LogicaCMG plc

Proposed Acquisition of Unilog S.A., France’s sixth largest IT services provider, for a total consideration of €930.3 million (£630.6 million), creating a top ten IT services provider in Europe

1 for 2 Rights Issue of up to 375,495,147 Rights Issue Shares at 107 pence per Share to raise net proceeds of approximately £389 million

LogicaCMG plc ("LogicaCMG") has conditionally agreed to acquire approximately 32.3 per cent. of the issued share capital of Unilog S.A. ("Unilog"), a leading French IT service provider, from certain members of the management of Unilog and others for a total of €255.4 million in cash and the issue of 19,572,703 new Consideration Shares.

Subject to a number of conditions, it is proposed to acquire the remaining 67.7 per cent. of the share capital of Unilog by way of a public tender offer to Unilog Shareholders.

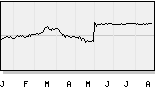

Under the Tender Offer, LogicaCMG will pay €73.0 in cash for each Unilog Share, representing a premium of approximately 11.5 per cent. over the one month average Unilog Share price of €65.5 on 15 September 2005 and approximately 32.8 per cent. over the one month average Unilog Share price of €55.0 on 30 June 2005, the day prior to the emergence of bid rumours in respect of Unilog.

The combination of the two businesses will significantly strengthen LogicaCMG’s position as a leading European force in IT services with over 27,000 employees, combined pro forma revenues in 2004 of £2.1 billion and a worldwide network of offices. The Directors believe that the combination of the two businesses will create:

A top ten IT services provider in Europe, well positioned to capitalise on improving markets and changing customer demands

The number four player in the French market, complementing LogicaCMG’s existing strong positions in the UK and the Netherlands

The opportunity to meet the need for outsourced and offshore services in France

A more effective platform for the combined group to develop its business in Germany

The ability to cross-sell LogicaCMG’s capabilities to Unilog’s European blue-chip customers.

The Directors and the Proposed Directors believe that there is significant potential to achieve operational synergies of approximately £19 million in the year ending 31 December 2007, up to half of which are expected to be achieved in the year ending 31 December 2006.

The Acquisition is expected to enhance LogicaCMG’s earnings per share in the first full year, growing thereafter, and to cover LogicaCMG’s cost of capital in the second full year following completion.

The Acquisition will be part-funded by way of a fully underwritten 1 for 2 Rights Issue of up to 375,495,147 Rights Issue Shares at a price of 107 pence per Share to raise approximately £389 million, net of expenses. The Issue Price represents a discount of approximately 36.3 per cent. to the closing price of 168 pence per Share on 16 September 2005. The Rights Issue has been fully underwritten by Merrill Lynch International, Hoare Govett and BNP PARIBAS.

Under the terms of the Acquisition Gérard Philippot, currently Executive President of Unilog, will join the Board of LogicaCMG as a non-executive director. Didier Herrmann, currently Executive Vice President of Unilog, will also join the LogicaCMG Board and, together with Aydin Azernour and Patrick Guimbal, will join LogicaCMG’s Executive Committee. Didier Herrmann will be responsible for LogicaCMG’s business in France, Germany and Switzerland.

Completion of the Acquisition is subject to a number of conditions, including LogicaCMG shareholder approval which will be sought at an Extraordinary General Meeting to be held on 13 October 2005. The French tender offer is expected to open in early November and to close by the year end.

Commenting on the proposed acquisition, Gérard Philippot, President of Unilog, said:

"This move is transformational for our customers and staff and secures the successful long-term future of Unilog in an increasingly global market place.

By combining with a leading international IT services player such as LogicaCMG, we will have improved strength and scale to compete on major international contracts and to support our prestigious clients globally. For our staff this transaction provides the opportunity to extend their expertise as part of a growing and dynamic enterprise with a strong international outlook."

Martin Read, Chief Executive of LogicaCMG, said:

"This transaction has a strong commercial, financial and strategic logic. Unilog is an excellent business with a track record of delivering a first class performance. Its highly successful management team share our approach and vision for the enlarged business. The two businesses have complementary client bases, geographical strengths and service offerings. There are exciting opportunities to cross-sell capabilities across the two businesses, particularly LogicaCMG’s expertise in outsourcing and global delivery as demand for these services increases.

Through the merger of Logica plc and CMG plc in 2002 we created a strong player in the European IT services market, particularly in the UK and the Netherlands. With the acquisition of Unilog, we strengthen this position further, by becoming a major player in France, Europe’s third largest IT services market.

This is an exciting development for both businesses. The Enlarged Group will be well placed to seize opportunities in a fast moving and increasingly global IT services market."