Key Figures (in EUR x million) 2017 H1 2016 H1

Revenues 16.0 14.4

EBITDA 1.1 1.7

Operating profit 0.8 1.3

Profit 0.4 0.7

Net cash from operating activities -1.1 -1.4

Net decrease in cash and cash equivalents -5.1 -3.8

Earnings per share (EUR) 0.20 0.37

NOTE: The information in this report is based on unaudited interim financial statements

Highlights

• 11% growth in revenue, driven by acquisition of Schöningh & Fink (9.0%) and organic growth (2.2%)

• Organic revenue growth was satisfactory considering two major sales deals in H1 2016 (EUR 0.3m)

• Outlook FY 2017: revenue growth greater than 10% including 2-3% organic growth and some EBITDA margin improvement.

• Continuing shift of the portfolio towards digital, subscription based products

• Integration of both Schöningh & Fink and Sense is progressing according to plan

• EBITDA impacted by corporate and acquisition related cost, one time royalty costs, Schöningh & Fink seasonal profile and investments in expanding market presence

• Net cash flow from operating activities improved from EUR -1.4m to EUR -1.1m

• Editorial workflow system fully used for journals and live for processing books in H2; online platform investment on track

• Sales office in Beijing open in August

Developments in the first half year

General

2017 is a transformational year for Brill, with clear progress on all three key strategic initiatives. We are busy integrating our first major acquisition in Germany and we reached agreement on the acquisition of Sense in the Netherlands, which was closed on July 11. These are major steps in our effort to expand our market position. Also, we expanded our market presence by hiring additional sales staff and implementing a digital marketing capability.

The presence in Asia with an office in Singapore will be expanded through the opening of a sales office in Beijing in August. Lastly, we completed the development of our editorial workflow system and preparations are ongoing for the launch of our new online publishing platform in Q4. All of these investments will help enable the planned growth.

We continue to see a good reception of our offerings in the main markets we serve; our sales force generated 13% growth in order intake in the US and Europe. Growth in The Middle East, Africa and Asia was impacted by last year’s exceptional deals.

Title output, excluding Schöningh & Fink, declined slightly versus last year, but is expected to be in line with 2016 for the full year. Major new titles contributing to H1 growth include Flavius Josephus Online, Rosenne’s Law and Practice of the International Court and the Brill Reformation Year eBook collection. For the second half of 2017, title output from the newly acquired program of Sense will add to total title output.

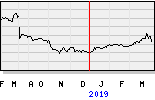

As in 2016, total H1 revenues showed a distinct increase versus the prior year:

(in EUR million) Revenues Growth Contribution to total growth 2016 H1 14.4

Print books 1.2 22.5% 8.4%

eBooks 0.2 4.6% 1.3%

Journals 0.3 5.1% 2.4%

Primary Sources -0.0 -7.0% -0.3%

Other -0.1 -27.9% -0.6% 2017

H1 16.0 11.2% 11.2%

Print book revenues were boosted by the acquisition of Schöningh & Fink; organic revenues were down by 1.5%. eBook revenues showed a healthy growth given last year’s one off deals; excluding those deals, eBook revenues grew by 13%. Journal revenues increased in line with expectations and were boosted by some timing differences.

The impact of the lower USD exchange rate in Q2 was mitigated by our hedging policy where we hedge both expenses and income on a rolling 12-month basis.

Digital revenue and subscription revenue declined as a percentage of overall revenue due to the consolidation of Schöningh & Fink which has mainly transaction based, print book sales. As a result, digital publications generated 53% of total revenue (H1 2016: 57% ) and subscription based revenue was 41% of total revenue (H1 2016: 42%).

Cost of goods sold showed continued underlying improvement in the mix of growing content costs versus efficiency and portfolio improvements. This effect was dampened by one off additional royalty accruals, and as a result Cost of goods sold as a whole grew more than revenues.

Operating expenses increased materially versus last year due to the consolidation of Schöningh & Fink but also due to our planned expansion of the sales & marketing organization, acquisition related expenses, and increased governance and audit expenses.

As a result of the above, EBITDA, Net profit and Earnings Per Share declined compared to H1 2016.

Balance sheet and cash flow

Versus last year, inventories increased due to the addition of the Schöningh & Fink inventory. Receivables decreased as payment patterns of customers improved. The deferred income increased mainly due to the growth of subscription revenue. Net cash from operating activities improved versus last year, but Net cash flow was impacted by higher dividend payment and higher investment activity. The solvency rate decreased slightly to 60.0% (HY 2016: 61.3%).

Outlook

Given the encouraging development in the first half of the year, the company expects total revenue growth for the full year to be above 10% - including organic growth of 2-3% - and some margin improvement. We expect this to result in a commensurate increase of EBITDA and growth of Earnings Per Share. As always, for achievement of this outlook we are heavily dependent on our annual performance on end of year sales. With Schöningh & Fink added, our revenue and profit weighing has become even more tilted towards the second half year.

Risk management

No significant changes occurred in the company’s assessment of relevant risks since the publication of the annual report 2016.

Responsibility Statement

The Half Year Report 2017 is an accurate account of assets and liabilities, the financial position and the profit of Koninklijke Brill NV and the entities which are included in the consolidation. Also the Half Year Report is an accurate account of the situation on the balance date, the state of affairs during the first half of the fiscal year of Koninklijke Brill NV and that of the entities whose data are included in the Half Year Report and the expected state of affairs. Special attention is paid to investments and to the circumstances on which revenues and profitability depend. Please note that the figures per 30 June, 2017 have not been reviewed nor audited.

see and read more on

http://www.brill.com/sites/default/files/press_release_brill_hyresults_2017.pdf