ASM International N.V. (Euronext Amsterdam: ASM) today reports its fourth quarter 2015 operating results (unaudited) in accordance with US GAAP.

FINANCIAL HIGHLIGHTS

Quarter Full Year

EUR million

Q4 2014 Q3 2015 Q4 2015 2014 2015

New orders 154.4 148.1 135.4 602.1 608.4

Net sales 124.3 162.0 144.7 545.6 669.6

Gross profit margin % 43.0 % 43.7 % 44.8 % 43.1 % 44.3 %

Operating result 13.4 23.2 12.5 90.5 106.3

Result from investments (excl. Amortization intangible assets resulting from the sale of the 12% stake of ASMPT) 8.9 8.1 2.2 61.1 44.4

Amortization intangible assets resulting from the sale of the 12% stake of ASMPT

(6.0 ) (6.7 ) (7.1 ) (22.5 ) (27.2 )

Net earnings 21.0 35.7 18.4 137.3 153.9

Normalized net earnings (excl. Amortization intangible assets resulting from the sale of the 12% stake of ASMPT)

26.9 42.4 25.4 159.8 181.1

Net sales for the fourth quarter 2015 were €145 million, a decrease of 11% compared to the previous quarter. Year-on-year net sales increased with 16%.

New orders at €135 million were 9% below the Q3 2015 level.

Normalized net earnings for the fourth quarter 2015 decreased by €17 million compared to the third quarter 2015. Operating result dropped €7 million due to the lower activity level and a one off charge due to the write off of the remaining 450mm assets (€3 million). The financing result included €6 million favorable effects from currencies compared to €3 million in the third quarter. The Q3 result included €9 million in one-off tax benefits. The Q4 result included €5 million one-off benefits resulting from the recognition of tax losses, incurred in the past, in the Netherlands. The result from investments decreased with €6 million.

COMMENT

Commenting on the results, Chuck del Prado, President and Chief Executive Officer of ASM International said:

"Q4 revenues at €145 million came in at the top end of our guidance, bringing the sales for the full year to €670 million. This represents a 14% currency comparable increase in 2015, in a year in which the wafer fab equipment industry did not show any growth. Order intake, at €135 million, came in at the higher end of our guidance. Our gross profit margin remained in the 44% range, finishing the year with a 120 basis points increase over 2014. Due to our favorable result development and healthy cash situation, we will propose during the upcoming AGM to increase the dividend to €0.70 per share.

OUTLOOK

For Q1 we expect sales between €135 and €145 million. For Q2 we expect sales between €140 and €150 million. In line with our earlier views, based on current visibility, we expect 2016 to be more revenue back loaded. The Q1 order intake is expected to be in the range of €150 to €165 million (all figures on a currency comparable level).

SHARE BUYBACK PROGRAM

October 28, 2015 ASMI announced that its Management Board authorized the repurchase of up to €100 million of the Company's common shares within the 2015-2016 time frame. This buyback program will be executed by intermediaries and will end as soon as the aggregate purchase price of the common shares acquired by ASMI has reached €100 million, but ultimately on November 20, 2016.

On May 21, 2015 the General Meeting of Shareholders authorized ASMI to acquire shares for a period of 18 months. The repurchase program is part of ASMI's commitment to use excess cash for the benefit of its shareholders.

The program started on November 26, 2015. On December 31, 2015 of the program 9% was repurchased.

REPORTING 2016

Up until the most recent reporting period, ASMI's primary external and internal reporting has been based on US GAAP. In addition ASMI issues quarterly reconciliations of net earnings and shareholders' equity and (semi) annual financial statements prepared in accordance with International Financial Reporting Standards (IFRS). Following the voluntary delisting from NASDAQ, August 2015, ASMI will migrate to IFRS as its only internal and external reporting standard from January 1, 2016 and will discontinue the use of US GAAP as of the same date. During 2016 comparable results based on US GAAP will be presented, as from 2017 only results based on IFRS will be reported.

2015 ANNUAL REPORT

On April 13, 2016 ASMI will publish its Statutory Annual Report. The report will be published on our website at www.asm.com.

tijd 09.33

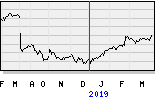

De Midcap 633,10 -4,72 -0,74% ASMI EUR 37,995 +97ct vol. 77.711