Luxembourg – February 25, 2019 (07:00 CET). B&S Group S.A. (“B&S Group” or the “Group”), a fast-growing, global distribution partner for consumer goods, today announces its full year 2018 results.

Key highlights

Total turnover growth lifted up to 16.8%, or 18.2% on a constant currency basis1 to € 1,746.5 million, with first-time contribution of seasonally strong fourth quarter of FragranceNet.com2 ;

Turnover up 11.0% organically on a constant currency basis, with growth in all business segments;

On a reported basis EBITDA increased by 4.0% to € 109.0 million, when adjusted for acquisition costs, share-based payments and FX-effects EBITDA increased by 11.5% to € 116.9 million (2017: € 104.8 million);

Adjusted Profit before tax stood at € 93.3 million, or € 98.7 million on a constant currency basis (2017: € 88.7 million when adjusted for the other gains and losses line3 , or € 92.0 million reported);

Solid financial position with net debt / EBITDA at 2.7;

Proposed cash dividend € 0.16, subject to shareholder approval, bringing total dividend for 2018 to € 0.29, corresponding to a pay-out ratio of 40%.

Bert Meulman, CEO: “2018 was a year of further growth for B&S Group. With all three business segments contributing, we realised double digit turnover growth with a related underlying longterm growth trend in EBITDA. In October we completed the acquisition of FragranceNet.com, a company on our horizon for quite some time, leading to immediate sourcing synergies. This acquisition not only provides us access to the US market - a geographical white spot until that moment - but also provides us with captive knowledge regarding the market they serve.

Despite uncertain and challenging global economic market conditions, mainly caused by political turmoil in geographies around the world, demand for FMCG remained robust and we delivered the performance we aimed for. We strengthened our international market positions and footprint and further expanded our role in the value chain.

The significant expansion of our logistical platform and the start of our operations in our new warehouse, led to temporary but significantly higher costs due to the delay in hand over of the technical infrastructure. We have taken the decisions we deemed necessary to ascertain that service levels to our customers are not impacted by this delay, be it at the expense of higher operational costs. We expect that the technical infrastructure will be fully operational by mid 2019. In the second half of the year we were also confronted with accelerated increases in logistical labour costs and major increases in international transport costs, mainly related to our food distribution services. With a delayed but visible effect into 2019, we were able to pass on most of these cost increases to our customers. We are now seeing the first effects of the decisions we took of passing on a part of our higher costs to our customers.

see & read more on

http://files.smart.pr/3d/87ff10387611e9bb79e32f3c408bc1/190225-B_S-press-release--FY-18-results.pdf

tijd 09.22

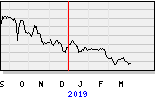

B&S EUR 12,90 -6ct vol. 2.499

tijd 16.28

B&S EUR 12,43 -53ct vol. 68.135