75 per share (2017: EUR 0.65) an increase of 15%.

see more on

https://www.aalberts.com/uploads/files/downloads/trading%20updates/FY2018_press_release.pdf

tijd 09.36

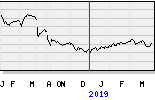

De AEX licht lager op 540,77 -1,75 -0,32% Aalberts EUR 31.76 -38ct vol. 174.000