Q4 2017 Q3 2017 Q4 2016 Q4-Q4 In EUR millions 2017 2016

324.5 312.1 338.8 - 4% Revenues 1,305.9 1,346.9 - 3%

Results -excluding exceptional items-

192.7 176.4 197.6 - 2% Group operating profit before depreciation and amortization (EBITDA) 763.2 822.3 - 7%

123.0 109.3 128.9 - 5% Group operating profit (EBIT) 490.4 558.4 - 12%

76.2 60.8 71.5 7% Net profit attributable to holders of ordinary shares 287.4 326.1 - 12%

0.59 0.48 0.56 5% Earnings per ordinary share (in EUR) 2.25 2.56 - 12%

Results -including exceptional items-

100.9 202.4 192.8 - 48% Group operating profit before depreciation and amortization (EBITDA) 695.3 1,023.2 - 32%

31.2 135.3 124.1 - 75% Group operating profit (EBIT) 422.5 759.3 - 44%

-0.2 86.8 67.6 - 100% Net profit attributable to holders of ordinary shares 235.4 534.0 - 56%

0.00 0.68 0.53 - 100% Earnings per ordinary share (in EUR) 1.85 4.19 - 56%

Cash flows from operating activities (gross) 713.8 783.2 - 9%

89% 89% 92% - 3pp Occupancy rate subsidiaries 90% 93% - 3pp

35.9 35.9 34.7 3% Storage capacity end of period (in million cbm) 35.9 34.7 3%

2.02 2.08 2.04 Senior net debt : EBITDA 2.02 2.04

9.6% 8.9% 10.0% - 0.4pp Cash Flow Return On Gross Assets (CFROGA) 9.5% 10.5%

Highlights for full year and Q4 2017 -excluding exceptional items-:

Full year EBITDA of EUR 763 million (2016: EUR 822 million). Adjusted for currency translation effects and divestments in 2016, EBITDA decreased by 4%

Occupancy rate of 90%, whereby the difference with the high 2016 occupancy rate of 93% is primarily caused by a less favorable oil market structure

Full year EBIT of EUR 490 million (2016: EUR 558 million)

Full year net profit attributable to holders of ordinary shares of EUR 287 million (2016: EUR 326 million) resulting in earnings per ordinary share (EPS) of EUR 2.25 (2016: EUR 2.56)

Full year Cash Flow Return On Gross Assets (CFROGA) after tax of 9.5% (2016: 10.5%)

Q4 EBITDA of EUR 193 million (Q4 2016: EUR 198 million)

Q4 net profit attributable to holders of ordinary shares of EUR 76 million (Q4 2016: 72 million)

Our worldwide storage capacity on a 100% basis increased by 1.2 million cbm to 35.9 million cbm compared to year-end 2016, primarily in operatorships. Upon completion, our projects currently under development will add 3.1 million cbm of storage capacity to our global network by 2019.

A dividend of EUR 1.05 (2016: EUR 1.05) per ordinary share, payable in cash, will be proposed during the Annual General Meeting on 18 April 2018.

Exceptional items:

EBIT(DA): total exceptional losses before finance costs and taxation amounted to EUR 68 million (2016: gain of EUR 201 million). This mainly comprises the gain on the partial divestment of Vopak Terminal Eemshaven and the impairments recognized on two joint venture terminals in Estonia and China

Net profit: total exceptional losses included in the net profit amounted to EUR 52 million (2016: gain of EUR 208 million). In addition to the items included in the EBIT(DA), this includes a make-whole payment of EUR 17 million in relation to the repayment of the 2007 USPPs and an exceptional tax gain of EUR 35 million. The latter was recognized in relation to the changes in corporate income tax rates in the United States and Belgium.

Subsequent events:

Early 2018, Vopak reached an agreement regarding a new pension plan in the Netherlands effective per 1 January 2018. The new pension plan, aimed to qualify as a defined contribution plan under IAS19, will be formally implemented during the first half of 2018. The settlement of the pension liability is expected to result in a material exceptional gain during 2018

Today, it is announced that Vopak and its partner PT AKR Corporindo will expand their strategically located import-distribution terminal in the Port of Jakarta, Indonesia. The expansion will add 100,000 cbm of storage capacity for clean petroleum products and biofuels supporting customers to comply with Indonesia's biofuel blending mandate regulations

Today, Vopak announces that it will expand its Sebarok terminal in Singapore with 67,000 cbm. The expansion mainly caters for storage and handling of marine gasoil to strengthen the position of our Sebarok terminal as the bunker hub of choice with flexibility of handling multiple fuels following the implementation of the International Marine Organization's global sulphur cap as of 1 January 2020.

Looking ahead:

Financial performance in 2018 is expected to be influenced by currency exchange movements of primarily the USD and SGD, and the currently less favorable oil market structure, impacting occupancy rates and price levels in the hub locations

Given the current 3.1 million cbm expansion program with high commercial coverage, in conjunction with the ongoing cost efficiency program, Vopak has the potential to significantly improve the 2019 EBITDA, subject to market conditions and currency exchange movements.

