Highlights

o Revenue +2.5% to EUR 1,274 million (organic +1.2%)

o Operating profit (EBITA) +12% to EUR 150.4 million; EBITA-margin 11.8%

o Net profit before amortisation +15% to EUR 105 million; earnings per share EUR 0.95 (+15%)

o Cash flow from operations +97% to EUR 93 million; ROCE improved to 14.0%

o Strengthened market positions with three acquisitions: Ushers, Schroeder, Tri-Went

o Divestment of one non-core activity

Key figures

in EUR million 1H2016 1H2015 DELTA

Revenue 1,274 1,244 2.5%

Added-value as a % of revenue 62.6 61.7

Operating profit (EBITA) 150.4 134.7 12%

EBITA as a % of revenue 11.8 10.8

Net profit before amortisation 104.9 91.5 15%

Earnings per share before amortisation (in EUR) 0.95 0.83 15%

Total equity as a % of total assets 45.1 44.3

Net debt 845 781 8%

Leverage ratio: Net debt / EBITDA (12-months-rolling) 2.1 2.1

Cash flow from operations 93.2 47.4 97%

Capital expenditure 57.0 41.2 38%

Net working capital 553 579 (4%)

Return on capital employed (ROCE 12-months-rolling) 14.0 13.3

Wim Pelsma - CEO

“WE HAVE MADE GOOD PROGRESS WITH THE IMPLEMENTATION OF OUR STRATEGY AND DELIVERED A GOOD

PERFORMANCE. EBITA MARGIN IMPROVED TO 11.8%, CASH FLOW FROM OPERATIONS DEVELOPED STRONGLY

AND NET PROFIT AND EARNINGS PER SHARE INCREASED BY 15%.

We achieved an organic revenue growth of 1.2% where

businesses and end markets showed a mixed picture.

Building Installations Europe, Climate Control and partly

Industrial Controls performed well. In activities related

to Industrial Installations North America and

Oil & Gas, we faced challenging circumstances.

We continued to focus on technologies with growth

potential, improved our market positions in North America

with three acquisitions, divested one activity and

consistently executed the many Operational Excellence

projects, using our group strengths”.

Financial results

The revenue increased by 2.5% (organic +1.2%) to

EUR 1,274 million (1H2015: EUR 1,244 million).

The added value margin improved to 62.6% (1H2015:

61.7%). Operating profit (EBITA) increased by 12% to

EUR 150.4 million (1H2015: EUR 134.7 million), 11.8%

of the revenue (1H2015: 10.8%). Net profit before

amortisation increased by 15% to EUR 104.9 million

(1H2015: EUR 91.5 million), per share by 15% to

EUR 0.95 (1H2015: EUR 0.83).

Cash flow from operations improved by EUR 45.8

million (+97%) to EUR 93.2 million (1H2015: EUR 47.4

million). Return on capital employed (ROCE) improved to

14.0% (1H2015: 13.3%). Total equity remained at a

good level of 45.1% of the balance sheet total (1H2015:

44.3%). Net debt was EUR 845 million (1H2015: EUR

781 million). The leverage ratio ended at 2.1 (1H2015:

2.1), well below the bank covenant < 3.5.

Operational developments

Building Installations realised organic growth and

good results in Europe. Higher revenues and operational

improvements in combination with a focused market

approach on technologies with growth potential are

becoming visible in the results. Also we further

optimised our product portfolio. In North America our

business for the residential and commercial end market

performed well, where the business for Industrial

Installations faced challenging circumstances. We

acquired TRI-WENT to strengthen our connection

technology activities for cooling applications. We

launched several new and upgraded valve product lines.

A global innovation roadmap is defined to drive further

organic growth.

Climate Control achieved a good growth of revenue

and results. The project activities in several markets

were improving, some markets still faced challenging

circumstances. We continued to integrate and optimise

the acquisitions and to improve the joint marketing and

system sales approach in combination with the

execution of the many Operational Excellence projects.

We started manufacturing and sales of several new

product lines in Eastern Europe and are investigating

further expansion plans in other regions. At several

positions we strengthened the Management Team.

Industrial Controls showed a mixed picture. Our

engineered valve business for the District Energy end

market performed on the same level as last year, in Russia

we realised growth. The activities related to the Oil & Gas

end market still faced difficult circumstances. Our high

pressure gas regulator and valve business for the

Automotive and Industrial end markets performed very

well. The growth plan for our combined business, after

acquiring VENTREX, looks promising for the coming years.

Our nano technology business for the Semicon & Science

end market showed lower revenues due to a different

product mix compared to last year. A better performance

is expected in the second half of the year. The precision

extrusion technology business made an excellent first half

year due to strong growth in the Aerospace end market.

Also our dispensing technology business for the Beverage

Dispense end market made a good start, including the

integration of SCHROEDER, acquired in February 2016.

We divested one non-core activity in the Netherlands.

In Industrial Services the heat and surface treatment

activities in Europe made a slower start than expected due

to lower volumes in the Machine Build and other

Industrial end markets. With strengthened management

and good action plans Impreglon improved its

performance compared to last year. In Eastern Europe and

North America our brazing and heat treatment activities

performed well, additional investments were made to

service the many business opportunities. We

strengthened our position in the Power Generation end

market with the acquisition of USHERS. The complex

precision stamping activities showed a good development,

especially in Eastern Europe and Asia.

Outlook

We will consistently execute our strategy and expect

to realise further progress during the year.

tijd 10.59

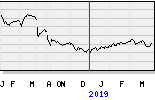

Aalberts EUR 30,29 +1,26 vol. 202.772