Highlights:

Revenue of € 5,557 million; organic growth 6.4%; gross profit up 6.4%

Topline grew 8% in Europe, 1% in North America and 9% in Rest of the world

Perm growth accelerating to 11% (Q4 2016: 4%), driven by all regions; NAM 6% (Q4 2016: -3%)

Gross margin 20.4%; underlying gross margins stable YoY

Underlying EBITA of € 209 million (+16% organically); EBITA margin up 20bp YoY to 3.8%

Adjusted net income up 21% to € 148 million; FCF of € 120 million (+ 91% YoY)

Comfortable leverage ratio of 1.1 (vs. 0.3 last year)

March organic sales growth in line with Q1; Volumes in early April indicate a continuation of the trend

All acquisitions well on track; Monster transition in full swing

"We started the year on a positive note, achieving sound organic sales growth and an acceleration in perm placement growth," says CEO Jacques van den Broek. "Momentum in Europe remained favorable and our North American business continues to grow. We are satisfied with the progress of our recent acquisitions and remain very excited about their future contribution to the Group. I would like to welcome our new colleagues who joined Randstad through the finalization of the acquisitions of Ausy and BMC. Meanwhile, we are taking the next steps in our digital strategy to enhance the implementation of technology in many of our processes. This enables us to offer clients and candidates tailor-made data-driven insights and to focus on where we are at our best: making the personal connection."

Core data

in millions of €, unless otherwise indicated Q1 2017 Q1 2016

YoY

change % Org. L4Q 2017 L4Q 2016

YoY

change % Org.

Revenue 5,556.8 4,701.5 18% 6% 21,539.4 19,489.3 11% 5%

Gross profit 1,133.9 865.4 31% 6% 4,202.7 3,645.1 15% 4%

Operating expenses 925.3 696.5 33% 7% 3,216.3 2,767.4 16% 4%

EBITA, underlying1 208.6 168.9 24% 16% 986.4 877.7 12% 8%

Integration costs and one-offs (17.9) (3.2) (69.4) (23.9)

EBITA 190.7 165.7 15% 917.0 853.8 7%

Amortization of intangible assets 2 (33.9) (30.4) (104.9) (117.5)

Operating profit 156.8 135.3 812.1 736.3

Net finance income /(costs) (2.6) 5.2 (11.6) (1.6)

Share of profit of associates 0.2 0.0 (0.6) 0.6

Result on disposal of associates - - 0.0 6.1

Income before taxes 154.4 140.5 10% 799.9 741.4 8%

Taxes on income (38.6) (38.0) (198.4) (179.6)

Net income 115.8 102.5 13% 601.5 561.8 7%

Adj. net income for holders of ordinary shares3 148.0 122.8 21% 714.1 640.3 12%

Free cash flow 119.5 62.5 91% 521.6 525.1 (1)%

Net debt 1,129.2 296.4

Leverage ratio (net debt/12-month EBITDA) 1.1 0.3

DSO (Days Sales Outstanding), moving average 50.5 50.8

Margins (in % of revenue)

Gross margin 20.4% 18.4% 19.5% 18.7%

Operating expenses margin 16.7% 14.8% 14.9% 14.2%

EBITA margin, underlying 3.8% 3.6% 4.6% 4.5%

Share data

Basic earnings per ordinary share (in €) 0.62 0.54 15% 3.23 3.01 7%

Diluted earnings per ordinary share, underlying (in

€) 4 0.81 0.67 21% 3.89 3.49 11%

1 EBITA adjusted for integration costs and one-offs.

2 Amortization and impairment of acquisistion-related intangible assets and goodwill.

3 Before amortization and impairment of acquisition-related intangible assets and goodwill, integration costs and one-offs. See table "Earnings per share" on page 23.

4 Before amortization and impairment of acquisition-related intangible assets and goodwill, integration costs and one-offs.

Revenue

Organic revenue per working day grew by 6.4% in Q1 to € 5,557 million (Q4 2016: up 6.6%). Reported revenue was 18.2% above

Q1 2016, of which FX accounted for 0.9%. M&A contributed 8.5% while working days had a positive effect of 2.4%.

In North America, revenue per working day increased by 1% (Q4 2016: up 1%). Growth in the US remained flat, while Canada

grew by 6% (Q4 2016: 4%). In Europe, revenue per working day grew by 8% (Q4 2016: up 8%). Topline growth in France

amounted to 9% (Q4 2016: 10%), and the Netherlands grew by 1% (Q4 2016: 2%). Germany was up 9% (Q4 2016: 10%), while

sales growth in Belgium accelerated to 10% (Q4 2016: 5%). Italy rose by 23% (Q4 2016: 26%), while revenues in Iberia were up by

8% (Q4 2016: 10%). In the 'Rest of the world' region, revenue increased 9% (Q4 2016: up 10%); Australia & New Zealand rose by

12% and Japan increased by 7%.

Perm fee growth accelerated to 11% (Q4 2016: up 4%), with North America and Europe up 6% (Q4 2016: -3%) and 16% (Q4

2016: 11%) respectively. In the 'Rest of the world' region, perm fee growth was 8%, up from 4% in Q4 2016. Perm fees made up

2.1% of revenue and 10.2% of gross profit.

lees verder op

https://www.ir.randstad.com/~/media/Files/R/Randstad-IR/documents/press-releases/2017/Q1%20results%202017.pdf

tijd 11.23

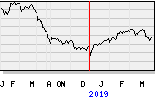

Randstad EUR 55,82 -37ct vol. 506.000