Eelco Hoekstra, Chairman of the Executive Board and CEO of Royal Vopak commented:

"Despite challenging market conditions, particularly in the oil markets, and following a strong performance in 2016, we had a satisfactory performance in 2017. We aim to identify and seize growth opportunities swiftly, ensure timely completion of projects under development and step up the global roll-out of our new digital systems. These steps will improve our financial performance by 2019.

Our projects under development will add 3.1 million cbm of storage capacity to our global network by 2019. We announced new growth projects with a total capacity of 862,000 cbm in South Africa, Brazil, Canada and Malaysia in 2017. Vopak's growth strategy is directed towards chemical (industrial) terminals and gas markets, while facilitating the increasing demand for fuels in emerging countries. We will continue to explore and find new possibilities within the LNG infrastructure market, to expand our role as a service provider in the LNG value chain.

In order to continue creating long-term value for all our stakeholders, we have taken strategic decisions regarding technology, and we are making substantial investments to deliver the full benefits of the digital transformation in future years to our customers and shareholders.

We are embracing the changing dynamics of the energy transition. As an infrastructure and service provider, we do not drive market choices, but facilitate energy flows. We help introduce infrastructure and logistic solutions for clean and efficient fuels. Vopak will work on further reducing the negative impact of our operations on neighboring communities and the environment. We will define targets for delivering on the UN Sustainable Developments Goals that we selected, and are actively considering the final recommendations of the Task-force on Climate-related Financial Disclosures. We are committed to continue storing vital products with care."

Dividend proposal

Barring exceptional circumstances, the principle underlying Vopak’s dividend policy for ordinary shares is to pay an annual cash dividend of 25% to 50% of the net profit -excluding exceptional items- attributable to holders of ordinary shares. The net profit -excluding exceptional items-, may be adjusted for the financial effects of one-off events such as changes in accounting policies, acquisitions or reorganizations.

A dividend of EUR 1.05 per ordinary share (2016: EUR 1.05), payable in cash, will be proposed to the Annual General Meeting of 18 April 2018. Excluding exceptional items, the payout ratio will amount to 47% of earnings per ordinary share (2016: 41%).

zie verder op

http://hugin.info/166669/R/2169478/835594.pdf

Royal Vopak: Expansion of the Vopak tank terminal (JTT) in the Port of Jakarta - Indonesia.

Jakarta, Indonesia / Rotterdam, the Netherlands, 16 February 2018

Today Royal Vopak announces the expansion with 100.000 cbm for the storage of gasoline and biofuels of the PT Jakarta Tank Terminal (JTT), a joint venture company in Indonesia between Royal Vopak and PT AKR Corporindo Tbk (AKR). The expansion will take the total tank capacity of JTT to more than 350,000 cbm.

Strategically located in Tanjung Priok, the main port of Jakarta, JTT serves the import and distribution market in the greater Jakarta region for fuel products.The import of fuel products, particularly gasoline has been rapidly increasing in Indonesia over recent years and is expected to grow further driven by the economic growth of Indonesia and its growing population. The demand for tank storage facilities is expected to increase both with the expansion of gasoline distribution by existing players as with the market entry of new players.

This expansion will add to the terminal: 8 tanks with a total capacity of 100.000 cbm, for gasoline, ethanol and biodiesel, a vapour recovery unit and additional (in-line)blending infrastructure which will facilitate the customers to comply with Indonesia's Biofuel Blending Mandate regulations.

The investment fits well in Vopak's strategy to facilitate customers in growing import markets and will strengthen JTT's position as an independent import location for fuels. The expansion is expected to be commissioned in phases from Q1 to Q4 2019.

Profile Jakarta Tank Terminal (JTT)

The terminal has a storage capacity of 251,025 cbm and enables the distribution of oil products in the greater Jakarta area. The facility has been designed and constructed in compliance with the highest Health, Safety, Security and Environmental standards and with high levels of integrated automation. The location allows our customers short delivery times to retail stations and industrial end users in the greater Jakarta area. In addition, the back-loading facilities provide opportunities for product transit to Indonesia's many islands. link to more information

Profile AKR

PT AKR Corporindo Tbk as the local partner is Indonesia's leading supply chain and logistics provider for petroleum products and basic chemicals. AKR brings over 5 decades of experience in operating terminals for bulk chemicals and petroleum products and has an extensive network of logistics facilities. AKR's infrastructure comprises of tank storage terminals with combined storage capacity of 666,000 KL, spread across Indonesia's archipelago in over 15 sea and river ports. PT AKR Corporindo Tbk., is listed on the Indonesia Stock Exchange since 1994. www.akr.co.id

AND

Vopak announces changes in the composition of the Supervisory Board

Vopak announces that Hanne B. Sørensen has decided to step down as member of the Supervisory Board of Vopak as per 16 February 2018, following her decision to accept another board opportunity outside the Netherlands.

The Supervisory Board and the Executive Board regret this decision and thank Hanne B. Sørensen for her contribution to Vopak during her tenure.

This press release contains inside information as meant in clause 7 of the Market Abuse Regulation.

tijd 09.50

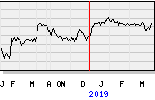

Vopak EUR 39,78 +5,32 vol. 959.000