PRESS RELEASE

Barendrecht, 24 October 2018

Q3 2018 RESULTS: REVENUE AND EBITDA GROWTH CONTINUES

Key developments:

Q3 2018

Revenue grew 23% to € 31.8 million (Q3 2017: € 25.8 million), organic revenue growth of 3%

EBITDA of € 3.1 million, up 24% compared to € 2.5 million in Q3 2017

Software solutions bundled in OrangeNXT

9M 2018

Revenue rose 21% to € 92.7 million (9M 2017: € 76.5 million), organic revenue growth of 5%

Underlying EBITDA of € 8.9 million (9M 2017: € 7.8 million). Including one-off costs for contract termination fees at InTraffic (€ 0.8 million), EBITDA amounted to € 8.1 million

Outlook

FY 2018 underlying EBITDA forecast at between € 13 and € 14 million

image

Jos Blejie, CEO of ICT Group N.V.: “ICT Group continues to realise good growth while making strategic progress in becoming a leading total solutions provider. The acquisition of the remaining shares in ICT Mobile was the jumpstart for OrangeNXT in which we have bundled promising ICT Group software solutions to help our customers reap all the benefits that digital transformation has to offer. We are convinced that combining our in-depth industry knowledge with our ability to connect people, devices and data provides a unique offering. Our outlook for the fourth quarter is positive and we expect an underlying EBITDA of between € 13 and € 14 million for the full year 2018.”

Financial developments

In the third quarter of 2018 revenue increased by 23% to € 31.8 million from € 25.8 million in the third quarter of 2017. Organically, i.e. excluding NedMobiel and the full consolidation of InTraffic, revenu grew 3%. For the first nine months of the year revenue amounted to € 92.7 million (9M 2017: € 76.5 million). Revenue rose 5% organically year-to-date.

EBITDA increased to € 3.1 million in the third quarter from € 2.5 million in the same period of 2017, mainly as a result of improved productivity at ICT Netherlands and recent acquisitions. The EBITDA margin was 9.7% in the third quarter, in line with 2017 (9.6%).

In the first nine months of 2018 EBITDA was up 4% compared to last year.

Underlying EBITDA, i.e.

excluding the one-off costs of € 0.8 million in the second quarter of 2018 relating to contract termination fees at InTraffic, increased by 14% compared to the same period last year. The resulting underlying EBITDA margin came in at 9.6% year-to-date (9M 2016: 10.2%). The positive impact of higher productivity levels at ICT Netherlands was offset by substantially lower EBITDA margins at InTraffic and lower hardware sales at BMA.

The improved productivity levels at ICT Netherlands resulted in a better financial performance for the segment compared to last year. Strypes Bulgaria performed slightly below last year’s level due to a small drop in productivity. InTraffic’s margin is currently below ICT Group’s target margin range. We have focussed on increasing efficiency to bring InTraffic’s margins in line with ICT’s overall group margins. The first benefits of these actions are already becoming visible and the full impact is set to materialise in the course of 2019. In the ‘Other’ segment Raster is benefiting from improving market conditions. BMA’s performance was substantially below last year’s due to lower hardware sales.

Improve performed more or less in line with last year.

Strategic themes

ICT has made clear choices in terms of growth, focusing on the strategic themes of Smarter Industries, Smarter Cities and Smarter Health. Smarter Cities realised considerable growth, mainly as a result of the acquisition of NedMobiel and the remaining stake in InTraffic. Smarter Industries posted good organic revenue growth, while revenue in Smarter Health declined as a result of lower hardware sales at BMA and lower productivity in the ICT Healthcare unit.

Revenue split per theme (in € millions) 9M 2018 9M 2017 ?

Smarter Industries 56.9 51.1 11%

Smarter Cities 24.9 12.1 105%

Smarter Health 6.0 7.9 -24%

Other 4.9 5.4 -9%

Total revenue 92.7 76.5 21%

OrangeNXT

In September 2018 ICT Group acquired the remaining 49% of the shares in ICT Mobile from its management. The software solutions provided by ICT Mobile have been housed with the solutions provided by other ICT Netherlands business units in OrangeNXT (formerly ICT Mobile), to distinguish the software as a service offerings from traditional time hire and project activities.

CIS Solutions Germany

CIS Solutions is a reselling agency for LogicNets and Internet of Things solutions in Germany for which ICT Group provided loans in 2016. In the third quarter of 2018 the outstanding convertible loans were converted into shares. Combined with an additional investment, ICT Group obtained 66% of the shares in CIS Solutions Germany.

Outlook

Going forward ICT Group will continue to focus on growth, both organically and through acquisitions.

ICT Group continues to invest in creating a strong platform to take its transformation into a total solution provider to the next level. The battle for talent continues and attracting and retaining the right people remains a key priority.

For the full year 2018 ICT Group expects underlying EBITDA to come in at between € 13 and € 14 million.

/ /

tijd 09.05

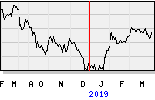

ICT EUR 11,65 +15ct vol. 1.420