Highlights

Revenue +12% to EUR 2,475 million (organic +2%)

Operating profit (EBITA) +10% to EUR 272 million; EBITA-marge 11.0%

Net profit before amortisation +13% to EUR 190 million; earnings per share EUR 1.72 (+13%)

Free cash flow +10% to EUR 243 million

Strengthened market position Industrial Controls due to acquisition VENTREX

Integration and optimisation of 2014 acquisitions proceeded well

Dividend proposal +13% to EUR 0.52 in cash per share.

Key figures

in EUR million 2015 2014 DELTA

Revenue 2,475 2,201 12%

Added-value 1,521 1,332 14%

Added-value as a % of revenue 61.5 60.5

Operating profit (EBITDA) 367 332 11%

EBITDA as a % of revenue 14.8 15.1

Operating profit (EBITA) 272 247 10%

EBITA as a % of revenue 11.0 11.2

Net profit before amortisation 190 168 13%

Average number of shares (in million) 110.6 110.6 -

Earnings per share before amortisation (in EUR) 1.72 1.52 13%

Cash dividend per share (in EUR) 0.52 0.46 13%

Total equity as a % of total assets 46.9 45.6

Net debt 718 690 4%

Leverage ratio: Net debt / EBITDA (12-months-rolling) 1.8 1.9

Interest cover ratio (12-months-rolling) 21.8 22.6

Cash flow (net profit + depreciation + amortisation) 286 253 13%

Free cash flow (before interest and tax) 243 222 10%

Free cash flow conversion ratio (FCF in % of EBITDA) 66.1 66.9

Capital expenditure 96 85 14%

Net working capital 461 427 8%

Net working capital as a % of revenue (12-months-rolling) 18.3 18.0

Capital employed 2,002 1,854 8%

Return on capital employed (ROCE 12-months-rolling) 14.3 14.1

Number of employees at end of period (x1) 14,709 14,492 1%

Effective tax rate in % 25.8 27.4

Wim Pelsma

Chief Executive Officer

“WE HAVE MADE GOOD PROGRESS WITH THE IMPLEMENTATION OF OUR STRATEGY AND DELIVERED A GOOD

PERFORMANCE WITH A NET PROFIT OF EUR 190 MILLION, EUR 1.72 PER SHARE, AN INCREASE OF 13% COMPARED TO 2014.

Our operating profit (EBITA) increased by 10% to EUR

272 million, despite additional integration and

restructuring costs during the year. Free cash flow

improved with 10% to EUR 243 million. Our revenue

increased by 12% to EUR 2,475 million, organic +2%,

despite difficult market circumstances in some markets

and regions.

We continued to focus our businesses on technologies

with growth potential, improve our marketing and sales

approach and consistently executed the many

Operational Excellence projects. We allocated our capital

thoroughly to accelerate organic growth and

innovations, driven by our newly installed business

management organisation. The integration and optimisation of the 2014 acquisitions

proceeded well and improvement plans are implemented

with dedicated strengthened management teams.

Furthermore our market position for high pressure

regulators and valves in our Industrial Controls business

was strengthened through the acquisition of VENTREX.

A cash dividend of EUR 0.52 per share (2014: EUR 0.46)

will be proposed, an increase of 13%.”

Financial results

The revenue increased by 12% (organic +2%) to EUR

2,475 million (2014: EUR 2,201 million).

The added value margin (revenue minus raw materials

and work subcontracted), improved to 61.5% (2014:

60.5%).

Operating profit (EBITA) increased by 10% to EUR 272.0

million (2014: EUR 246.6 million), 11.0% of the

revenue (2014: 11.2%).

Net interest expense amounted to EUR 17.8 million

(2014: EUR 15.7 million). The income tax expense

increased to EUR 58.6 million (2014: EUR 56.4 million)

resulting in an effective tax rate of 25.8% (2014:

27.4%).

Net profit before amortisation increased by 13% to EUR

190.4 million (2014: EUR 167.9 million), per share by

13% to EUR 1.72 (2014: EUR 1.52). Capital expenditure on property, plant and equipment

increased by 14% to EUR 96 million (2014: EUR 85

million). Net working capital increased to EUR 461

million, 18.3% of total revenue (2014: EUR 427 million,

respectively 18.0%).

Cash flow (net profit + depreciation + amortisation)

improved by EUR 33 million (+13%) to EUR 286 million

(2014: EUR 253 million). Free cash flow improved by EUR

21 million (+10%) to EUR 243 million (2014: EUR 222

million). Return on capital employed (ROCE) improved to

14.3% (2014: 14.1%).

Total equity remained at a good level of 46.9% of the

balance sheet total (2014: 45.6%) while, as result of

acquisitions, net debt increased by EUR 28 million to

EUR 718 million (2014: EUR 690 million). The leverage

ratio ended at 1.8 (2014: 1.9), well below the bank

covenant < 3.0.

zie en lees meer op

http://www.aalberts.com/uploads/files/downloads/trading%20updates/pressreleaseFY2015.pdf

tijd 09.10

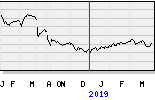

Aalberts EUR 28,86 +43,5ct vol. 8.373