The third quarter 2018 results of ABN AMRO are expected to include several incidental items and a change in allocation of income.

Incidental items in Q3 2018

The third quarter 2018 results will include the following items:

A restructuring provision of EUR 27 million related to the previously announced CIB update (to be booked in CIB). Additional provisions are expected to be booked at a later date.

The closing of the sale of ABN AMRO Bank (Luxembourg) s.a. led to an additional EUR 12 million gain in Private Banking.

Change in allocation of deposit income following model update

From Q3 2018, the allocation of Net Interest income (NII) between Group Functions and the business segments has changed. This follows improvements to the model for non-maturing deposits (deposits and current accounts with no tenor) enabling us to calculate better the duration of these deposits. The improvements have led to a shortening of the modelled duration of non-maturing deposits. As a result, the bank's overall hedging position has been adjusted in order to keep ABN AMRO's interest rate sensitivity modest. The total impact of this model update on Group NII is limited, reflecting higher hedging costs within Group Functions (approx. EUR 40 million per annum).

The model update has resulted in a lower transfer price being paid by Asset & Liability Management (ALM, part of Group Functions) to the business segments in respect to non-maturing deposits (mainly Retail, Private and Commercial Banking) which results in an increase in the NII of Group Functions. As ALM manages interest rate risk on behalf of the business segments, we will reallocate ALM's NII to the business segments. The allocation will be proportional to the equity allocated per segment.

The combined impact of these measures on the business segments in the third quarter 2018 is approximately EUR 30 million lower NII for Retail Banking, approximately EUR 10 million lower NII for Private Banking, approximately EUR 20 million lower NII for Commercial Banking while CIB NII will be approximately EUR 20 million higher and Group Functions NII approximately EUR 40 million higher. Over time, the development of this impact is dependent on market interest rate movements and developments in the associated client rates.

The third quarter results are scheduled to be published on 7 November 2018.

Investor day details

As previously announced, ABN AMRO will host its first Investor Day on Friday 16 November 2018. The purpose of the Investor Day is to introduce the new Executive Committee, provide an update on our achievements since IPO, address ABN AMRO's strategic ambitions with respect to sustainability, customer focus and business transformation and update investor focus areas such as IT, business outlook and capital position.

The event to be held in London, will start at 09:30 and end at 15:30. The event will be livestreamed through a webcast available on our website abnamro.com/ir.

tijd 09.43

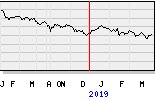

ABN AMRO EUR 22,41 -31ct vol. 211.000