- Signify reports second quarter sales of EUR 1.5 billion and operational profitability of 8.4%; Increases share repurchase program to EUR 300 million

Second quarter 20181

Sales of EUR 1,537 million; a comparable decrease of 3.4%

LED-based comparable sales growth of 4.7%, representing 70% of total sales (Q2 2017: 63%)

Adj. currency comparable indirect costs down EUR 46 million, a reduction of 8%; or 150 basis points of sales

Adj. EBITA of EUR 130 million (Q2 2017: EUR 159 million), impacted by currency effects of EUR -22 million

Adj. EBITA margin of 8.4% (Q2 2017: 9.4%), including a currency impact of -80 basis points

Net income of EUR 29 million (Q2 2017: EUR 73 million), reflecting higher restructuring costs, lower profitability and a real estate gain in Q2 2017

Free cash flow of EUR -31 million (Q2 2017: EUR -44 million excluding real estate proceeds)

Share repurchase program for 2018 increased from EUR 150 million to EUR 300 million

Half year 2018 highlights1

Sales of EUR 3,038 million, a comparable decrease of 3.4%; LED-based comparable sales growth of 5.3%

Strong reduction in currency comparable indirect costs of EUR 84 million, or 120 basis points of sales

Adjusted EBITA margin of 7.7% (H1 2017: 8.4%), including a currency impact of -60 basis points

Working capital improved by 70 basis points to 10.5% of sales

Free cash flow of EUR -37 million, an improvement compared with EUR -62 million, excluding real estate proceeds in H1 2017

Eindhoven, the Netherlands - Signify (Euronext: LIGHT), the world leader in lighting, today announced the company's 2018 second quarter results. "In the second quarter, profitability improved in Lamps, LED and Professional while the performance in Home remained weak. We significantly reduced our cost base and working capital, thereby structurally improving our cash generation," said CEO Eric Rondolat. "However, given the slow start to the year and as we expect ongoing challenging market conditions, we have decided to revise our sales outlook for the year. We expect our sales growth performance to improve in the second half, but this will not be enough to deliver positive comparable sales growth for the full year. At the same time, we confirm our profitability and cash flow outlook for the year as our teams remain focused on relentlessly executing our strategy, driving down our cost base while investing in innovation and growth opportunities."

Outlook

Given the slow start to the year in Home, more challenging market and competitive dynamics in some geographies, as well as global scarcity in certain electronic components, Signify has decided to revise its sales outlook for 2018. The company expects its comparable sales growth in the second half to improve compared with the first half, however, the improvement is not expected to be sufficient to deliver positive comparable sales growth for the full year.

Taking into account the anticipated cost savings in the second half of 2018, the company maintains its earlier outlook to improve the Adjusted EBITA margin from 9.6% in 2017 to 10.0-10.5% in 2018, albeit at the lower end of the range. The company also continues to expect to generate a solid free cash flow in 2018, which will be somewhat lower than the level in 2017 due to higher restructuring payments.

Capital allocation

Increase in share repurchase program for 2018 from EUR 150 million to EUR 300 million

The company has decided to increase the amount allocated for share repurchases from EUR 150 million to EUR 300 million. In the first half of 2018, the company repurchased shares for an amount of EUR 71 million by participating in share disposals by its main shareholder. As a result, Signify intends to repurchase additional shares for up to EUR 229 million in the remainder of 2018, either in the open market or by participating in share disposals by its main shareholder.

Second contribution of USD 50 million to US pension fund planned for Q3 2018

Signify has an active pension de-risking strategy in which it actively looks for opportunities to reduce the risks associated with the defined-benefit plans. As part of this strategy, it announced in Q2 2017 that it intended to contribute approximately USD 150 million to its US pension fund over the period 2017-2019 to further reduce liabilities and to lower interest expenses going forward. Following the first contribution of USD 50 million in Q3 2017, Signify intends to make the second contribution of USD 50 million in Q3 2018.

Financial Review

Changes to financial reporting

Since the first quarter of 2018, Signify reports and discusses its financial performance based on the recently announced portfolio changes to further align the organizational structure with the strategy. In March 2018, the company provided an update to show the effect of changes to the business portfolio as well as changes to the allocation methods of centrally-managed costs and to the threshold for other incidental items as adjusting items when presenting certain non-IFRS measures such as Adjusted EBITA.

see & read more on

https://www.signify.com/static/quarterlyresults/2018/q2_2018/signify-second-quarter-results-2018-report.pdf

tijd 09.24

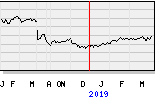

Signify EUR 24,03 +1,46 vol. 315.311